2014 Silver Eagle Sales Break Annual Record at Over 43 Million!

Commodities / Gold and Silver 2014 Dec 12, 2014 - 12:26 PM GMTBy: Jason_Hamlin

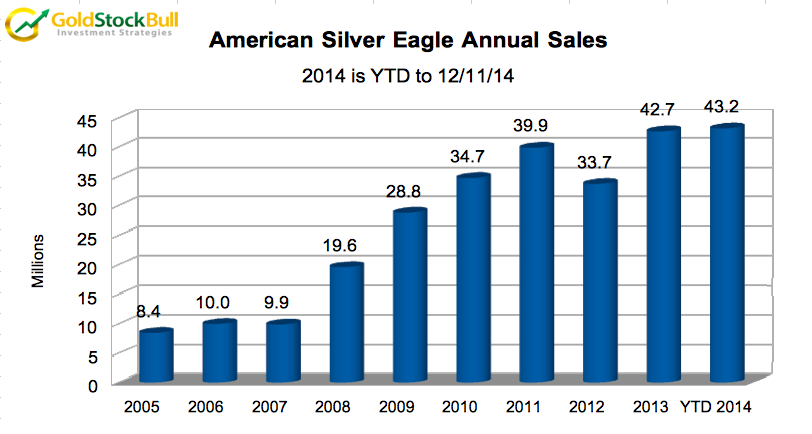

Silver Eagle sales in 2014 have already broken the 2013 annual record with a few weeks of sales still left to be counted. As of December 11, the U.S. Mint reported that 43.1 million silver eagles have been sold so far in 2014. This compares to the 42.7 million during all of 2013, which was the previous all-time record.

Silver Eagle sales in 2014 have already broken the 2013 annual record with a few weeks of sales still left to be counted. As of December 11, the U.S. Mint reported that 43.1 million silver eagles have been sold so far in 2014. This compares to the 42.7 million during all of 2013, which was the previous all-time record.

Investor demand for silver clearly remains strong and people are taking advantage of discount prices. Why not? It isn’t too often that you can purchase an end product for less than the cost to produce it. Many miners are unprofitable at current silver prices as their all-in cost of production is closer to $20. I believe this is an excellent time to take advantage of the paper games that have pushed prices to such absurd lows. Silver at under $20 per ounce is not likely to last long.

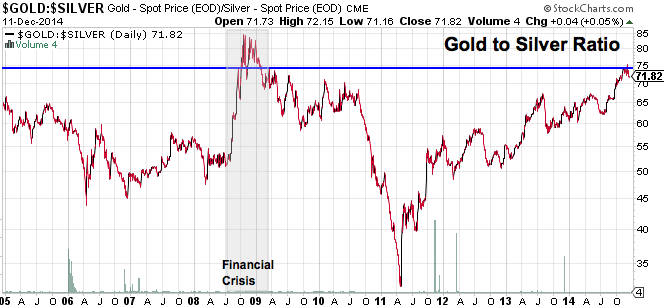

Another reason that I believe silver is vastly undervalued at present time is the gold to silver ratio. It has now risen to the highest levels since the depths of the 2008 financial crisis and third-highest levels since the start of the bull market back in 2001. You can now buy twice as many silver eagles with one ounce of gold that you could in late 2008!

Why is the current ratio so insane? Because the historic gold to silver ratio is closer to 16 and the production ratio is also closer to 16. Since its inception in 1986, the U.S. Mint sold 401.4 million Silver Eagles and 20.6 million oz of Gold Eagles. This is an overall ratio of 19 to 1. The natural ratio of the metals in the ground is 9 ounces of silver to every one ounce of gold. So, while one might expect the price ratio to be somewhere in the 10 to 20 range, it is currently above 70!

Over time, the ratio should trend downwards as all of the gold ever mined is still in existence and most of the silver gets used up in industrial applications and is not economically recoverable. Some analysts believe these supply and demand fundamentals will eventually lead to silver prices being close to parity with gold.

Silver selling at 1/72 the price of gold is an anomaly that I do not believe will last. If we use a ratio of 20-to-1, the price of silver would need to climb to $60 at the current gold price. And even at a ratio of 30-to-1, silver would need to revalue to $40 per ounce, going up by roughly 2.5 times!

The bottom line is that on a long-term historical basis, silver is wildly undervalued not only in fiat dollar terms, but also relative to gold. The gold to silver ratio does not climb above 70 too often and I believe this represents a rare buying opportunity. I hold both gold and silver, but have been adding exclusively silver over the past few months and will continue to do so until the ratio drops considerably. Conservative investors might be interested in a pair trade at this time by going long silver and short gold.

The greatest returns are likely to come from silver mining stocks or silver streaming companies that have fallen to severely undervalued levels. The best in breed mining stocks are likely to offer investors leverage of 2x to 4x the move in the silver price. If silver climbs back to $40 in the coming months, I expect quality silver miners to go up by 5 to 10 times! This is the upside potential that I believe exists at the current time in the silver market with very little downside risk.

If you would like to see which silver stocks we currently hold in the Gold Stock Bull Portfolio and get updates whenever we are buying or selling, sign up for the premium membership by clicking here.

A 3-month trial subscription is just $95 and we offer a 100% satisfaction guarantee. In addition to the portfolio and trade alerts, you will also get our monthly contrarian newsletter with fundamental and technical analysis across not only precious metals, but the energy, agriculture and technology sectors as well.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here.

Copyright © 2014 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.