Welcome, Baby 2015

Stock-Markets / Financial Markets 2015 Jan 02, 2015 - 12:58 PM GMTBy: Gary_Tanashian

So Baby 2015 has slammed the book on wrinkled old 2014 (this imagery just cracks me up), a year that featured the continuation of existing macro trends like US stocks up, global stocks wobbling, precious metals weak and commodities weak to tanking.

So Baby 2015 has slammed the book on wrinkled old 2014 (this imagery just cracks me up), a year that featured the continuation of existing macro trends like US stocks up, global stocks wobbling, precious metals weak and commodities weak to tanking.

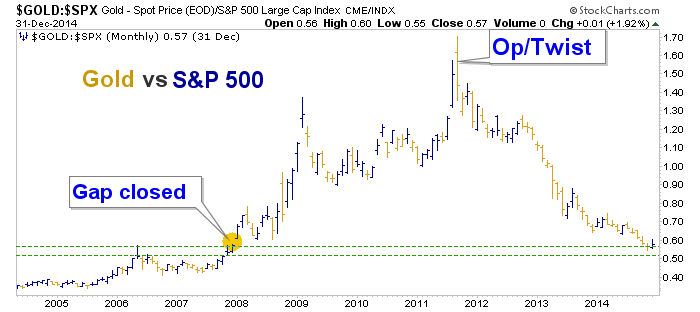

Personally, I found the year revolting as an honest market participant, but thankfully made like a caveman and simply used my tools to help me avoid the pitfalls of my emotions and logical mind. I try very hard to tune down the Tin Foil Hat stuff, but I continue to be in awe of Policy Central and the depths of what looks to me like depravity that they will stoop to in order to keep up appearances. Reference Operation Twist and its “inflation sanitized” selling of short-term notes and buying of long-term bonds.

Who would’ve thought managing an economy and a financial system could be so easy, so controlled and well, so sanitary? Of course, that was way back in 2011, when the macro began to quake in anticipation of change. An anti-market (AKA gold) was brought under control but good and though the masses would hold tightly to their fear (so deeply ingrained from 2008) for another year or more, 2013 and 2014 saw increasing momentum toward a complete recovery of hurt feelings from the 2008 crisis time frame.

This one act of man (among all the others that came before and after it) inflicted upon markets came in tandem with a profound change on the macro as illustrated by the chart of gold vs. the S&P 500. We can complain all we want (and I sure did my share of it) or cry foul but the chart has been the grim reality for three years now.

Why is it grim reality when it accompanied an era of increased money creation but no inflationary repercussions and to boot, strengthening economic activity? Well, I am afraid I don’t have that answer yet other than to continually parrot that for every action there is a roughly equal and opposite reaction and that you don’t get somethin’ for nuthin’.

My market report is named Notes From the Rabbit Hole for just this reason; sometimes things are not readily quantifiable at their essence by normal metrics. Until the last few months when the US stock market began to decouple from its normal fundamentals, we had noted that the market was not particularly over valued and certainly not in a bubble. It was monetary policy – running 24/7 since 2008 – that was in a bubble.

Today, some aspects of that policy have been altered and even withdrawn, and 2015 promises to introduce new dynamics into the picture as QE’s money creation fades and the ‘will they or won’t they?’ interest rate hype comes to the fore. But a big point for contrarians to take note of is that the events that culminated in the figurative end of the (financial) world in Q4 2008 are now closed out. They never happened. The of the gap on the chart above says so.

Speaking of gaps, NFTRH.com would like to wish you a Gappy New Year with its routine management of daily charts of the RUT, NDX, SPX and Dow.

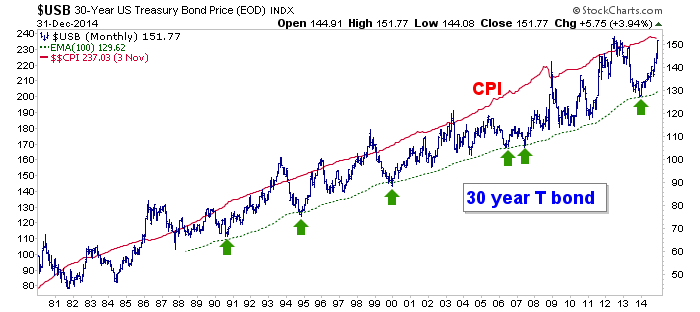

Back on message, here is another chart I keep close by among the hundreds of indicators (seen LIBOR lately?) and reference points available. It is the very simple view of a dysfunctional Treasury bond market climbing higher and higher over the decades, ostensibly because their is no inflation problem. Yet as we all know the CPI has a funny way of not only not giving back the cost pressures of previous inflationary operations, but certain segments of the economy are building cost pressures. These are of course due to the inflation that has been running since 2008 and really, 2001 or so when Alan Greenspan really kicked off the age of ‘Inflation onDemand’ ©.

I want to wish all Biiwii.com and NFTRH.com readers a happy and prosperous New Year. There is only one way to manage when things are so asymmetrical or non-linear as they are in today’s macro markets and that is through focus and hard work. Global policy makers have mucked up the works so thoroughly that it is ever more focused and hard work that will see us through. My New Years’ resolution is to continue to improve in my methods and discipline, and beat them at their own game.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.