Petrobas Plunge - A Timeless Lesson on Investing With the Government

Companies / Investing 2014 Nov 01, 2014 - 11:33 AM GMTBy: DailyWealth

Brian Hunt writes: Sometime in the past decade, Americans who should know better embraced a horrible investment idea...

Brian Hunt writes: Sometime in the past decade, Americans who should know better embraced a horrible investment idea...

If you've ever bought a stock because an investment guru told you it was "state owned" and backed by the government, chances are good you fell for a common mistake... And chances are good you lost money on the deal.

In today's essay, I'll show you why this is the case... and why you should always be leery of investing with "state owned" companies.

To drive the point home, we'll look at a poster child of "state owned" investing – Brazil's oil firm, Petrobras. It's a popular stock among investment advisors and fund managers. If you watch a financial television program about "investing around the globe," you'll probably hear someone gushing about Petrobras and its "state owned" status. After all, how could you go wrong partnering up with the national government?

Answer: very easily.

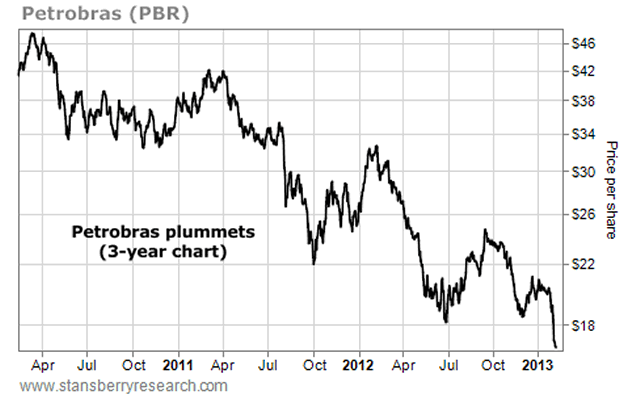

Below is a three-year chart of Petrobras. It tracks shares from early 2010 through 2012. They've plummeted from $47 per share to $17… a loss of 64%. This horrific performance was produced in a rising oil price environment. During the same period, other "Big Oil" companies like ExxonMobil and Chevron registered gains. (Note: See our "Market Notes" section below for an updated look at Petrobras versus ExxonMobil.)

How could the "experts" be so wrong about Petrobras? How could investors in a big "state backed" company get killed while investors in regular oil companies did well? It's easy to explain. But we have to leave investment "La La Land" and remember how things work in the real world...

Remember how your average government agency works (or doesn't work). The bureaucrats running government agencies are not incentivized to produce profits. They are not incentivized to improve the long-term value of a business. Bureaucrats are incentivized to spend their entire budgets and grow larger. This allows them to acquire more power... and bigger budgets for next year... which allows them to acquire more power and bigger budgets for the year after that.

Compare this to an entrepreneur who has his own money on the line. He's going to do his best to keep costs down, instead of intentionally blowing his budget. He's going to do his best to hire only employees he needs... rather than hire as many people as possible. He's going to keep a close eye on his cash flow, or he'll go broke.

Most smart people know this is the difference between government and business. But when it comes to investment, even "small government" republicans and libertarians lose their minds and line up to buy shares in inefficiently managed, state-owned companies. It defies belief. They'd be better off partnering up with a crack addict.

As for Petrobras, the company has phenomenal assets. It controls some of the biggest untapped oilfields on the planet. But they are offshore oilfields. Developing them will cost enormous amounts of money. That's why the company has trumpeted its planned $200 billion-plus capital-spending plans. It's believed to be the biggest corporate-expenditure program in the world.

This absurdly large amount of spending will be overseen by bureaucrats. Take a guess on how that will turn out. While you're forming your guess, remember that if an entrepreneur opened a lemonade stand, he would work by himself and turn a profit. If a government opened a lemonade stand, it would have a dozen employees and go broke in three months.

Don't get me wrong: I'm not saying you should never buy shares in a state-owned company. They can work out as trades. Also, I'm not saying all government is bad. I'm not saying government employees are horrible people. Save your hate mail.

But just remember what happens with most every government agency or program. They are not run for a profit. They are not incentivized to keep costs down. They are incentivized to grow bloated and inefficient.

The next time you're considering "partnering up with a government" – and buying a state-owned company – remember how government works.

You'll probably do better with a lemonade stand.

Regards,

Brian Hunt

Editor's note: If you'd like more insight and actionable advice from Brian Hunt, consider a free subscription to DailyWealth. Sign up for DailyWealth here and receive a report on the most important books on investing. This report will show you several of the DailyWealth team's "must read" books, which will help you become a much better investor right away. Click here to learn more.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.