Stocks Rally Following Janet Yellen's Conference and Scotland's Historic Referendum Result

Stock-Markets / Stock Markets 2014 Sep 23, 2014 - 10:42 AM GMTBy: Frank_Holmes

Interest rates can't stay zero forever, but for now it's more of the same.

Interest rates can't stay zero forever, but for now it's more of the same.

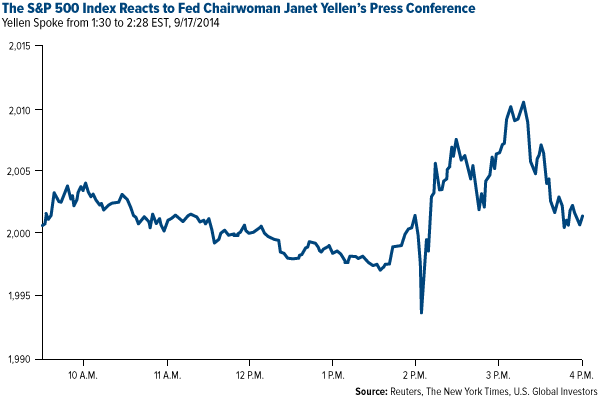

The Federal Reserve's bond-buying program, enacted to spur growth, will indeed be winding down next month, as expected. But record-low interest rates will stay as they are for a "considerable time," Fed Reserve Chairwoman Janet Yellen insisted during her Wednesday press conference last week.

It was "game on" for the stock market following Yellen's speech. The Dow Jones Industrial Average closed at a new record high of 17,156, while the S&P 500 Index rose two points to close at 2,001, the Nasdaq nine points to end at 4,562.

This news gives stocks reason to rally for a "considerable time," or at least until the Fed gives us a more concrete timeframe for a rate hike.

With interest rates very likely to rise sometime next year and at an indeterminate pace, you want to be diversified with short-term bonds, as they're less volatile to rate changes. Our Near-Term Tax Free Fund (NEARX), which invests in such bonds, recently received the coveted five-star rating from Morningstar for the three-year performance period.

Last week in an interview with Marc Lichtenfield's Oxford Club Radio, U.S. Global Investors Director of Research John Derrick highlighted some of the fundamentals of NEARX:

"Our average maturity's around 2.75 years, so under three years right now... The overall fund structure is pretty conservative. [NEARX] really doesn't move around that much. It's a steady grinder."

Rolling with the Punches

Chairwoman Yellen stated that the decision to raise rates was "highly conditional" and dependent on the Federal Open Market Committee's (FOMC) assessment of the economy, which appears right now to be showing moderate or, in some sectors such as housing, faltering growth. Inflation has also fallen short of expectations.

But as always, we see opportunity.

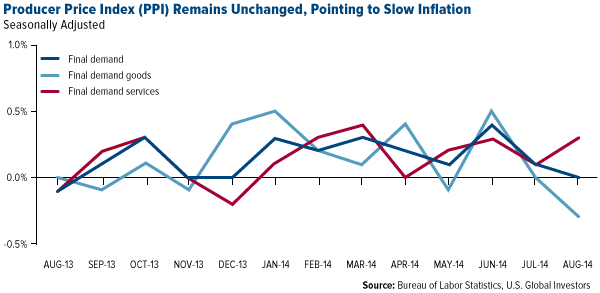

The producer price index (PPI) numbers, released last Monday by the U.S. Bureau of Labor Statistics (BLS), reveal that demand goods such as gasoline and food dropped 0.3 percent while demand services rose 0.3 percent, resulting in an unchanged final demand of 0.0 percent.

