Stock Market Happy Holidays

Stock-Markets / Stock Markets 2014 Dec 27, 2014 - 08:07 PM GMTBy: Tony_Caldaro

The week started at SPX 2071. On Monday the market rallied to the previous all time high at SPX 2079. Then on Tuesday, Wednesday and Friday it made higher highs, reaching SPX 2093. For the week the SPX/DOW gained 1.15%, the NDX/NAZ gained 0.85%, and the DJ World index gained 0.80%. Economic reports for the week were mixed. On the uptick: Q3 GDP, personal income/spending, the FHFA index and weekly jobless claims improved. On the downtick: existing/new home sales, consumer sentiment, durable goods, and the WLEI. Next week, another holiday shortened week, there are only two reports scheduled: ISM manufacturing and Construction spending, both on Friday.

The week started at SPX 2071. On Monday the market rallied to the previous all time high at SPX 2079. Then on Tuesday, Wednesday and Friday it made higher highs, reaching SPX 2093. For the week the SPX/DOW gained 1.15%, the NDX/NAZ gained 0.85%, and the DJ World index gained 0.80%. Economic reports for the week were mixed. On the uptick: Q3 GDP, personal income/spending, the FHFA index and weekly jobless claims improved. On the downtick: existing/new home sales, consumer sentiment, durable goods, and the WLEI. Next week, another holiday shortened week, there are only two reports scheduled: ISM manufacturing and Construction spending, both on Friday.

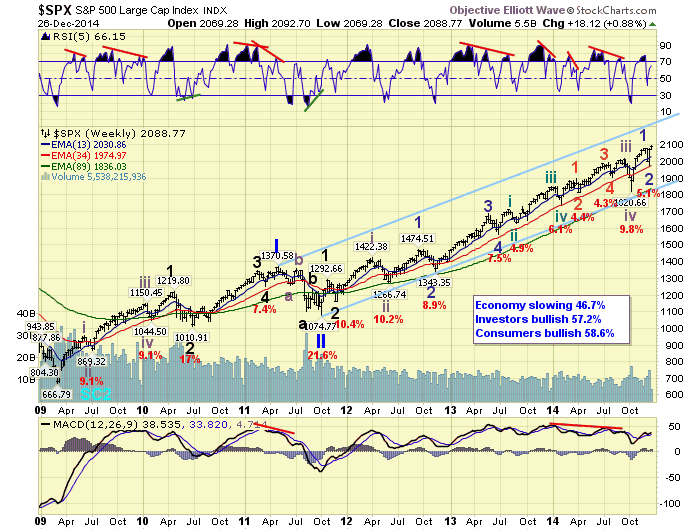

LONG TERM: bull market

With three trading days left in 2014, it appears this bull market will soon enter its sixth year. The long term trend is up, the medium term trend is up, and the short term trend is impulsing higher. The market is up 13% for the year, and may even hit 14% before close of business on Wednesday. All in all a fairly solid gain considering the alternatives.

We continue to label this market as Cycle wave [1], the first bull market of the multi-generational Super cycle wave 3. Cycle wave [1] should unfold in five primary waves. Primary waves I and II completed in 2011. Primary wave III has been underway since then. Primary wave I divided into five Major waves: with a subdividing Major wave 1 and simple Major waves 3 and 5. Primary wave III appears to be alternating with that pattern: a simple Major wave 1 and thus far a subdividing Major wave 3. Since Major wave 3 has yet to complete, it recently extended again, we still have Major waves 4 and 5 ahead before even Primary III completes. Then after a Primary IV correction, Primary V should then take the market even higher. After 69 months of generally rising prices, the market has more than tripled. It appears this bull market has many months to go, if not, a few years.

