Gold's Obituary

Commodities / Gold and Silver 2014 Oct 29, 2014 - 02:31 PM GMTBy: David_Petch

This is probably not the type of article anyone who owns precious metal stocks would like to read, but here it is. The analysis presented today illustrates short-term and mid-term outlooks up front, with the Elliott Wave count indicating the longer-term trend expected over the next 5-7 years. I am not really going to provide much information on investment strategies around this analysis, but if one connects the dots, it should reveal a crystal clear picture.

This is probably not the type of article anyone who owns precious metal stocks would like to read, but here it is. The analysis presented today illustrates short-term and mid-term outlooks up front, with the Elliott Wave count indicating the longer-term trend expected over the next 5-7 years. I am not really going to provide much information on investment strategies around this analysis, but if one connects the dots, it should reveal a crystal clear picture.

Ratios

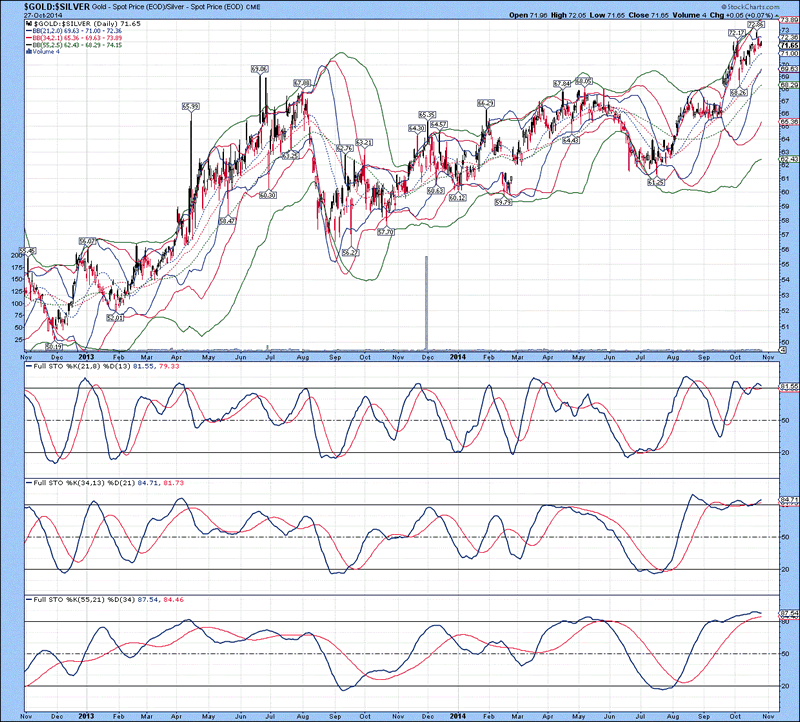

The daily chart of the gold/silver ratio is shown below, with Bollinger Bands® in proper order of alignment, indicating no overbought or oversold conditions exist. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K above the %D in all three instances. Higher highs have been put in place, but it appears sideways to downward price action is the next likely trend.