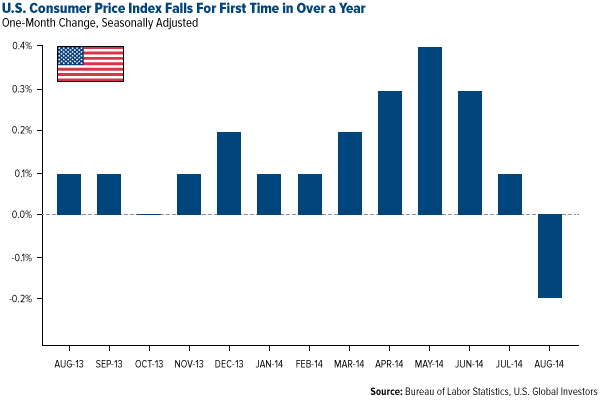

Meanwhile, the consumer price index (CPI), which measures the cost of living, unexpectedly decreased 0.2 percent in August, the first time it's done so since April of last year. The all-items index, however, has risen at a rate of 1.7 percent over the last 12 months.

U.S. housing starts had a disappointing downturn last month, the Commerce Department reported, tumbling 14.4 percent to a seasonally-adjusted annual rate of 956,000 units. This decline is even lower than the projected -4.9 percent. Building permits fell 5.6 percent, below the -1.6 percent economists estimated.

Despite a decline in starts and permits from July, homebuilders' confidence in the market soared to 59.0, according to the National Association of Home Builders/Wells Fargo builder sentiment index. This is the highest such reading since November 2005, before the housing bubble collapsed.

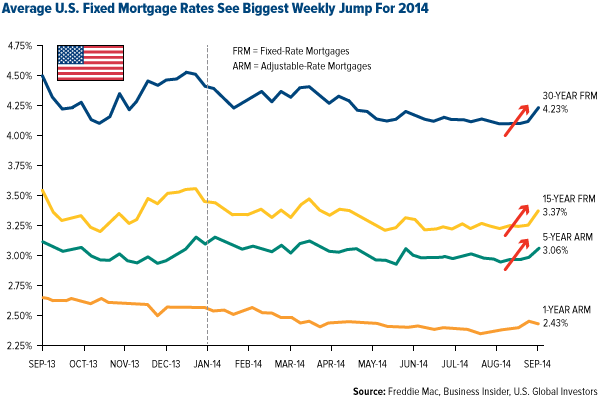

We might see stronger growth in the housing market very soon, as U.S. fixed mortgage rates recently had their biggest weekly jump of the year, following the increase in 10-year Treasury yields on the heels of Yellen's press conference. This might help light a fire under hesitant homebuyers and encourage them to act. According to the Mortgage Bankers Association's (MBA) weekly survey, mortgage applications rose 7.9 percent from a week earlier.

Through the 12 months ended August 2014, the annual U.S. inflation rate is 1.7 percent, below many economists' and Fed policymakers' hopeful estimate of 2 percent.

Although lower-than-expected inflation might lead to less pain at the pump and checkout aisle, it can also sometimes lead to a sluggish economy. Debt financing becomes challenging. And as counterintuitive as it might seem, when prices are down, people tend to sit on their money and wait for even better prices to come along.

Rising prices, on the other hand, often prompt spending. For this reason, a little inflation is welcomed by some companies and their employees. Profits and wages can both increase, which stimulates borrowing and spending. The jump in mortgage rates is a perfect example.

As the U.S. Ends Quantitative Easing (QE), China and Europe Begin

With low inflation also comes the risk of dipping into deflation territory, which China is now facing. The country's own PPI declined 1.2 percent in August, continuing a 30-month downtrend, while its CPI rose only 0.2 percent from July. Its purchasing managers index (PMI) also dropped last month, as did imports and manufacturing jobs.

To counteract this slowdown, China's central bank injected $81 billion to five state-owned banks. So far the market seems to have liked the stimulus measure, as stocks in both the Hang Seng Index and Shanghai Composite Index have rallied, tracking positive stock performance on Wall Street. Only time will tell if the world's second-largest economy is in a permanent recovery mode, but we're optimistic.

Like the People's Bank of China, many central banks around the world continue or are implementing easing policies. The European Central Bank (ECB), for instance, will be buying close to $1.3 trillion in bonds to provide fresh capital to the Union's depressed banking system. All of this global stimulation activity is good for global financial markets and specifically U.S. equities. We'll be exploring this very topic in our October 2 webcast, "One World Market, Many Central Banks: How Will Your Investments Be Impacted?"