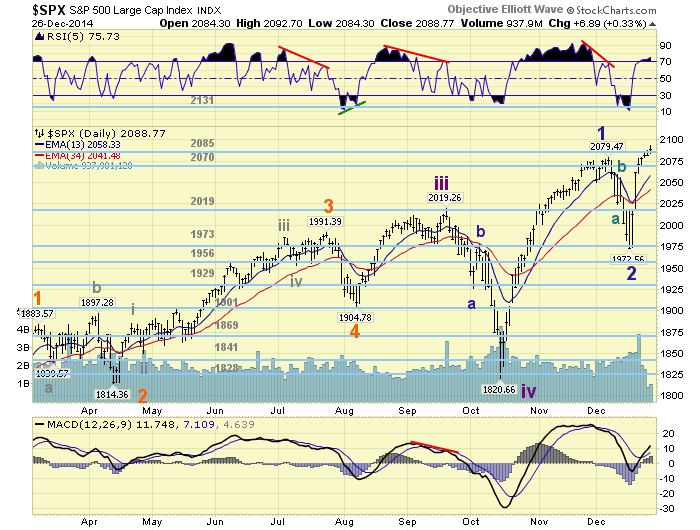

MEDIUM TERM: uptrend

Nearing the SPX 2079 early December uptrend high, we expected a correction ranging anywhere from 5% to 15% to unfold. The reason for the range is that we have been monitoring three potential counts for this bull market. The preferred count, which has been posted in these reports, suggested a 5% to 10% correction. Ten percent if Major wave 3 completed at SPX 2079, or 5% if Intermediate wave v of Major 3 was subdividing.

After the uptrend topped and the correction was underway, we tracked the wave pattern to observe how it was unfolding. We counted a simple zigzag down to SPX 2024 for an A wave, then a simple rally to 2056 for wave B. After that the wave C that followed became complex. Nevertheless, we identified a potential low at SPX 1973 a week ago Tuesday. At that low the market had corrected 5.1%, and all of the technical parameters we track suggested a potential downtrend low. The following day the market rallied in five waves to SPX 2012, pulled back to 1992, then rallied to 2017 before ending the day at 2013. A new uptrend appeared underway.

This week OEW confirmed the uptrend. With only a 5% downtrend correction, an Intermediate wave v extension is probably underway. This suggests the uptrend high at SPX 2079 was only Minor 1 of Int. v, and the low at 1973 Minor 2. This uptrend should be Minor 3. Our initial target for this uptrend is the OEW pivot at 2214. Medium term support is at the 2085 and 2070 pivots, with resistance at the 2131 and 2214 pivots.

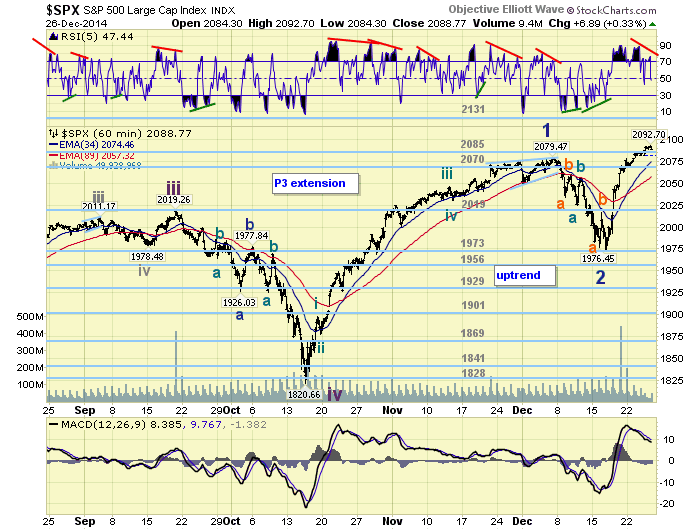

SHORT TERM

As noted above, from the downtrend low at SPX 1973 the market rallied five waves to 2012. We are counting that as wave 1 of Minute i of this Minor 3 uptrend. Then after a pullback to SPX 1992, wave 2, the market rallied in wave 3 of Minute i. Thus far, we can count seven waves up from that low into Friday’s high at SPX 2093. This suggests a pullback, and then one more rally to end this third wave.

The internal structure of this rally suggests a maximum high, for this third wave, at SPX 2100. Should that level be exceeded before we observe about a 20 point pullback, then the count would have to be updated. The updated count would suggest Minute i and ii ended at SPX 2012 and 1992, with Minute iii underway. And not, as previously noted. Short term support is at the 2085 and 2070 pivots, with resistance at SPX 2100 and the 2131 pivot. Short term momentum is displaying a negative divergence.

FOREIGN MARKETS

The Asian markets were mostly higher on the week for a net gain of 1.0%.

The European markets were mostly higher on the week for a net gain of 0.9%.

The Commodity equity group were all higher for a net gain of 3.4%.

The DJ World index gained 0.8%.

COMMODITIES

Bonds continue to downtrend and lost 0.5% on the week.

Crude also continues to downtrend and lost 4.6% on the week.

Gold is still in an uptrend, had a choppy week, and gained 0.1%.

The seven month uptrend continues as the USD gained 0.5% on the week.

NEXT WEEK

Thursday: holiday. Friday: ISM manufacturing and Construction spending at 10am. Nothing noted on the FED’s agenda. Best to your weekend and New Year week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2014 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.