Figure 1

Gold:Silver Daily Chart

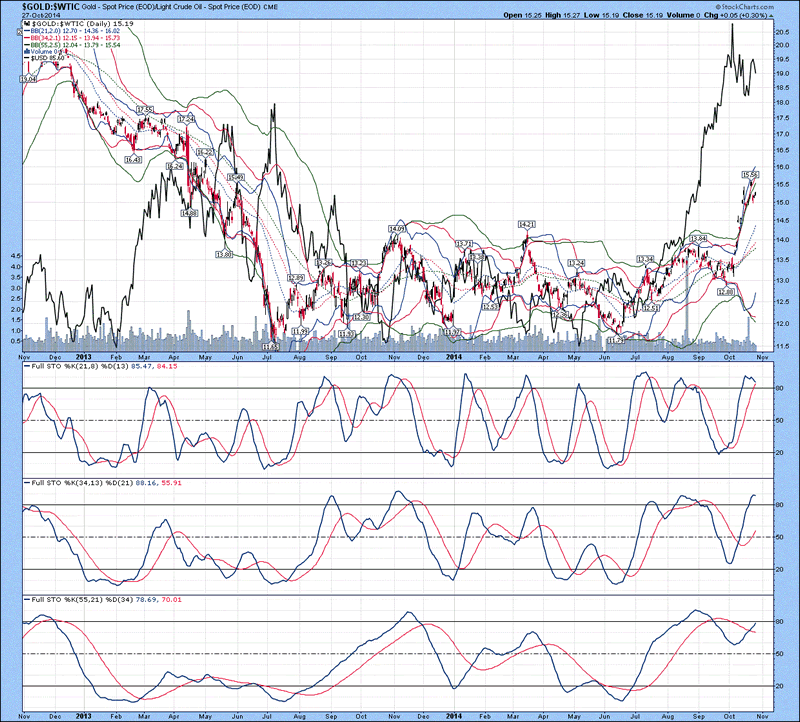

The daily chart of the daily chart of the gold/oil chart is shown below, with the US Dollar denoted in black. The upper 21 MA Bollinger Band is above the 34 and 55 MA Bollinger Bands, indicating an overbought condition is developing. Lower 34 and 55 MA Bollinger Bands have yet to curl up, indicate that a top has been put in place or are looming. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K beneath the %D in 1 and above the %D in 2 and 3. The chart is not very telling, but the ratio appears to have broken out of a trading range, so over the near term, expect gold to continue to outperform oil on a relative basis.

Figure 2

Gold:WTIC Daily Chart

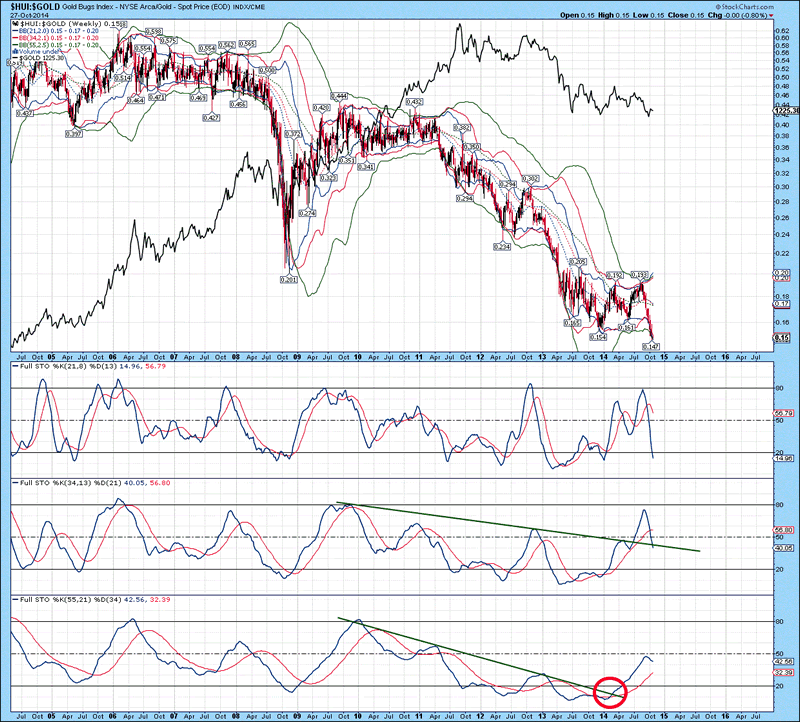

The weekly chart of the HUI/Gold ratio is shown below, with gold denoted in black. All three upper Bollinger Bands are curling up, indicating that weakness in the HUI relative to gold is likely to continue for at least another 3-5 months. The ratio has plumbed to new lower low, indicating the 12 month consolidation was merely a pause between two down legs. This ratio could decline down to 0.05 if we have a repeat of 1999-2000. The US Dollar Index has not even started to break out yet and when it does, being in precious metals will be one of the last places one will wish they had money. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K beneath the %D in 1 and 2 and above the %D in 3. The %K in stochastic 2 breaking below the lower downtrend line from 2009 until mid-2014 was a very bearish setup, indicating failure. Extrapolation of the %K in stochastics 1 and 2 suggest a mid-term bottom is not likely to be put in place until around late December 2014/January 2015.

