US Banking System in Crisis- Why banks are Not lending?

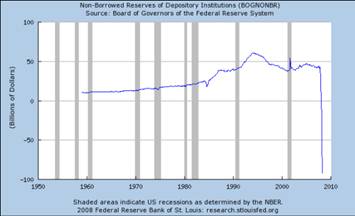

Stock-Markets / Financial Markets May 24, 2008 - 11:38 AM GMT Here's an eye opener. The attached report from the St. Louis Fed on banks' non-borrowed reserves shows that it has just gone down in flames. According to the chart, the amount of money that banks have in reserve that is non-borrowed is not only at a 50-year low, but has entered negative territory for the first time since these statistics have been kept. Does this mean our banks are now insolvent?

Here's an eye opener. The attached report from the St. Louis Fed on banks' non-borrowed reserves shows that it has just gone down in flames. According to the chart, the amount of money that banks have in reserve that is non-borrowed is not only at a 50-year low, but has entered negative territory for the first time since these statistics have been kept. Does this mean our banks are now insolvent?

Frankly, I don't have an answer, but this information is very disturbing, to say the least. The FDIC is gearing up for it, too.

Mr. William M. Isaac, former chairman of he FDIC, has written an article that also reflects what I have been commenting about in the past weeks. Here are a couple of his observations , “ Do we want the Fed underwriting takeovers of failing firms? Are we willing to allow that to happen without a competitive bidding process, which is routinely used when insured banks fail? Would we want the Fed to rescue an insurance company? How about an auto company? In short, what are the rules going forward?

Mr. William M. Isaac, former chairman of he FDIC, has written an article that also reflects what I have been commenting about in the past weeks. Here are a couple of his observations , “ Do we want the Fed underwriting takeovers of failing firms? Are we willing to allow that to happen without a competitive bidding process, which is routinely used when insured banks fail? Would we want the Fed to rescue an insurance company? How about an auto company? In short, what are the rules going forward?

I'm delighted the liquidity crisis has eased (Has it?) , and I believe the Fed had a big hand in that. But I'm deeply troubled by the precedent that has been set and the implications for our financial system.”

“That's where the money is…”

...the quote is attributed to Willie Sutton , the famous bank robber. The irony is, he never said those words. He believes that, “The credit belongs to some enterprising reporter who apparently felt a need to fill out his copy...”

But one thing is certain, the investment bankers are going where the money is… Asia . According to Dealogic, which supplies IT solutions to the banking industry, the number of acquisitions by private equity in Asia - excluding Japan - rose 15% in the first quarter of the year while worldwide deals fell.

A vote of “no confidence.”

NEW YORK ( MarketWatch ) -- U.S. stocks fell on Friday and were poised for weekly losses, as crude oil surged above $133 a barrel, putting renewed pressure on a market besieged by worries that inflation will crimp consumption and further weaken the economy.

NEW YORK ( MarketWatch ) -- U.S. stocks fell on Friday and were poised for weekly losses, as crude oil surged above $133 a barrel, putting renewed pressure on a market besieged by worries that inflation will crimp consumption and further weaken the economy.

Last week I asked whether there might be a crisis in confidence in the markets. The market had seemed to be going up despite the bad news. It now appears that the accumulation of bad news may be taking its toll.

Skeptical about inferred relationships.

( Reuters ) - U.S. Treasury debt prices plunged on Thursday as worries over rising inflation, fueled by soaring energy prices, boosted expectations the Federal Reserve might have to raise interest rates to fight price pressures.

Analysts have long warned that should energy and food price surges become ingrained trends, longer-maturity bo nd yields may spike at some point. Inflation erodes a bond's value over time. As a result, we have seen bond values decline over the last two months. On the technical side, there may be a brief rally if the decline in stocks accelerates. However, this may not be the start of an uptrend.

nd yields may spike at some point. Inflation erodes a bond's value over time. As a result, we have seen bond values decline over the last two months. On the technical side, there may be a brief rally if the decline in stocks accelerates. However, this may not be the start of an uptrend.

The bulls are back…but for how long?

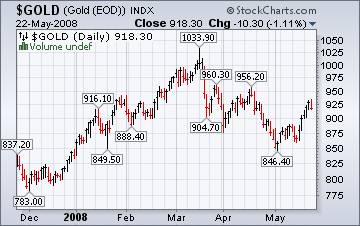

( Reuters ) - Gold bounced Friday, capping a week of solid gains on the back of a sharp crude oil rally and after a drop from a one-month high spurred buying from bargain hunters.

( Reuters ) - Gold bounced Friday, capping a week of solid gains on the back of a sharp crude oil rally and after a drop from a one-month high spurred buying from bargain hunters.

The news has certainly been encouraging for gold investors. However, they are still going against the larger trend. Speculation is still strong, but the long-term buyers in Asia are holding back from larger purchases. Purchases for jewellery and investment fell 50 percent in the first quarter of 2008 in India due to high prices, the World Gold Council has said. India 's jewellery and investment demand stood at 71 tonnes and 31 tonnes, respectively.

