Is the Gold And Silver Golden Rule Broken?

Commodities / Gold and Silver 2014 Nov 22, 2014 - 06:39 PM GMTBy: Michael_Noonan

He who owns the gold rules.

He who owns the gold rules.

That has been the clichéd "wisdom" for some time. However it appears Russia has become the Rodney Dangerfield of the Golden Rule, for it certainly is not getting any respect. To the contrary, the Golden Rule has become subservient to Military Rule, the last remaining leg upon which the US rests in its ongoing inability to retain respect internationally.

As formidable as US military might is, it is not always effective in execution, and to date, it has only been [in]effective against those nations that have no military might, Iraq, Libya, Afghanistan. Syria is still a work in process, but the only reason why Syria has not been destroyed, like the other countries, is because Russia, Putin, stepped in to expose the Obomb-em administration and false flag "insurgent" gassing of citizens.

What continues to be an equal deterrent like military might is the Rothschild-established fiat monetary system that has engulfed and economically eviscerated the Western world. One exception would be Germany, but Merkel has been allowing her central bankers hold sway, via US sanctions against Russia, and harming Germany's economy and ability to otherwise survive the economic chaos in the rest of the EU.

As the US de facto 51st State, Germany is running at cross-purposes toward its own survival. It is unlikely that the more pragmatic German sense of maintaining her superior economic sustainability will tolerate much more US abuse, but the time is now for Germany to declare its independence from external forces that have created that nation's recent economic slide.

The intrusion of the NSA spying on German politicians and companies, along with all her citizens should have been enough to sever the fiat umbilical cord, but there has been a degree of German complicity in setting up the ability for the NSA to begin with. Then there was the affront, at least apparent on the surface, by telling Germany her gold could not be repatriated or even inspected, for the next seven years, more likely if ever. Yet, Germany also backed down from that US insult, too.

For as long as Merkel and the prevailing politicians can keep the fed-up business sector at bay, the US and its cadre of Red Shield central bankers will pursue self-destruction as these controlling forces of evil pursue the attempted destruction/survival of Russia.

It is interesting that elite master puppeteer Henry Kissinger chose to air his views in an article published by Der Spiegel, in Germany, that a new world order is needed, while acknowledging that the handling of Ukraine by the West, blaming Russia and pushing for sanctions has been a mistake. Why would Kissinger, a devout elitist, choose Der Spiegel, except perhaps as a signal that Germany is important as a link to preserve the efforts at creating the final ends of the NWO, and that nation should not break ranks? For Germany's own interest, breaking ranks is imperative, and likely a matter of time.

Kissinger, stating the West mishandled the Ukrainian fiasco in the US bungling efforts to economically weaken Russia and isolate her from the rest of Europe, along with Alan Greenspan's earlier announcement that gold was a buy are not random events. Something is going on when two old guard elite messengers are sending some kind of message, maybe that the "dollar" is on its way out and there has to be more careful reconfiguration as to how the NWO is going to accomplish its insidious objective of ending all national sovereignty in favor of an uber-governmental rule by a handful of people.

Said Kissinger, "Russia is an important part of the new world order." The only way in which Russia can be important is to keep it isolated from any further relationship with Europe, as has been the intent of the elitists since the early 1800's. At that time, it was the duty of Britain to keep Russia engaged in the Anglo-Afghan Wars, parts I and II. Once the UK went belly up, the US took over in the 1940's and 1950's with Operation Gladio, part III, doing whatever was/is necessary to prevent Russia from engaging with Europe as a supplier of its vast natural resources, thus minimizing the role of the US and Western central banker control.

Russia has the gold [along with China], the US and EU do not. Why is the Golden Rule not being applied? The timing is not quite right for Russia, for Putin must coordinate with China and the other BRICS nations so as not to disrupt the building economic ties that are bringing the US to its fiat knees. Also, and maybe most importantly of all, the elites are not yet positioned to wield control and power over Russia as the NWO shifts its base from West to East, a transition that has probably been planned for several decades in advance.

While many have been assuming that the shift in gold, and its attendant power, from West to East, mostly China and Russia, spells the end for the elites and their Western central bank dominated fiat Ponzi scheme, that may not be the case. The elites are the most powerful controlling forces on the planet, and to think that the Red Shield demons have not been planning for that inevitability is pure folly.

Both Russia and China are on record for saying that the IMF should play a key role in the world's monetary system. Why would both countries pay tribute to the IMF, a lower part of the BIS, when these institutionalized monetary systems of theft and world-enslavement via debt, are the backbone of the Rothschild elite's world domination? Why has the concerted effort to suppress gold and silver been so unopposed by China and Russia when either country to "stick it" to the West and collapse the "dollar" and Western central banks in a day?

Is it the newly emerging powerful East, flush with control of the world's physical supply of gold, versus the rapidly declining West, choking on maintaining a paper derivative house of cards that could collapse with just the right amount of minimal effort from the East?

As the Rothschild forces switch from West to East, the "Game" must be preserved at all costs, and that includes the gaming of the rest of the non-elite world. Nothing is ever as it seems when dealing with the elites, masters at deception and mass-mind control through its own total control of governments and all media.