Figure 3

HUI:Gold Weekly Chart

Gold

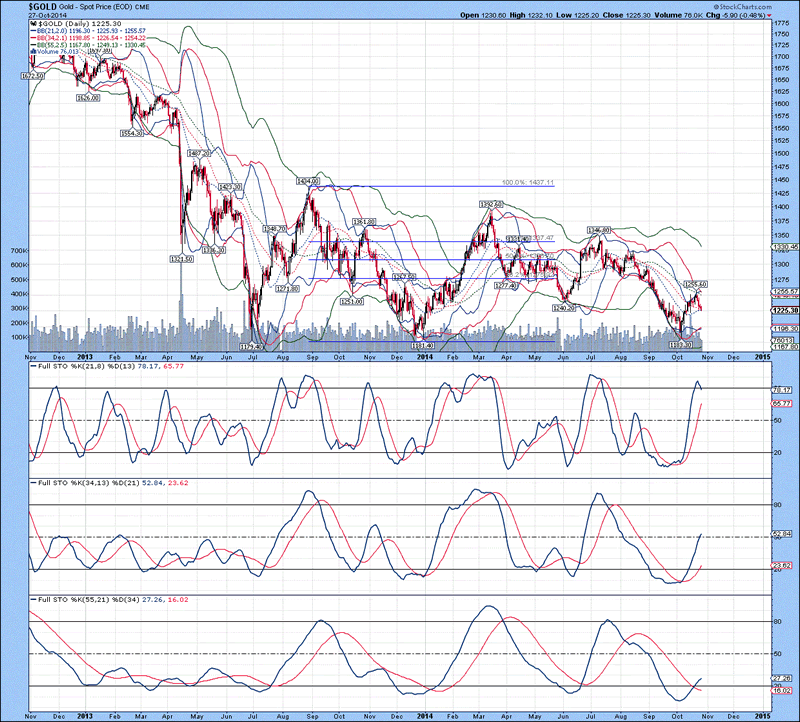

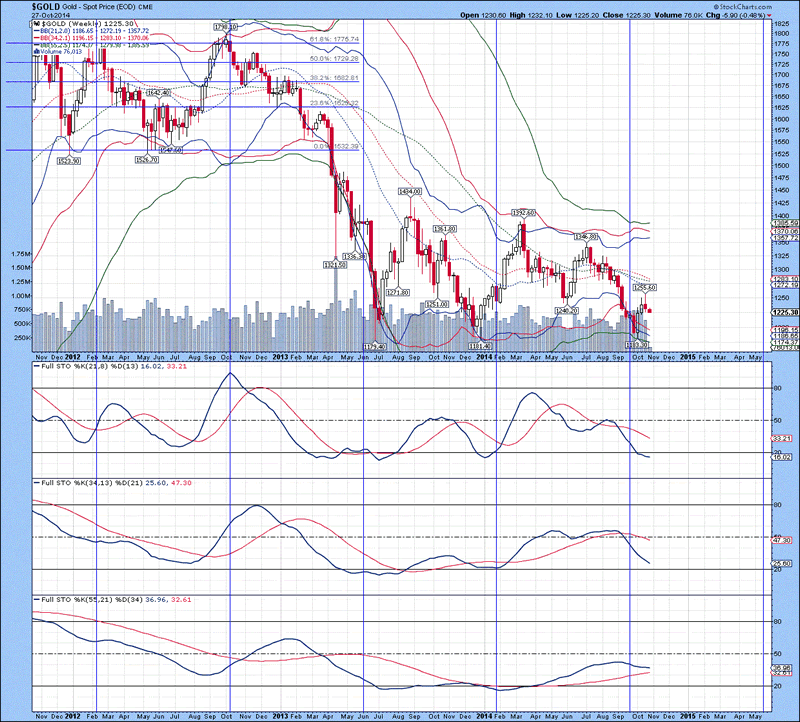

The daily chart of gold is shown below, with the lower 21 MA Bollinger Band beneath the 34 MA Bollinger Band, indicates an oversold condition. Upper Bollinger Bands have the 21 MA Bollinger Band beneath the 34 MA Bollinger Band, so there is a pull between oversold and overbought conditions. A lower high was put in place at $1255/ounce, indicates sustained weakness in gold. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K above the %D in all three instances. The daily chart at best suggests continued sideways price action for another 2-3 weeks and aside from that, there is nothing really to extract from this chart.

