Gold Demand in UK, Europe and U.S. – Reuters Interview GoldCore

Commodities /

Gold and Silver 2015

Mar 02, 2015 - 04:37 PM GMT

By: GoldCore

Jan Harvey from Thomson Reuters interviews Mark O’Byrne, Director of GoldCore Research

| Jan Harvey |

thomsonreuters.com |

We were hearing quite a bit about rising physical demand in Europe earlier this year, as a confluence of factors (euro zone QE, SNB scrapping franc peg to euro, Greek election outcome) came together to support buying. Here to discuss how that has developed in February is Mark O’Byrne, executive director of Goldcore. Welcome, Mark! |

| Mark O’Byrne |

goldcore.com |

Happy Friday Jan and thanks for having me on the forum |

| Jan Harvey |

thomsonreuters.com |

Great to have you with us. How have sales this month compared to last? |

| Mark O’Byrne |

goldcore.com |

The month started very strongly with momentum from January but after a busy start demand tapered off as risk appetite returned and gold prices gave up the gains seen in January. |

| Jan Harvey |

thomsonreuters.com |

How are you expecting that trend to continue as the year progresses? |

| Mark O’Byrne |

goldcore.com |

Overall – sales are marginally down in February on January – down 6%. Price weakness is again making investors hesitant – particularly buyers in the UK and U.S. |

| Mark O’Byrne |

goldcore.com |

Very difficult to say as a lot of potential “event risk” and obviuosly the price will be important. We are constructive on the price for the year but as ever nervous regarding short term corrections. No crystal balls but the uncertain geopoitical and monetary backdrop is a positive environment for gold. Indeed, we believe global bond and stock markets are looking very toppy and bubbly and material corrections in either market should be beneficial for gold. |

| Mark O’Byrne |

goldcore.com |

Of note is fact that we had 4% more account openings in February than in January despite the drop in sales. Many new clients have funded accounts and are waiting to allocate their funds. With today being the last day of trading in February, this means that March could see good demand. |

| Jan Harvey |

thomsonreuters.com |

How has demand compared in different regions of Europe so far this year? |

| Mark O’Byrne |

goldcore.com |

Unless that is – we see further price weakness or indeed gold going sideways for a period of time – which is also possible although I think unlikely given global demand being quite robust. A sharp fall in the price or indeed a sharp increase in the price will bring out buyers. Sideways trading creates hesitancy, concern and a lack of demand. |

| Mark O’Byrne |

goldcore.com |

We saw an uptick in demand in most countries in January – both English speaking world and other countries. There were a lot of ‘events’ that led to this demand – Charlie event in Paris, SNB Swiss Franc debacle, Ukraine and tensions with Russia and the start of renewed concerns about Greece |

| Mark O’Byrne |

goldcore.com |

This UK and U.S. demand then tapered off in February – however Greek demand has remained quite high and German demand is robust |

| Mark O’Byrne |

goldcore.com |

Greece saw the greatest increase in demand in January and this continued into the end of February. Gold sovereigns and bars remain the most popular – some for delivery but more for storage, Zurich primarily. British sovereigns remain the traditional favourite of Greek investors – for historical and familiarity reasons. |

| Jan Harvey |

thomsonreuters.com |

Are there any particular products that have been favoured this year? |

| Mark O’Byrne |

goldcore.com |

In general we have not seen any particular gold coin or bar format being favoured (except in Greece). As we deal with investors and some HNW and family offices – they tend to favour bullion in the cheapest format possible. This used to be London Good Delivery bars but kilo bars are increasingly popular for price conscious, sophisticated buyers. Sovereigns remain popular in the UK too as they are CGT free – making them attractive from a total expense point of view. |

| Mark O’Byrne |

goldcore.com |

We have seen no material increase in demand from Italy and Spain where demand remains anaemic. We saw a marked pick up in Russian demand in December when the rouble was collapsing but that has abated now. This included HNW demand for bullion stored in Zurich. |

| Mark O’Byrne |

goldcore.com |

We saw a marked pick up in Russian demand in December and early January when the rouble was collapsing – this included HNW demand for kilo bars and bullion stored in Zurich was favoured. That demand has abated |

| Jan Harvey |

thomsonreuters.com |

How has silver demand compared to gold this year? |

| Mark O’Byrne |

goldcore.com |

That is interesting as ever. Silver demand remains robust and for retail buyers of coins , there remains a propensity to favour silver eagles, maples and philharmonics over gold bullion coins. |

