Is The Halt of QE3 The End of The Loose Monetary Policy?

Stock-Markets / Quantitative Easing Dec 10, 2014 - 02:58 PM GMTBy: Arkadiusz_Sieron

The end of QE3 neither implies the real abandon of purchasing assets (due to reinvesting interest and principal payments and rolling over retiring Treasuries) nor the permanent exclusion bond-buying programs from the tools of monetary policy. Investors should also be aware that the end of QE3 does not rule out loose monetary policy. Why?

The end of QE3 neither implies the real abandon of purchasing assets (due to reinvesting interest and principal payments and rolling over retiring Treasuries) nor the permanent exclusion bond-buying programs from the tools of monetary policy. Investors should also be aware that the end of QE3 does not rule out loose monetary policy. Why?

The reason is that the quantitative easing regime is only one measure in the central banks' arsenal of monetary policy instruments. Other unconventional monetary policies are: interest rates kept very low for a significant amount of time, signaling lower market expectations for lower interest rates in the future and credit or qualitative easing, i.e., purchasing not only government bonds, but also private sector assets (e.g., related to real estate markets). These instruments did not change and are not going to change in the immediate future. Although Charles Plosser, the President of Federal Reserve Bank of Philadelphia and a voting member of the policy-setting Federal Open Market Committee, said recently that the U.S. central bank should raise short-term interest rates rather sooner than later, the Committee wrote in its latest statement that the interest rates will remain extremely low for a "considerable time". It is worth recalling in this context that the low real interest rates are one of the most important drivers of the gold price, as we explained in one of the previous editions of the Market Overview.

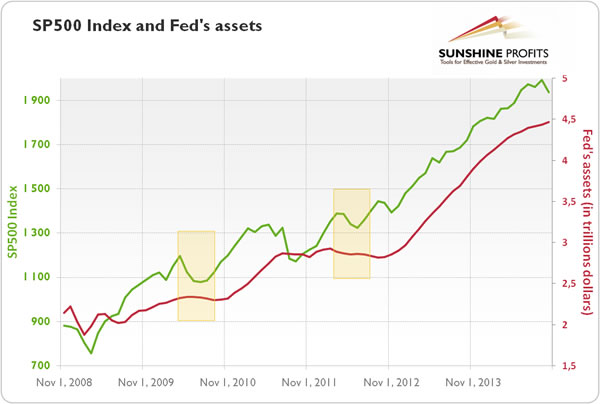

The Fed is unwilling to hike low interest rates too soon, so its balance sheet will not change for a while. According to the "stock view" accepted by the U.S. central bank, the long-term interest rates are influenced by the total stock of securities held, not the flow of new purchases. Since the Fed is still going to hold these assets, investors should expect long-term interest rates to remain low. As we can read in the Fed's press release from September 17, 2014, "the Committee expects to cease or commence phasing out reinvestments after it begins increasing the target range for the federal funds rate; the timing will depend on how economic and financial conditions and the economic outlook evolve." So, in a sense, this is all about the proper signaling. According to William Dudley, the President of the New York Federal Reserve Bank, shrinking the balance sheet could inadvertently convince markets that interest-rate hikes were imminent. On the other hand, some think that the U.S. central bank has to reduce its balance sheet and commercial banks' excess reserves to make the federal funds rate effective. Otherwise, the fed funds rate would no longer send signals across the yield curve because banks do not need interbank loans with so much liquidity from the QE.

The Fed has bought assets worth $3 trillion in the last six years. Purchasing has stopped, but do not confuse this with a monetary tightening. The Fed is not filling up the financial hole left by its expansionary monetary policy. It has only stopped digging itself deeper. Not surprisingly it has to be a gradual process - the U.S. central bank cannot just dispose of bonds worth $3 trillion at once as this would decrease asset prices and raise long-term interest rates. And the very probable scenario is that Fed will not actively sell its holdings of assets, but will instead allow the portfolio to shrink as bonds mature.

But let's leave aside the Fed's future exit strategy and emphasize once again that the end of QE3 is not monetary tightening. It will be obvious if we accept the opinion that QE3 was actually never a form of expansionary monetary policy, but rather a way to support equity markets and bail out financial institutions, because it removed some of the riskiest assets from commercial banks' balance sheets, while it did not encourage banks to make new loans and increased only their excess reserves at Fed.

Graph 1: SP500 Index and Fed's assets (in trillions of dollars) from November 2008 to October 2014

The end of QE3 is in the best case only the first step on the long road to normalizing the U.S. central bank's policy (which also requires interest rate hikes and shrinking Fed's balance sheet). But probably this is only a change in monetary policy tools. However, the monetary policy will remain accommodative, and any restrictive effect of the end of QE3 could be neutralized by more expansionary usage of normal open-market operations or other instruments, such as the interest on required balances and excess balances, the reverse repo or term deposit facilities. Eric Rosengren, the President of the Boston Federal Reserve Bank, also noted the intent of "holding interest rates very low for longer than anticipated and communicating that intent publicly". Some even voiced opinions that the end of QE3 was a price paid by the dovish camp to the hawks for the promise to keep short-term interest rates near zero well into the future, which would be a positive message for gold investors.

Stay updated on the latest developments in the Fed's policy, gold market and US economy by signing up for our Market Overview reports. We also provide Gold & Silver Trading Alerts for traders interested more in the short-term prospects. If you're not ready to subscribe now, we still encourage you to join our gold newsletter. It's free and you can unsubscribe in just a few clicks.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.