Figure 4

Gold Daily Chart

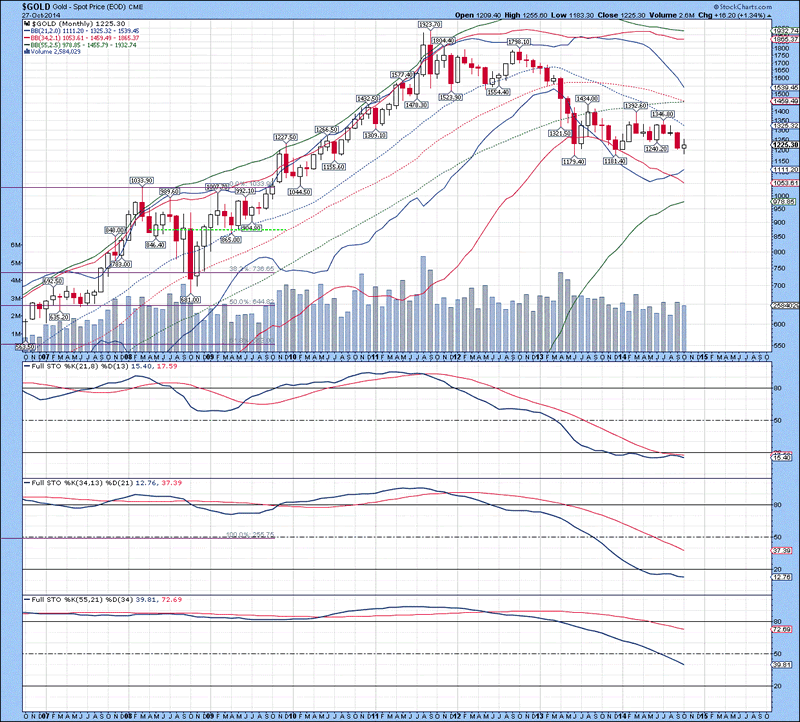

The weekly chart of gold is shown below, with the lower 21 MA Bollinger Band beneath the 34 and 55 MA Bollinger Bands suggests an oversold condition continues to develop. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K beneath the %D in 1 and 2 and above the %D in 3. With all three upper Bollinger Bands trending sideways, it would not take much to get them to curl up to indicate another down leg in gold. The weekly chart is not very telling, which suggests caution. With strength in the US Dollar Index hinting at no reprieve until at least August 2015, there is no reason to even attempt to play the precious metals arena at this particular point in time.

Figure 5

Gold Weekly Chart

The monthly chart of gold is shown below, with oversold conditions that existed for 10 months completely dissolved. A monthly close below $1175/ounce would set the stage for the potential to hit $600/ounce if the second down leg was to be equivalent to the first. The price of gold does not have to decline to $600/ounce, but the potential setup is there. Sideways price action for nearly 18 months in the price of gold with a series of lower highs and a flat bottom puts extreme pressure on gold to maintain pricing stability above $1180/ounce. Full stochastics 1, 2 and 3 are shown below in order of descent, with the %K beneath the %D in all three instances. Extrapolation of the %K trend in stochastic 3 indicates no sign of a bottom anytime soon. The monthly chart suggests fresh lows are established before June 2015. There likely will be a bounce around this time that should coincide with weakness in the US Dollar. Remember that the US Dollar is likely in a new bull market lasting for at least another 5-6 years. Based upon this, it stands to reason that commodity prices remain weak over this period of time.

Figure 6

Gold Monthly Chart

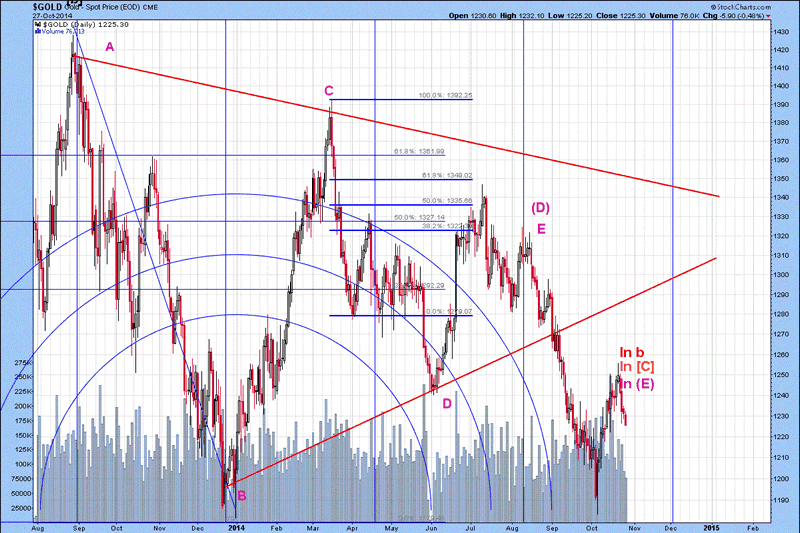

The short-term Elliott Wave count of gold is shown below, with the start of a new leg down after breaking below the B-D line of the triangle. Wave C was equivalent in time to waves A+E, so from a triangle perspective, this fits the count quite well. A collapse after the breakdown to test the late 2013 support and bouncing is further validation that his pattern is correct. Based upon this pattern, wave (E) is likely to last for at least another 11-12 months before a final bottom is put in place. The absolute bottom in gold is likely years away, given that the US Dollar is in a 5-6 year bull market. Any daily close below $1175 is a strong indication of lower lows directly ahead.

