Consumer Sentiment Worst in 28 years- Market Hits Inflection Point

Stock-Markets / Financial Markets May 31, 2008 - 03:17 AM GMT

The University of Michigan/Reuters consumer sentiment index was released on Friday, showing the worst reading since 1980. It appears that the press has adopted the language used by the Federal Reserve that deflects blame for the condition away from their policies and puts it back on the consumer. They use the words “inflation expectations” to lay the blame for higher prices on consumers. Do you mean to tell me that there is no inflation, only inflation expectations? Give me a break!

The University of Michigan/Reuters consumer sentiment index was released on Friday, showing the worst reading since 1980. It appears that the press has adopted the language used by the Federal Reserve that deflects blame for the condition away from their policies and puts it back on the consumer. They use the words “inflation expectations” to lay the blame for higher prices on consumers. Do you mean to tell me that there is no inflation, only inflation expectations? Give me a break!

Inflation erased all the gains…

… in disposable personal income in April, while U.S. consumer spending was flat after adjusting for higher prices, according to the Commerce Department report on Friday. I don't believe for a minute that consumer income kept up with inflation in April. Then there's the statement, “ Personal saving -- DPI less personal outlays -- was $75.0 billion in April, compared with $78.9 billion in March. Personal saving as a percentage of disposable personal income was 0.7 percent in April, the same percentage as in March.” No, it was down 5%! I like how they abuse their statistics.

The latest report from the FDIC is out…...and the news may be worse that the headlines say. For example, fourth quarter bank earnings were restated from $5.8 billion to $646 million in the last three months. That's an 89% adjustment to the previous earnings report and we haven't heard of it until now? My, oh my!

The bottom line for the FDIC is this, “"Insured Deposits increased by $150 billion, while the Deposit Insurance Fund increased by only $430 million.” Does this evoke any confidence in the FDIC's ability to handle its liabilities? This might explain FDIC's rush to rehire their former liquidation specialists from the 1980s.

The market at an inflection point.

Will it be up...or down? It seems the market “remembers” certain stopping points on its way up or down. When those points are revisited, it creates an inflection point that needs a decision…up or down? This is also known as support, when the market is above, and resistance, when the market is below. 1400 in the S&P 500 is just such a point. I had made a point in late April that it felt like Ground Hog Day when 1400 resisted the S&P for an entire week. We're at that point again.

Treasuries sell off...is it time to buy?

After two consecutive months of decline , is it safe to buy Treasury bonds again? Prices in bonds have been battered by soaring oil and rising inflation. This has put pressure on the Federal Reserve to stop lowering rates, because the market simply wouldn't go along anyway. I have commented many times that the Fed doesn't lead…it follows interest rate trends in the market. In this case, interest rates are rising again, putting an absolute limit on its ability to stimulate the economy by lowering rates.

After two consecutive months of decline , is it safe to buy Treasury bonds again? Prices in bonds have been battered by soaring oil and rising inflation. This has put pressure on the Federal Reserve to stop lowering rates, because the market simply wouldn't go along anyway. I have commented many times that the Fed doesn't lead…it follows interest rate trends in the market. In this case, interest rates are rising again, putting an absolute limit on its ability to stimulate the economy by lowering rates.

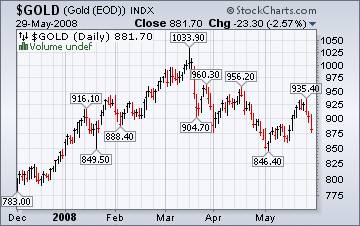

Gold highs were not sustainable.

Last weeks highs in gold couldn't be sustained and a $54.00 decline in the price of gold has again battered investors. Gold dealers still seem to be keeping a stiff upper lip, but their talk is a little less ebullient than a week ago. I did a segment on gold on www.yorba.tv yesterday that may be very informative to those who are looking for a technical analysis of the potential price of gold. Just click on the Archives and look for Segment 1 on May 29 th . Mark Hulbert (Market Watch) also weighs in on gold newsletters and is disturbed by their lack of concern about risk.

Last weeks highs in gold couldn't be sustained and a $54.00 decline in the price of gold has again battered investors. Gold dealers still seem to be keeping a stiff upper lip, but their talk is a little less ebullient than a week ago. I did a segment on gold on www.yorba.tv yesterday that may be very informative to those who are looking for a technical analysis of the potential price of gold. Just click on the Archives and look for Segment 1 on May 29 th . Mark Hulbert (Market Watch) also weighs in on gold newsletters and is disturbed by their lack of concern about risk.

The gain chasers were set up for a disappointment.

HONG KONG — Most Asian markets gained Friday, following Wall Street's lead after oil prices slid further and a report showed the U.S. economy grew faster in the last quarter than previously thought.