What will be the impact for gold and silver? Maybe not the upside explosion so many are expecting. Control is the strongest suit of the elites, and they will not let gold and silver explode to unheard of levels if such an event is not in their best interest. It may also well be that China and Russia are assisting the IMF because it is not in their best interest to see gold and silver "reset" dramatically higher. All the world is a stage.

Where there could be a huge increase in the "value" of gold and silver is in the United States when the fiat "dollar" self-destructs from the unsustainable creation of "dollars" the rest of the world will no long accept. That can only lead to the de"value"-ation of the "dollar," and where it takes 1,200 fiat Federal Reserve Notes [FRNs], called "dollars" even though they are not, to buy an ounce of gold, and 17 FRNs to buy an ounce of silver, with the destruction of the US fiat monetary system, those of us living in the US will discover that it could take thousands of fiat FRNs to buy the same one ounce of gold, and hundreds of the same fiat to buy an ounce of silver.

The relative price "value" of silver and gold may not change as much for those in the East, but the imagined $5,000 or $10,000 ounce for gold and $150 or $300 ounce for silver, in the West, may not be the anticipated dream come true and instant wealth, but instead a nightmare as the fiat trillions have no value for the East factions and Weimar-like value for those in the West, and for sure the US.

The Golden Rule may not be broken, but it may just be in the process of necessary change for it to reassert itself. For US citizens, do not get caught without holding any.

For as manipulated are the stock markets by the Fed, as can be seen in the charts, the same holds true for gold and silver. The charts do not show any change in the forces being applied, and all anyone can do is read them as they are.

Silver may play a pivotal role in the next rally phase for PMs. If nothing else, the ratio of gold to silver says it will eventually come in from its present 73+:1. The ratio could go still higher: 80:1, 90:1, who knows, as a bottoming process unfolds before reversing lower.

Considered as the poor man's gold, some suggest the elites want to "crush" silver and exhaust the patience and/or willingness for people to hold silver. Then, once that game plan has been executed, thrust the price of silver substantially higher and closer in value to gold, thereby making it too expensive for the average person to buy. Whether this is idle conjecture or not makes little difference. What does matter is that both silver and gold remain the best alternative to the FRN fiat, or any others, will come undone, at some point, whenever that may be.

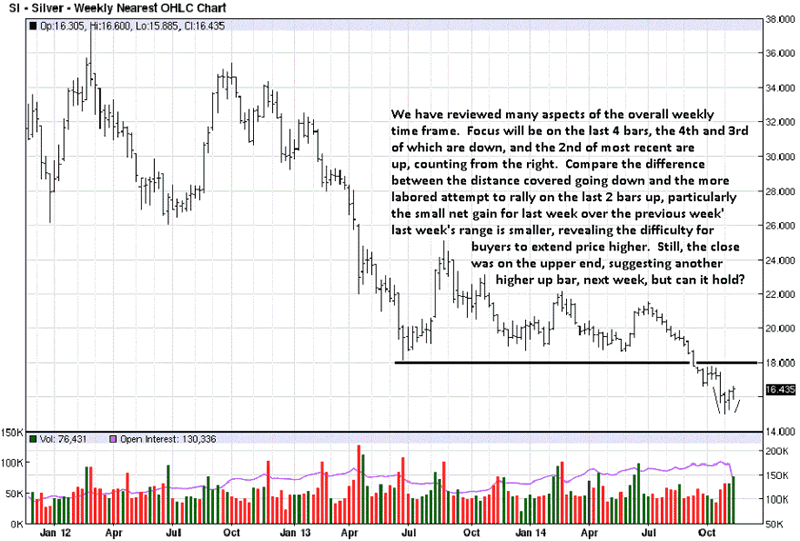

For as encouraging as the recent PM rally may seem, it is still just a rally within a clearly defined down trend. When price declines, the ranges are greater than when price rallies, and that is the character of a market that is struggling to go higher. Unlike gold, silver has not even come close to regaining a close back into the broken downside of 18.

The smaller range of last week reflects the struggle for buyers to extend the rally higher. However, the close was at the high-end of the range, and it is a better show, relatively, for buyers over sellers. The upper range close gives a higher probability of an extended rally into next week. How much higher is not known. It could be just a little or a lot higher, but there is no apparent change in trend.