Scots Vote "Nay" in Historical Referendum

Speaking of one world market, it breathed a collective sigh of relief last Thursday when Scotland voted to stay in its long-term relationship with the United Kingdom. Once the votes were counted, stocks in London rose and the pound bounced up a quarter of a percent.

As a Canadian, I'm familiar with separatist movements. In Scotland, as it is with Quebec, there seems to be a disconnect between wanting to break up the government in order to obtain more government. At a time when there's so much uncertainty in the world, when members of the eurozone are in the doldrums, when China is trying to jumpstart its economy, when Russia is rattling its saber and ISIS is spreading as quickly as the Ebola virus, the last thing we needed was a major restructuring of one of the globe's most stable and reliable countries.

Granted, every people has the right to declare its independence for the right reasons. If that were not the case, America might today be in the same family as Scotland. University of Bath professor Chris Martin said it best when he wrote: "The desire for independence seems to be driven by romantic views of a separate Scottish identity and culture rather than by cold economic logic."

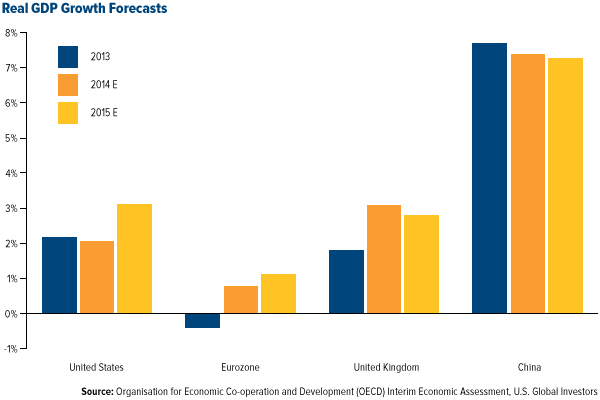

Below you can see the current gross domestic product (GDP) growth forecasts for the U.S., eurozone, U.K. and China. Had Scotland voted "yes" in the referendum, it's possible that the increased uncertainty might have stalled growth among these powers and altered economists' predictions.

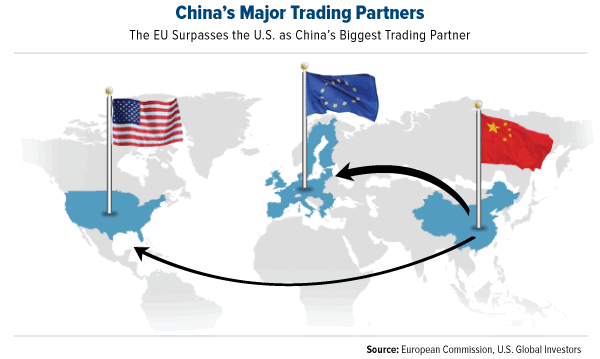

Indeed, it's important to realize that the U.S., E.U. and China--the world's three greatest economic powers--all rely on one another and help drive the rest of the globe.

Even many Scots were apprehensive of the economic implications of leaving the U.K. and, by proxy, the E.U. According to the gold trading firm BullionVault, approximately 40 percent more Scots bought gold in September compared to last year, most likely as a hedge against an uncertain economic future.

Once again, who says gold isn't currency?

Keep on Keepin' On

Although the week began with speculation and uncertainty--would the Fed raise rates? would Scotland break up the U.K.?--we ended on more solid ground than some were expecting.

The bull market that we've seen this year has continued to charge forward, creating healthy intraday and closing market highs. We can relax for the moment knowing that the Fed isn't undertaking any drastic measures. And easing around the world has improved liquidity, making it easier for companies and individuals to invest in their future.

These are all good reasons to stay calm and keep seeking and investing in quality equities.

Want to receive more commentaries like this one? Sign up to receive email updates from Frank Holmes and the rest of the U.S. Global Investors team, follow us on Twitter or like us on Facebook.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.