Strong U.S. Dollar Undermines Gold and Silver

Commodities / Gold and Silver 2014 Sep 12, 2014 - 04:54 PM GMTBy: Alasdair_Macleod

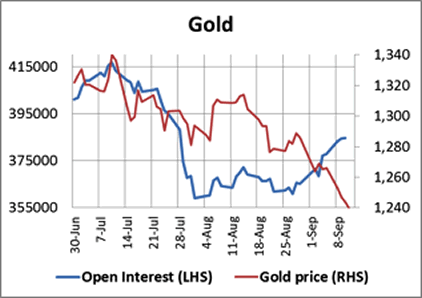

Precious metals have had to endure a week of gathering dollar strength, which is at least partly the result of problems specific to the euro, yen and sterling. The result is gold has fallen a further $30 over the week, and silver by about $0.70c. The first chart is of gold and open interest on Comex.

Precious metals have had to endure a week of gathering dollar strength, which is at least partly the result of problems specific to the euro, yen and sterling. The result is gold has fallen a further $30 over the week, and silver by about $0.70c. The first chart is of gold and open interest on Comex.

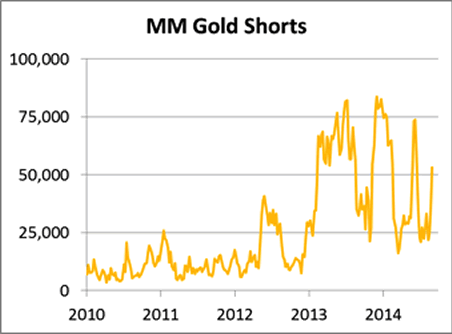

Over the last two weeks the gold price has been falling while open interest has been rising: in other words paper gold has been flooding the market. This is illustrated in the second chart, of Managed Money short positions.

Last Tuesday’s position (not yet in this chart) will be released after-hours tonight, and I expect these shorts to rise to about 70,000 contracts. Given the action of the last few days I would expect this short interest to currently be at a new record. For the third time in a year, hedge funds and other fund managers are betting the ranch on a falling gold price.

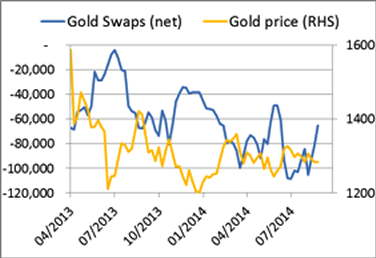

Usually, it is sensible to buy into a heavily oversold market, and that is just what the bullion banks are doing, which is reflected by a fall in the net swap short position in the third chart.

Again, this will be updated tonight, when I expect to see net shorts decline below 50,000 contracts, and today it is probably less than 30,000 contracts.

The relationship between speculation by money managers and bullion banks is clear. The bullion banks are the professionals and they are buying. The money managers are increasingly late sellers, after prices have declined. The signal that bullion banks are closing their shorts is probably a more important predictor of future prices than blindly following money managers.

That having been said, the current strength in the dollar has brought a new dose of uncertainty to precious metal prices. For the moment, it has been more a case of weakness in major currencies, particularly the euro yen and pound, rather than dollar strength. If signs develop of bigger shifts in favour of the dollar, markets could be signalling a greater degree of currency instability, leading the Fed to contemplate how to counteract the deflationary effect on domestic US prices. This should generally be positive for gold after the current period of uncertainty.

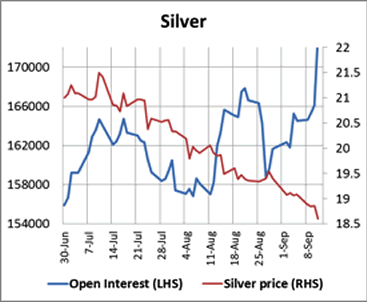

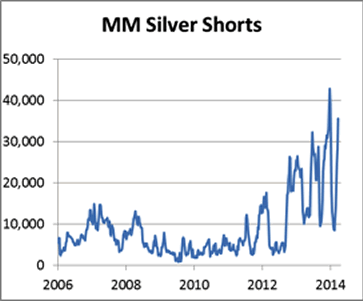

Silver’s open interest is growing strongly as the bears increase their shorts. The preliminary figures for yesterday take open interest to a new record level.

And here the shorts are well on their way to taking silver into record oversold territory, which is almost certainly the case given the explosion in open interest in the last few days.

To summarise: while currency instability has introduced short-term uncertainty over the price outlook for gold and silver, buyers looking to close profitable bear positions outweigh sellers by far. Dramatically oversold futures markets are likely to lead to an unexpected technical rally rather than significant further downside, given that bearish activity appears to be concentrated in the paper markets while physical demand continues unabated.

Next week

Monday. Eurozone: Trade Balance. US: Empire State Survey, Capacity Utilisation, Industrial Production.

Tuesday. UK: CPI, Input Prices, Output Prices, ONS House Prices, Output prices (Core). Eurozone: Labour Cost Index, ZEW Economic Sentiment. US: PPI, Net Long-term TICS Flows.

Wednesday. UK: Average Earnings, Claimant Count, ILO Unemployment Rate. Eurozone: HICP. US: CPI, Current Account, NAHB Builders Survey, Fed Funds Rate. Japan: Customs Cleared Trade.

Thursday. UK: Retail Sales. US: Building Permits, Housing Starts, Initial Claims. Scotland votes on Independence.

Friday. Japan: All Industry Activity Index, leading Indicator (Final). Eurozone: Current Account. US: Leading Indicator.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.