HONG KONG — Most Asian markets gained Friday, following Wall Street's lead after oil prices slid further and a report showed the U.S. economy grew faster in the last quarter than previously thought.

Japanese exporters benefit from a weaker yen, which makes their goods more competitive overseas and boost the value of their repatriated profits. The yen stood at 105.42 to the dollar midafternoon in Tokyo , compared with 105.55 late Thursday in New York . Is Japan at an inflection point, too?

China has a mess to clean up.

SHANGHAI 'S key stock index closed higher today thanks to a rise among oil-related heavyweights in the market .

Insurance company shares also rose despite heavy claims payouts anticipated for the earthquake victims. But this may be only an “oversold” reaction to the 12% decline in Chinese shares since the earthquake. More declines are on their way.

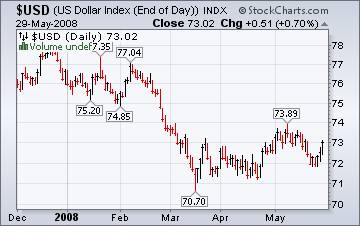

Does the rising Dollar signal an improving economy?

May 30 ( Bloomberg ) -- The dollar was headed for a second straight monthly advance against the yen and euro as gains in stocks signaled traders are more optimistic the economy will improve.

May 30 ( Bloomberg ) -- The dollar was headed for a second straight monthly advance against the yen and euro as gains in stocks signaled traders are more optimistic the economy will improve.

``The idea that the Fed will continue to cut rates has been completely put to bed and the market is now flirting with the idea of a rate hike,'' said Alan Ruskin , head of international currency strategy at RBS Greenwich Capital Markets in Greenwich, Connecticut. ``That has given the dollar a boost.'' On the surface, it sounds good, but the Fed may have to raise interest rates to curb inflation. That may mean a weaker economy in the near term. Will the dollar continue to rise anyway?

Housing prices dropping like a rock.

Most economists share Alan Greenspan's view that housing prices cannot fall so far as to become destabilizing to the economy. Then again, Mr. Greenspan has made several infamously wrong predictions. It now appears that housing prices are now falling faster than they did during the Great Depression. The S & P /Case-Shiller national index fell by 14.1% in the year to the first quarter. At this pace, we could see larger declines than the cumulative 26% drop in home prices in the five years ending in 1933 before this is over.

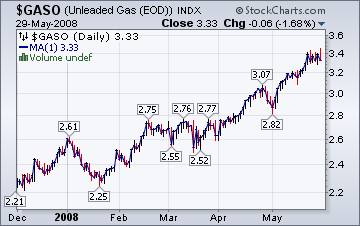

West Coast Gasoline Price Soars Past $4 - Diesel Price Surpasses $5 in California .

The Energy Information Administration's This Week In Petroleum tells us that; “For the ninth consecutive week, the U.S. average retail price for regular gasoline climbed to another all-time high. The price shot up by 14.6 cents to 393.7 cents per gallon. During the last two weeks alone, prices have climbed by 21.5 cents.” For those of you who see the world through green shades, you may be interested in why $8 gasoline is good for us . Oh yeah?

Low stockpiles and speculators keep prices high.

The Energy Information Agency's Natural Gas Weekly Update states, “Current prices in all parts of country exceed historical records for this time of year, when moderate temperatures lead to significantly lower aggregate demand and result in additional supplies injected into storage for later in the year. However, natural gas prices this year have followed the rising trend that has occurred for many commodities, including petroleum products.”

The Energy Information Agency's Natural Gas Weekly Update states, “Current prices in all parts of country exceed historical records for this time of year, when moderate temperatures lead to significantly lower aggregate demand and result in additional supplies injected into storage for later in the year. However, natural gas prices this year have followed the rising trend that has occurred for many commodities, including petroleum products.”

The Era of the Immoral Hazard.

When one hears of the Peter Principle, one can only shake his head and mumble, “It can't get that bad…” But it can. Jeremy Grantham , a market philosopher and historian, puts his thoughts about our current economic crisis into a clear statement that honors honesty and integrity as the hallmark of good business and good government…which we have not seen for a long time. Here is an excerpt that I found intriguing.

Greenspan came onto my radar screen in the late sixties as a seller of economic and financial advice to the investment industry. To be brutally honest, he was considered run of the mill by anyone I knew then or have met later who knew his service then. His high point in most memories, certainly mine, was a famous call in January 1973 that, “it is rare that you can be as unqualifiedly bullish as you now can,” a few days before a market decline of over 60% in real terms, second only to the Great Crash in a century, accompanied also by a bitter recession. This was one of the first of a long line of terrible prognostications for which he has remarkably not been remembered, except by a handful of us amateur historians.

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.