Japan Is Dying And We Still Don’t Get It?!

Economics / Japan Economy Nov 18, 2014 - 04:18 PM GMTBy: Raul_I_Meijer

What is it with us? Don’t we WANT to understand? Japan announced on Monday that its economy is in hopeless trouble and back in recession (as if it was ever out). And what do we see? ‘Experts’ and reporters clamoring for more stimulus. But if Japan has shown us anything over the past years, and you’re free to pick any number between 2 and 20 years, it’s that the QE-based kind of stimulus doesn’t work. Not for the real economy, that is.

What is it with us? Don’t we WANT to understand? Japan announced on Monday that its economy is in hopeless trouble and back in recession (as if it was ever out). And what do we see? ‘Experts’ and reporters clamoring for more stimulus. But if Japan has shown us anything over the past years, and you’re free to pick any number between 2 and 20 years, it’s that the QE-based kind of stimulus doesn’t work. Not for the real economy, that is.

The land of the setting sun has during that time thrown so much stimulus into its financial system that Krugman-esque calls for even more of the same look even more ludicrous today than they did all along. Abenomics is a depressing failure, just as we knew it would be since it started almost two years ago. It’s not complicated, and it never was.

Japan’s stimulus has achieved the following: banks get to pretend they’re healthy and stocks rise to heights that are fundamentally disconnected from underlying real values. On the flipside of that, citizens are being increasingly squeezed and ‘decide’ not to spend (not much of a decision if you have nothing to spend). Since Japan’s ‘consumer’ spending makes up about 60% of GDP, things can only possibly get worse as time passes. If ‘consumers’ don’t spend, deflation is the inevitable result – and that has nothing to do with the much discussed sales tax, it’s been going on for decades -.

Therefore, the sole thing QE stimulus has achieved is a wealth transfer from poorer to rich. And that’s not only the case in Japan. Mario Draghi yesterday hinted – again – at all the stuff he could start buying next year, including sovereign bonds, even though that would violate EU law. And whether or not Germany will let him in the end, the fact that he keeps the option alive even if only in theory, tells us plenty about the mindset at the ECB.

That is, it’s the same as in Japan. And doing the same can only lead to the same results. A poorer population, a richer toplayer and an economy that continues to shrink, which will and must lead to the same deflationary trend. The idea that an economy can be rescued by pushing public funds into its finance system and stock markets has been forever thrown out by Japan’s experiences.

Draghi said yesterday that ‘monetary policy has done a lot’, and while that may be correct, it says nothing about WHAT it has done. From where I’m sitting, Germany’s recent drift into negative territory and the ongoing record unemployment rates around the Mediterranean certainly tell us a lot about what it has NOT done. QE, no matter how big and how crazy, doesn’t heal real economies, it makes them sicker.

If consumer spending makes up 60% of GDP, as in Japan, or even 70%, as in the US, then you need to boost that spending. And you don’t do that by handing over what financial wiggle room you have left, to banks so they can pile it on to the reserves they hold at central banks.

It is accepted as gospel that it’s a good thing to give banks free money, but it would be the devil’s work to give it to consumers. Instead, the latter must be squeezed from all sides, through austerity, the loss of services, benefits, wages and jobs, in order to prop up the financial system. How and where is it not clear what that will result in? There’s only one possible outcome.

The reason why all governments and central banks keep following the failed QE stimulus path regardless lies in the relative political powers that different parts of a society have. In today’s world, saving the banks, which equals saving the rich, is not only the priority, it’s the only deliberation.

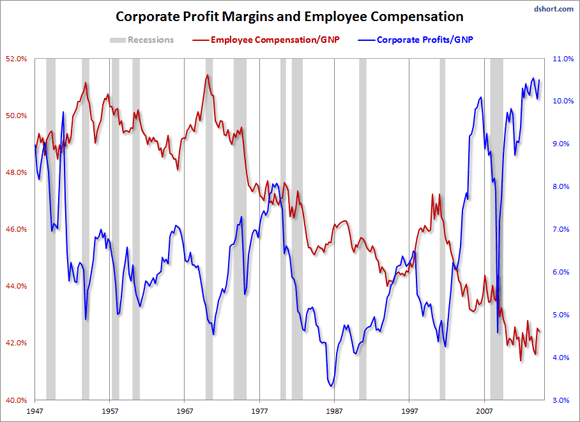

And if you might be under the impression that what is true in Japan and Europe does not hold in the US, why not start with this graph from Doug Short, and take it from there.

If and when an economy is as deep in the doldrums as all major economies today are, you can’t rescue it by taking from the poor to save the rich. It’s fundamentally impossible. You need the bottom 90%’s spending in order to generate enough GDP to stay out of deflation. Money must move through an economy for it to stay sufficiently ‘lubricated’. And the only people who can keep that money moving are the bottom 90%. It’s Catch-22.

Any stimulus must be directed at the bottom, or it must of necessity fail. Nothing commie or socialist about it, but simply the way economies work. And it’s not just some difference of ideal or insight or something, it’s very simply that an economy cannot function without its poorer 90% of citizens spending.

Anything else is simply Grand Theft Auto. Both Japan and Europe are preparing for more of it.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.