Gold and Silver Steady Start for 2015

Commodities / Gold and Silver 2015 Jan 09, 2015 - 02:54 PM GMTBy: Alasdair_Macleod

Gold and silver started the year at a muted point, with gold at $1168 and silver at $15.50, from which modest rallies have developed, with gold up 4% and silver 6%. These rises were against a background of high volatility in equity markets, a strong US dollar and very weak oil prices.

Gold and silver started the year at a muted point, with gold at $1168 and silver at $15.50, from which modest rallies have developed, with gold up 4% and silver 6%. These rises were against a background of high volatility in equity markets, a strong US dollar and very weak oil prices.

The firmly entrenched bearish opinions in recent months for the outlook for gold and silver have backed off from recent extremes. There is confusion in dealers’ minds, brought about by the threat of deflation and the collapse in oil prices.

Whereas hedge funds would automatically sell gold whenever they detected dollar strength, this is no longer the case. Precious metals now seem to be responding more to the threat of global financial instability triggered by a strong dollar, and fund managers are selling other commodities instead. Indeed, it is remarkable that despite the USD hitting new highs against nearly all currencies, gold has not only held its ground but is actually rising.

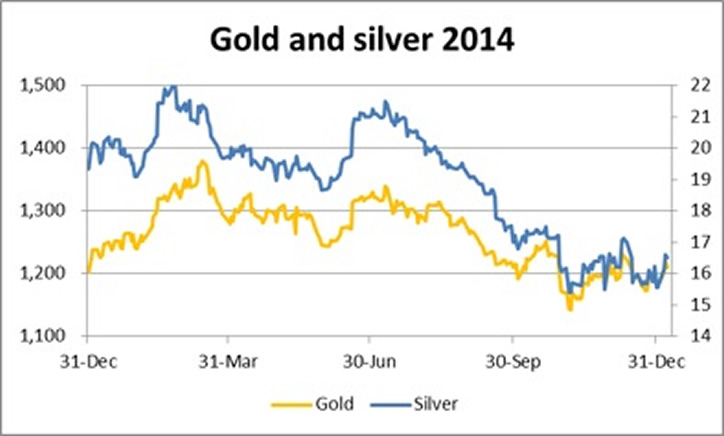

In reviewing last year, we note that the establishment was bearish of gold with forecasts down to $850. Remember that it was described by one major house as a slam-dunk sell. In the event, gold was more or less unchanged in USD, but rose in nearly all other currencies: 4% in sterling, 11% in euros and 15% in yen. In emerging market currencies the rise was even greater, for example doubling against the Russian Ruble. Silver, in common with most industrial metals, weakened from mid-year onwards, losing significantly over the year.

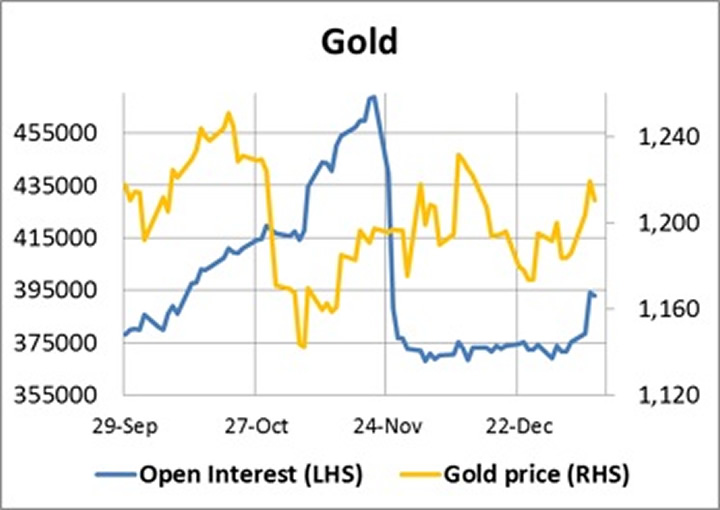

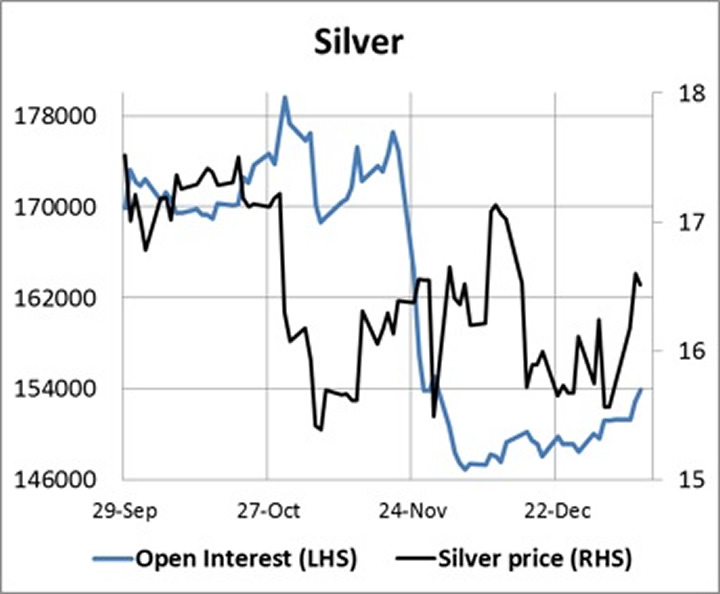

The current market is mildly encouraging for precious metals so far, as the following two charts of Comex open interest illustrate.

Gold’s open interest has perked up this week after the sharp fall in November as shown in the chart above, indicating buyers returning to the market. A similar pattern is developing in silver as shown in the next chart.

Over the holidays the gold open forward rate (GOFO), stayed negative signalling a continuing shortage of physical gold in the market. The pattern of GOFO has been to go more negative on dips below $1200, which suggests that physical buyers have been accumulating bullion at that level.

In the three trading days between Christmas and New Year the Shanghai Gold Exchange delivered a further 28.96 tonnes, giving a total delivered into Chinese wholesale markets for the year of 2,102.36 tonnes, compared with 2,194.99 tonnes in 2013. This is a remarkable figure, and with a revival in Indian demand following relaxation of import restrictions, China and India are officially absorbing the world’s mine supply between them, given that there is strong evidence that China’s domestic mine output is quietly absorbed by the State.

Next week

Monday. Japan: Bank Lending Data, Current Account.

Tuesday. Japan: Economy Watchers Survey, M2 Money Supply. UK: CPI, Input Prices, ONS House Prices, Output Prices. US: Budget Balance.

Wednesday. Eurozone: Industrial Production. US: Import Price Index, Retail Sales, Business Inventories. Japan: Key Machinery Orders.

Thursday. Eurozone: Trade Balance. US: Empire State Survey, Initial Claims, PPI.

Friday. Eurozone: HICP. US: CPI, Capacity Utilisation, Industrial Production, Net Long-Term TICS Flows.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2015 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.