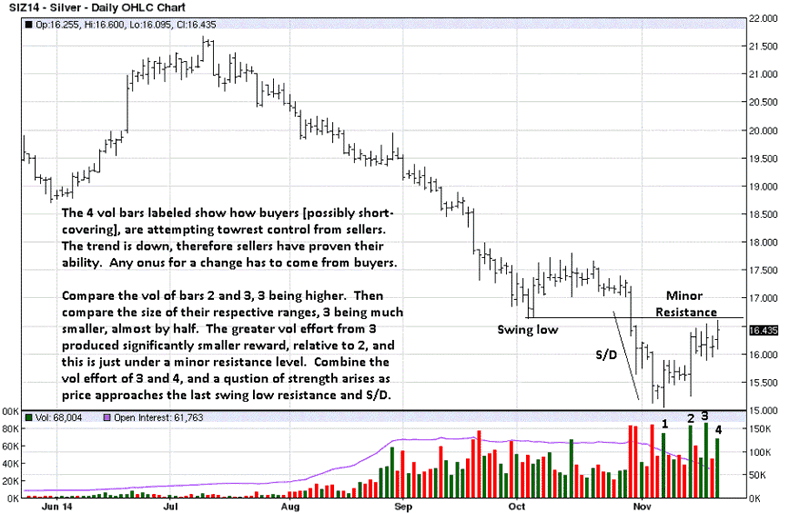

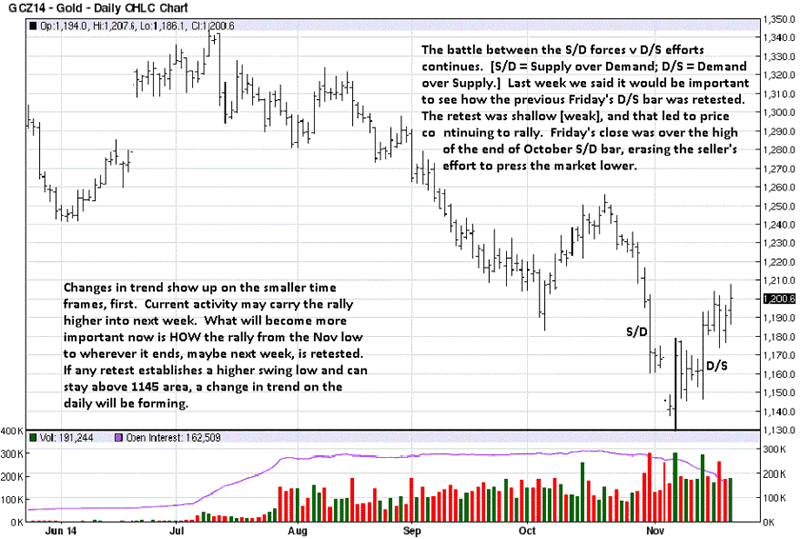

Applying a little bit of common sense can give anyone an idea of the market's ability or lack of ability to sustain a rally. You can see the swing low from early October, when it acted as brief support. Once that support was broken at the end of October, it became potential future resistance. The current rally has stalled just under that level.

Judging from the weak reaction after the strong rally two Friday's ago, the current pause may be buyers absorbing all the offers from the sellers prior to moving higher. The highest volume effort has been on rally days. We point out a contrary read on the chart comment. Which way will it go? There is no need to "guess" or "predict," in advance. It is a future event, and no one knows how the future will unfold. Better to watch how the market activity develops, and at some point, an opportunity will present itself.

S/D = Supply overcoming Demand in a stronger than normal manner. The opposite is true for D/S, when Demand [Buyers], overwhelms Supply [Sellers].

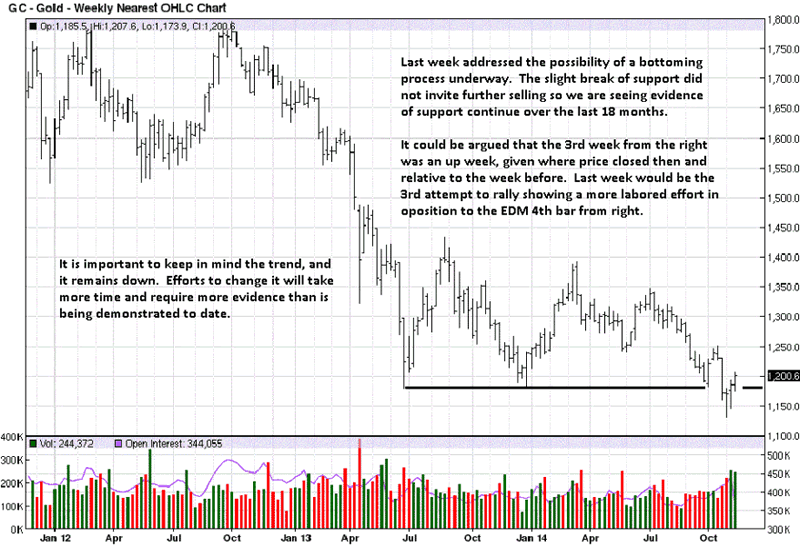

The prospects for a bottoming process continues, without necessarily saying a bottom has been established. Will the low from 3 weeks ago hold and establish a bottom? The only way to ever know that for certain is from future developing market activity that confirms a bottom is in place. What would that be? A series of higher swing highs followed by higher swing lows. It takes time and patience for a bottom to be confirmed. Just ask those who thought the market reached a bottom over the past few years.

The race to be first to "know" is an ego-driven one that is typically costly and a fool's game.

The current rally from November is creating a swing high. What must follow is the next reaction lower has to stay above the November low. There have been several swing highs in this chart, but you can readily see that there has been no successful higher swing low. The swing lows from June, August, and October have all failed to hold. There is no evidence yet that the November low will hold. It may, but its realization as a low can only be confirmed by future activity.

For trading purposes, there is no reason to be long. For buying and holding physical gold and silver, there are too many reasons not to be long. Plan accordingly.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.