Will Canadian Regulators be Able to Avoid Final Fatal TSX Venture Exchange (TSX-V) Crash?

Commodities / Gold and Silver Stocks 2014 Aug 25, 2014 - 07:40 PM GMTBy: Submissions

Dr. Volkmar Hable writes: The answer of course is no, if history is any guidance. So what is wrong with the central Canadian market place, the world’s most important stock exchange for the junior resource and energy sector?

Dr. Volkmar Hable writes: The answer of course is no, if history is any guidance. So what is wrong with the central Canadian market place, the world’s most important stock exchange for the junior resource and energy sector?

The last 3 years have seen a meltdown in the TSX-V share values that brought it right back where it started almost 10 years ago. We have been witnessing on the TSX-V an unprecedented historical annihilation in shareholder value that has not been seen in this form on any other stock exchange in the world.

While virtually all stocks in all sectors have had a tremendous (though central bank induced) value appreciation in the past 5 years, the TSX Venture Exchange had seen its value drop further only to end up in a sideways meandering trading pattern.

Many investors seem reluctant to enter the fray of TSX Venture Exchange listed junior companies for a good reason. A severe confidence crisis in regards to the business model of TSX Venture Exchange listed companies is at the heart of decaying share prices.

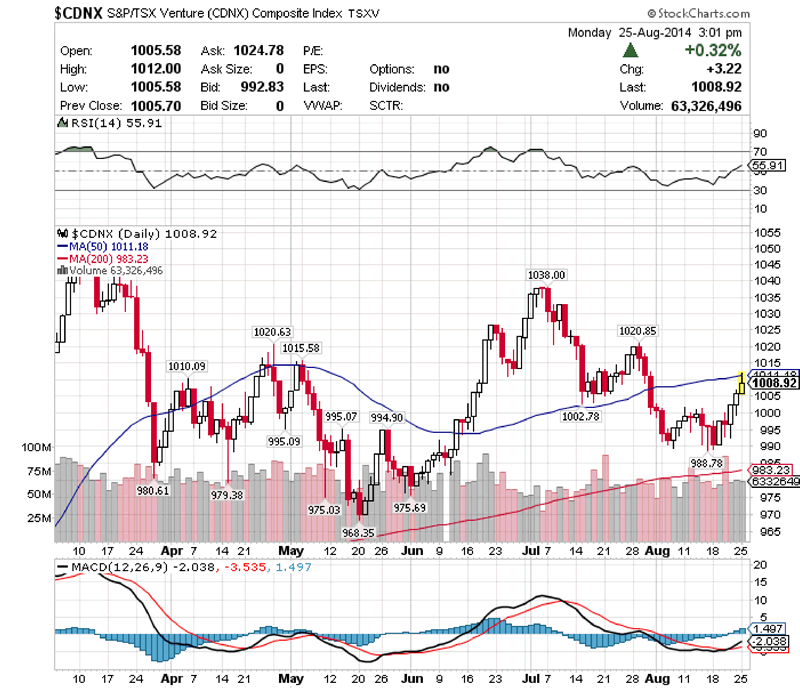

Graph 1 of the TSX Venture Exchange: The TSX-V is not a pretty sight at all. It is right back to its beginning more than a decade ago. The gains in all the other stock markets world-wide since its inception have been all but annihilated.

As of July 2014 word is out by leading auditors that more than one third of the TSX Venture Exchange listed junior companies has less than 200,000 $ available in its bank accounts. As an FYI to readers: the annual exchange listing costs are in the 300,000 $ range.

While Canadian regulators have gone to great lengths trying to restore order to a market which has turned into a snake oil sales center in the days leading up to the BreX scandal, the results are mixed at best some 15 years later. True, the financial and scientific reporting has been disciplined, which makes a positive difference to the US Pink Sheet markets. Canadian regulators have done an outstanding job on this end. But that’s where the differences stop and the similarities to the infamous Pink Sheet notorieties begin.

Some of the TSX-V and security regulations clearly have gone too far into the wrong direction resulting in more similarities than difference to the US pink sheet market. The best recent example are the rule changes for fund raising. Honestly, some lawmakers may have confused the cure with the disease and, with all due respect, may lack a basic understanding of the core issues at hand. The problem is not the fund raising process itself but rather the use of funds. The simple conclusion of course should be that not the fundraising process but the use of funds should be better regulated.

Alas, TSX-V companies with improper motives still can freely advertise non-existing projects or grossly exaggerate the merits of their business without having to fear consequences in the vast majority of the cases, or a slap on the wrist in the worst case. Does it make sense to hold exclusively brokers and certified market dealers responsible for the misdeeds of several foul promoters and company founders, that is from an investor’s point of view? Certainly not. It represents a gross lack of fairness towards brokers and market dealers, who have to cope with the legal consequences of several foul apples whose mostly unpunished actions threaten to bring down the entire TSX-V constitution. It resembles to shooting the messenger of the bad news instead of punishing the bad guy behind the bad news. Market dealers and brokers are the last place where additional regulations are required. The future consequence is going to be a significant increase in the costs of fund raising for those honest hard working company founders and promoters who spend years without a salary or income on a project.

The lawmakers haven't made the world a better place with their interventions. The facilitated the actions of fraudulent company founders. Many of those company founders and promoters with their aides and helpers have in fact created moral hazard, encouraged the formation of asset misinformation on a large scale that will eventually burst the TSX-V (leaving economic messes), widened inequality gap between honest and fraudulent juniors to record levels, discouraged hard work and bona fide investment, severely penalized good faith investors with out-of-control dilution fraud, encouraged spending of investor money for payment of personal bills, caused the funding of useless projects which will never go into production, blowing up the share price in order to commit insider selling, lengthened the recession in the TSX-V to such a level that fatality seems inevitable and likely caused a severe loss of jobs and business opportunities in Canada that would have been created if the regulations had been applied to a more realistic scenario addressing the real problems.

