Investing in Stocks - Safety in Numbers, Protection in Options

InvestorEducation / Learning to Invest Feb 19, 2015 - 07:00 PM GMTBy: Casey_Research

By Andrey Dashkov

By Andrey Dashkov

If you want to fail as an investor, the possibilities are endless. Buying stocks on a whim, holding on to the losers for too long, and dumping winners too soon are just a few ways to start.

Options, like anything else, can cost you money or make you money. Due to the leverage employed when trading options, they often add both a layer of potential profit and a layer of risk on top of their underlying assets. But a less-known benefit of trading options is that they can serve as a hedge or form of insurance.

To illustrate, I’ll use a strategy that may seem intimidating but shouldn’t be: option collars.

Even though it sounds technical, it’s actually pretty simple. It boils down to holding an underlying asset (let’s say shares of a stock) while simultaneously selling (i.e., writing) call options and buying put options on that holding. The premium received from selling the call covers (completely or mostly) the premium paid to buy the puts, and the two of them work together to limit portfolio risk.

Let’s take a look at how a collar works step by step.

Suppose stock XYZ is trading at $40 a share on January 1. You want to invest in the stock, but you’re worried that the market could tank within the next couple of months and take XYZ down with it. So you decide to set up a collar to limit your downside risk.

You decide March 20 (more on the date in a moment) is far enough into the future to protect you from the imminent market decline you’re worried about. You also decide that if you could sell XYZ for $50 between now and March 20, you’d be happy with that gain; but you don’t want to have to sell XYZ for any less than $30 over that time period.

So, to create a collar that meets all of your requirements, you do three things: buy 100 shares of XYZ at $40; sell one March call option on XYZ with a strike price of $50; and buy one March put option with a strike price of $30.

(Please note that the third Friday of the contract month is the option expiration date. That’s why we used March 20 above. Also, each options contract is written on 100 shares of the underlying asset. That’s why we only need to sell one call option contract and buy one put option contract on XYZ to collar our 100 shares.)

Now, back to creating the collar…

Let’s assume that the premium you receive from selling the March call option is $1 per share (i.e., $100 per contract), while buying the March put option will cost you $0.50 per share ($50 per contract).

So your initial outlay is $4,000 for the 100 shares of XYZ and $50 for the put; and you receive $100 from writing the call. Your total investment is $3,950. (We’re ignoring broker commissions throughout this illustration.)

Now let’s consider two scenarios:

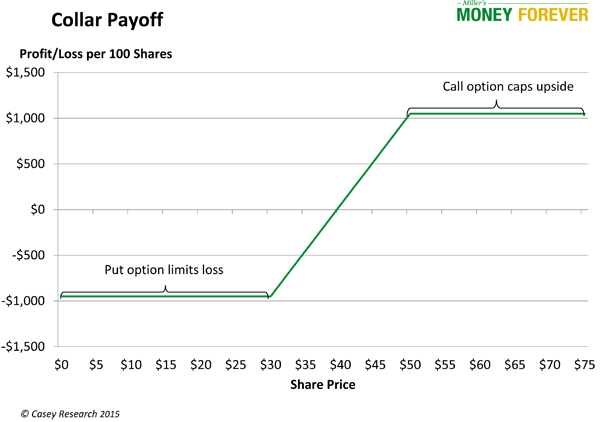

- Before March 20, XYZ goes up to $55. In this case, your call option is exercised at $50, and you’re forced to sell your shares at that price. That’s fine, because you had already decided that you were willing to sell your shares for $50 within that time period. Your proceeds are $5,000, and the net gain is $1,050, or 26.6%. Not bad! The trade-off, however, is that the gain is limited: if the stock shoots to $80, you still have to sell it for that $50 strike price.

- Before March 20, the stock goes down to $25. Without the put protection, you’d incur a loss of $15 per share (approximately 38%), or $1,500 for the whole position. But that’s not what happens: your protective put allows you to sell the shares for $30 each, establishing a floor for your losses. So you sell the shares for $3,000 and pocket a loss of $950, or 24.1%. Even if XYZ had gone to $0, your maximum loss would still only be 24%.

The payoff would look like this.

So while options are a powerful tool that can ruin an investor who doesn’t understand them, here you see how they can be used as protection. Remember, however, that unless you’re a seasoned options trader, it’s wise to leave even protective strategies to the professionals. In fact, the Money Forever team only recommends one options strategy for individual investors: selling covered calls. Learn more about this straightforward, low-risk moneymaker and download our free option calculator here.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.