The gain chasers were set up for a disappointment.

( Bloomberg ) -- Most Japanese stocks fell, dragged down by trading companies and shipping lines, as commodity prices and cargo rates declined.

The Nikkei index rose 33.74 points today, but did not regain the losses earlier in the week. It has begun to follow the U.S. markets, which have been in decline since Tuesday.

.

China has a mess to clean up.

SHANGHAI, China : Chinese stocks fell Friday as investors sold shares in companies that had gained on speculation over possible profits in reconstruction projects after last week's earthquake.

Trading volume was thin as investors also awaited cues on whether China 's economic growth will maintain its momentum or be sapped by weakness in the U.S. economy.

Is the gloomy outlook going to affect the dollar?

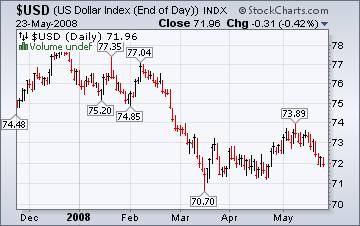

The dollar put in its worst weekly performance for two months against the euro after the Federal Reserve painted a gloomy picture of the US economy and oil prices hit record levels on Wednesday.

The dollar put in its worst weekly performance for two months against the euro after the Federal Reserve painted a gloomy picture of the US economy and oil prices hit record levels on Wednesday.

The minutes of the Fed's April meeting revealed that officials were concerned over rising inflationary risks while downgrading their assessment of the US economy. The overriding concern was that the employment situation was projected to deteriorate and the housing market showed no sign of bottoming.

Housing starts its next series of declines…the biggest yet.

WASHINGTON ( AP ) - A home- price index considered to be the most comprehensive reading of the U.S. market posted the sharpest quarterly decline in its 17-year history, and analysts say housing has yet to bottom out.

WASHINGTON ( AP ) - A home- price index considered to be the most comprehensive reading of the U.S. market posted the sharpest quarterly decline in its 17-year history, and analysts say housing has yet to bottom out.

Freddie Mac's reported net loss last quarter of $151 million, which was smaller than analysts' estimates. In reality, Freddie is gushing much more red ink than that. Yet hardly any of it is showing up on the company's income statement. It has listed $32.4 billion in losses as “temporary,” meaning that the assets with the losses are available for sale, but Freddie has not yet found a buyer. Some of these “temporary” losses have been on the books for over two years! This begs the question, “How long is temporary?” Problem is, the losses are twice the size of total shareholder equity…bailout, anyone?

Capitulation at the pump.

For years, it was not clear whether rising prices would ever prompt Americans to use less gas. But a combination of record prices, the slowing economy and a tight credit market have beaten consumers down. Gasoline demand has fallen sharply since the beginning of the year and is headed for the first annual drop in 17 years, according to government estimates.

“The psychology has changed,” said Sara Johnson, an economist at Global Insight. “People have recognized that prices are not going down and are adapting to higher energy costs. It's a capitulation.”

…just when you thought it couldn't get any worse…

The Energy Information Administration's This Week In Petroleum tells us that; “This year, daily retail gasoline prices reported by AAA have climbed every day since May 5, and EIA's weekly retail gasoline survey has increased steadily since March 24. A dramatic increase in the price of crude oil, rather than the transition to summer-grade gasoline or the start of the peak summer driving season, has been the main driver in pushing gasoline prices higher so far this spring.”

The Energy Information Administration's This Week In Petroleum tells us that; “This year, daily retail gasoline prices reported by AAA have climbed every day since May 5, and EIA's weekly retail gasoline survey has increased steadily since March 24. A dramatic increase in the price of crude oil, rather than the transition to summer-grade gasoline or the start of the peak summer driving season, has been the main driver in pushing gasoline prices higher so far this spring.”

Low stockpiles and speculators keep prices high.

May 23 ( Bloomberg.com ) -- Natural gas futures advanced, following crude oil, as a declining dollar increased the lure of commodities as an investment.

May 23 ( Bloomberg.com ) -- Natural gas futures advanced, following crude oil, as a declining dollar increased the lure of commodities as an investment.

Returns from investing in commodities, especially energy, have gained this year as investors sought alternatives to stocks. Natural gas has gained 58 percent and oil is 39 percent higher. A slower-than-average increase in gas stockpiles last week also lifted prices.

Squatters and scams coming to your neighborhood?

Squatting is on the rise across the United States as foreclosures surge, eviction notices mount and homes go unsold for months, complicating the worst U.S. housing slump in a quarter century and forcing real-estate brokers to enlist the help of law enforcement and courts to sell empty houses.

In some regions, squatting is taking on new twists to include real-estate scams in which thieves "rent out" abandoned homes they don't own. Others involve "professional squatters" who move from one abandoned home to another posing as tenants who seek cash from banks as a condition to leave the premises -- a process known by real-estate brokers as "cash for key."

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

I am now a regular guest on www.yorba.tv every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.