Justice is needed, as well as transparency. And a hard-nosed special sheriff in town as well.

A good initial step would be to go aggressively after all fraudulent asset statements or deceptive claims made by junior companies and their promoters. Some serious convictions might be just what is needed to restore order and investor confidence in a market gone wild (again). Columns in the Vancouver Sun once in a while naming the perpetrators have proven to be as ineffective as useless.

Regulatory authorities are clearly understaffed, and understandably have a difficult time to keep pace with the significant number of fraudulent deals.

It is not an understatement describing the business model of a remarkable number of junior companies as a premeditated scheme to raise money for paying the personal monthly bills of the company founders.

Where are the CEOs who work for a 1$ salary? There are NONE on the TSX-V. Instead hefty fees paid out to CEOs and company founders from investors’ hard earned money are not the exception but the rule. This has to change. I encourage lawmakers to address the issue of personal fees and salaries. Just a zero salary rule for the key promoters or key founders would reduce the number of fraudulent lifestyle companies significantly.

What regulators can’t do because of lack of adequate resources and staffing in their department, investors should do even if it at the expense of significant time, which is to thoroughly investigate their investment target.

Investors don’t need a degree in finance or geosciences in order to validate the business model of a seemingly interesting company. Some good old common sense would go a long way. But greed is a powerful driver.

While investors know that the high risk can bring huge rewards, the risk—along with a lot of hype and misinformation about new resource projects —has become so large in the perception of the investors that none but the most fearless of them is willing to give it a try. This is the core problem of the junior sector today and it is not unreasonable to assume that the next fatality will be the TSX-V itself. Its current constitution and form can’t possibly survive.

Even in remote African countries the ruthlessness of certain stock promoters and their foul plays are known. I travel regularly to Africa and astonishingly in 2013 for the first time ever I heard in two remote West-African countries in the respective legal advisory department of the mining ministries complaints about “Canadian stock market speculators, who just need any project to play their pump-and-dump games”. I guess it’s a bit unfair to offload all the bad reputation on some Canadian players, as German and US speculators and other nations contribute significantly to the number of foul plays. The “open market” of the German stock exchange comes to my mind and I mentioned the Pink Sheets in the US before. This needs to change. But investors should not give up.

Graph 2 of the TSX Venture Exchange: The spread between bid and ask is consistently above 3%. This large spread puts the TSX-V on a same level with the risky options markets just without the potential benefits of the options. Clearly something has to happen here.

I would like to bust one myth about the resource market. Yes, it can make investors rich. In my capacity as a fund manager have been always a contrarian. The entire resource and energy sector is currently at historic lows and I can see tremendous buying opportunities and upside potential across the entire resource and energy sector, though carefully selected. While the TSX Venture Exchange may not survive the downturn in its current constitution, the savvy investor (equipped with more than the average dose of common sense) may profit from outstanding buying opportunities if the proper research is done.

It sounds trivial but investors need to do their due diligence and in the process should not limit themselves to the projects advertised by the company but as well as and above all to the character traits of the company founder(s) and promoters, their CV, their track record, a clean criminal background check, bank references and other usual professional references. Don’t be shy to ask from the company CEO and other key company managers a criminal background check or a bank reference. If you don’t get this basic information, don’t invest. It’s a simple as this.

Investors could contribute to a highly overdue culture change of the TSX-V by actively demanding transparency on the use of funds and projects from the junior companies.

A good test also is to research the exit strategy for a certain project. The widespread “let’s drill and see” attitude ain’t no good! Investors have a right to know what the exit plan is. Too many junior companies are drilling in areas where it is clear from the beginning that a production license will never be obtained on that site in the first place. This just is another typical symptom of a cancerous disease called “lifestyle company syndrome”. These are companies, pretending to have a viable project, but in reality have been set up for the mere purpose of funding the antics and daily bills of its founders and promoters. The diagnosis is clear, the treatment in the absence of any law enforcement would be for investors to apply common sense.

Again, investors should back out of if they can’t get clear answers and convincing concepts that comply with the most basic rules of common sense.

Investors also should be mindful about technical analysis. The TSX Venture Exchange is way too illiquid for technical analysis to be of any use. Technical patters known from the large stock exchanges don’t work with TSX-V companies. Even TSX-V securities that have above average volumes suffer from the distortions caused by the notorious illiquidity of the exchange. Thorough fundamental analysis is the way to go.

And this leads me to the next myth, which is that financial statements are difficult to read and understand. They are not. Every speculator and investor should take a crash course in reading and understanding financial statements. These are few hours to invest and will pay off nicely. Abundant literature is available as well. Or ask a friend to give you a helping hand.

I love resources and I believe in it. The world’s population will grow to 15 billion by the end of this century—and the world’s energy and resource requirements will grow exponentially. Regardless of the poverty level in the developing countries, the BRICS, or the lifestyle in the Western world, people will consume more of everything and will need many more resources. Resources will be needed to manufacture all those goods required by billions of people, and energy will be need to ship those goods to their buyers.

There couldn’t be a better case for a long-term uptrend in any economic sector than resources and energy. I do hope that Canada keeps its leading role in this sector and that lawmakers address the obvious problems of the TSX-V rather sooner than later. It should not deter investors from carefully selecting great opportunities.

About the author: Dr. Volkmar Hable is a geologist and physicist by training. He has held senior executive positions in blue chip companies, and is currently CEO of Samarium Investment Corporation.

© 2014 Copyright Dr. Volkmar Hable - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.