Goodbye Money Laundering: The Slide in Luxury U.S. Real Estate Market

Housing-Market / US Housing Feb 03, 2015 - 04:30 PM GMTBy: Harry_Dent

Couldn’t happen to a nicer group of people: ultra-rich criminals, drug dealers, despots and the mafia globally. I’m being sarcastic, of course.

Couldn’t happen to a nicer group of people: ultra-rich criminals, drug dealers, despots and the mafia globally. I’m being sarcastic, of course.

It seems the greatest scheme for international money laundering is rapidly coming to an end and it couldn’t come soon enough. Unfortunately, this will have some negative effects on real estate in the super-expensive cities across the county because buying of high-priced condos for cash in places like New York, Miami, L.A. and San Francisco is going to come to a screeching halt.

Did you know that the National Association of Realtors gets a major exemption from Anti-Money-Laundering provisions?! That’s something I read about only recently in a Zero Hedge article. And it’s another fine example of our perverted special interests-driven political system!

It’s disgraceful that all a foreign government official or ultra-rich and shady business person has to do to buy an expensive condo without scrutiny is get cash into the U.S. (legally or illegally, on their private plane or strapped to a mule’s chest). When they finally flip it, they’ve successfully laundered money in the world’s reserve currency.

Well, cracks are appearing in the ultra-luxury market that these bad-guys move in…

The Strong Dollar’s Effect on Foreign Buyers

I used to live in Miami and still go there often. When I’m asked to describe why South Beach and downtown Miami have an even greater bubble than the last one, while most cities don’t, I have a standard reply: “Brazilian drug dealers with bags of cash.” They are the types driving the top 1% of real estate in such cities and that has been where most of the action and gains have been.

Along with the rest of the law-abiding ultra-rich, they’re driving the most extreme bubbles in our largest cities because they have to have large places to park their money and they feel high-end real estate is much safer than stocks and bonds…

They’re about to find out just how wrong they are about that.

At the top of the 1929 bubble you would have lost dearly on almost all financial assets, but you would have done way better in stocks over the next decade than Manhattan real estate, and you would have roughly doubled your money in high quality bonds. And I believe it will be the same in the years ahead.

Today, in New York, about 30% of the $2 million-plus real estate market, where most of the actions and gains have been occurring, is bought by foreign buyers; typically Russian, Middle Eastern, South American and Chinese.

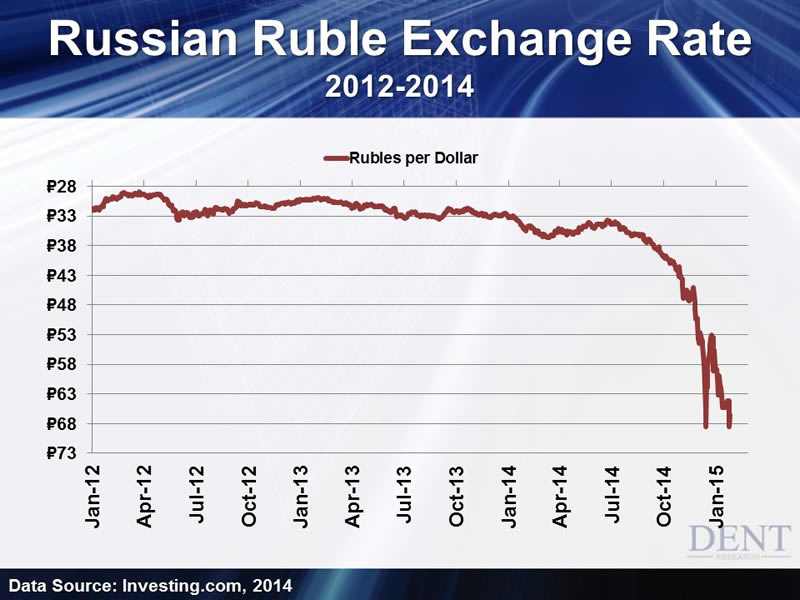

As I explained in Boom & Bust last month, the Russians will be the first to go. The ruble has fallen 55% versus the dollar so a $5 million condo now costs $11.1 million at the rate of exchange from June 2014. That’s gotta hurt those Russian mafia bosses!

The Brazilian real has fallen 20% against the dollar in the last year alone. And that’s going to hurt the drug lords in Miami — their playground — big time.

Many emerging country fortunes have been made in commodity industries and those bubbles, like oil, keep bursting and destroying wealth, so the Middle Eastern ultra-rich are feeling the pain now as well.

And we have the dollar wrecking ball to thank. As the dollar gains in strength, it hits commodities, U.S. exports, and now ultra-rich foreign buyers.

Well, no more! The ultra-rich will be punished as the most expensive real estate in the world slides the furthest and fastest. As these foreign buyers rapidly disappear, there will be no-one able or willing to buy at today’s prices, so these guys will learn the very painful lesson that real estate can — and does — go down in value.

The richest are going to get their asses kicked the hardest in this next crash, not Homer Simpson.

Mark my words on this. If you know anyone dabbling in that market, give them my warning. Their real estate is about to get very illiquid, very fast. They should get out now, while they still can.

And as for you, remember to protect your assets against insidious bubbles so you don’t’ suffer when they inevitably burst.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.