Figure 7

Gold Daily Chart

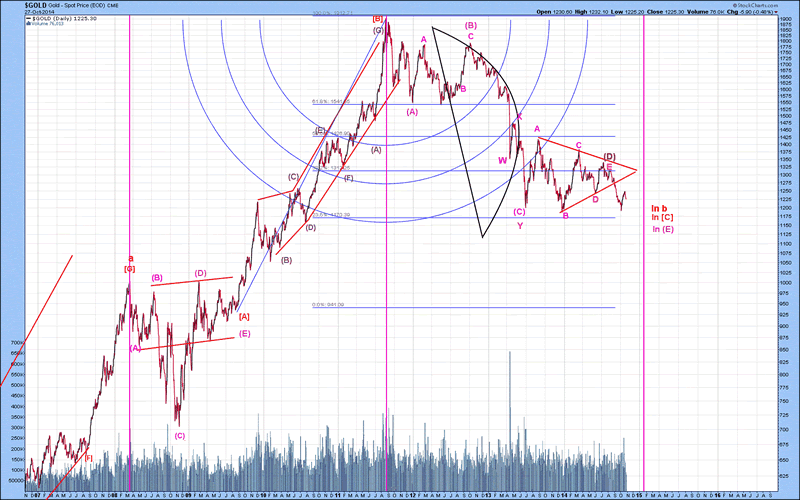

The mid-term Elliott Wave count of gold is shown below, with the longer-term count shown over the past 7 years. It is important to note that the entire move from 2008 until present is thought to be a part of the same pattern. Following wave (E), this will complete higher Degree wave [C], which should be followed by wave [D] up and then wave [E] down. Based upon this pattern and knowing that wave (E).[C] has at least another 12 months left before bottoming, the remaining two waves should each consume at least 2-3 years each. If one does the math, the shortest expectation for a bottom in precious metals is in 5 years, or 2019 while the longest expectation for a bottom is 7 years, or late 2021/early 2022. There is no reason to warm up to precious metals anytime soon, aside from those who want to collect bullion as an averaging down approach. I thought this wave count I had was spooky and did not assign much validity to it, but examination of my US Dollar count indicates it probably is quite valid now in retrospect.

This is not what anyone really wants to hear, but in the current environment, a rising US Dollar is the symptom of deflation, with everyone seeking to preserve capital. There will be time to buy gold again...maybe when we hit a bottom in wave [E] near 2020, but there will be a very nice trade once wave [C] bottoms. The trade for the next 8-10 months? Being in US Dollar based investments, with index funds based upon the S&P 500 Composite Index. I decided to post this on the web because there are so many Gold BUGS expecting gold to vault to the moon. In the current environment, if it was to have happened it would have already started...With this, I bring you the Obituary of Gold. It will rise like Phoenix out of the ashes, but first it must be laid to ashes. And that should happen over the next 5-7 years, as per the Elliott Wave count of Gold.

Figure 8

Gold daily Chart 2

That is all for today....I will update the AMEX Gold BUGS Index tomorrow AM. Have a great day.

By David Petch

http://www.treasurechests.info

I generally try to write at least one editorial per week, although typically not as long as this one. At www.treasurechests.info , once per week (with updates if required), I track the Amex Gold BUGS Index, AMEX Oil Index, US Dollar Index, 10 Year US Treasury Index and the S&P 500 Index using various forms of technical analysis, including Elliott Wave. Captain Hook the site proprietor writes 2-3 articles per week on the “big picture” by tying in recent market action with numerous index ratios, money supply, COT positions etc. We also cover some 60 plus stocks in the precious metals, energy and base metals categories (with a focus on stocks around our provinces).

With the above being just one example of how we go about identifying value for investors, if this is the kind of analysis you are looking for we invite you to visit our site and discover more about how our service can further aid in achieving your financial goals. In this regard, whether it's top down macro-analysis designed to assist in opinion shaping and investment policy, or analysis on specific opportunities in the precious metals and energy sectors believed to possess exceptional value, like mindedly at Treasure Chests we in turn strive to provide the best value possible. So again, pay us a visit and discover why a small investment on your part could pay you handsome rewards in the not too distant future.

And of course if you have any questions, comments, or criticisms regarding the above, please feel free to drop us a line . We very much enjoy hearing from you on these items.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities as we are not registered brokers or advisors. Certain statements included herein may constitute "forward-looking statements" with the meaning of certain securities legislative measures. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the above mentioned companies, and / or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Do your own due diligence.

Copyright © 2014 treasurechests.info Inc. All rights reserved.

Unless otherwise indicated, all materials on these pages are copyrighted by treasurechests.info Inc. No part of these pages, either text or image may be used for any purpose other than personal use. Therefore, reproduction, modification, storage in a retrieval system or retransmission, in any form or by any means, electronic, mechanical or otherwise, for reasons other than personal use, is strictly prohibited without prior written permission.

David Petch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.