| Mark O’Byrne |

goldcore.com |

Smaller buyers are taking the view that they can get more ‘bang for the buck’ with ‘poor man’s gold’ and many also believe that silver will outperform gold in a new bull market and we agree with them on this. Many saw how silver outperformed gold in the 1970s and again in the 2000s bull run. |

| Jan Harvey |

thomsonreuters.com |

It had a couple of enormous reversals in 2011, though. Has that made investors a bit warier than they once were about taking a punt on silver? |

| Mark O’Byrne |

goldcore.com |

Has definitely deterred the typical retail investor. But hard core silver bugs love their silver and view all sell off as gifts from the Gods to accumulate the ‘metal of the moon’ : ) |

| Jan Harvey |

thomsonreuters.com |

Ha! |

| Jan Harvey |

thomsonreuters.com |

Thanks Mark. And thank you very much for joining us today! |

| Mark O’Byrne |

goldcore.com |

p.s. dislike term silver bug and gold bug. Pejorative and we don’t call people stock roaches or paper bugs or dollar bugs : ) |

| Mark O’Byrne |

goldcore.com |

Pleasure Jan. Thank you for the opportunity and enjoy your weekend. Hope we beat you in the rugby in the big game Sunday !

(Ireland versus England in 6 Nations. Result: Ireland 19-9 England) |

MARKET UPDATE

Today’s AM fix was USD 1,216.75, EUR 1,084.93 and GBP 789.48 per ounce.

Friday’s AM fix was USD 1,205.00, EUR 1,073.59 and GBP 782.77 per ounce.

Gold climbed 0.22% percent or $2.70 and closed at $1,211.10 an ounce on Friday, while silver rose 0.18% or $0.03 to $16.57 an ounce. Gold and silver both finished up for the week at 0.84% and 2.09% respectively.

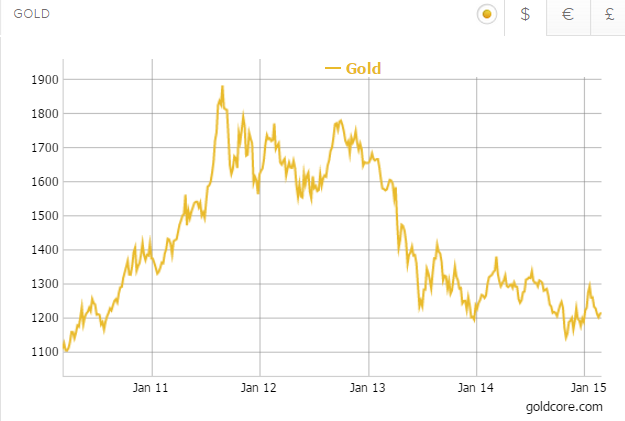

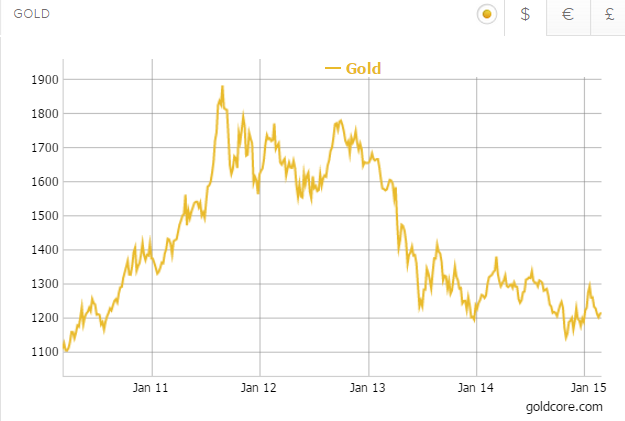

Gold in US Dollars – 5 Years

Gold in US Dollars – 5 Years

Gold in Singapore climbed to its strongest price in almost two weeks, strengthened by firm Chinese demand after an interest rate cut in China which is a positive for the yellow metal. In late afternoon in Singapore, gold bullion was up 0.7 percent at $1,221.40 an ounce its highest since February 17th. In February, gold lost 5.5 percent its most since September 2014.

Premiums at the Shanghai Gold Exchange (SGE) remained firm near $4-$5 an ounce over the global spot benchmark.

The Chinese central bank said the 25 bp cut in the benchmark lending and deposit rates “does not represent a change in the direction of monetary policy”. However, this is just another example of a central bank employing quantitative easing as the currency wars continue and look set to intensify.

On Friday, Q4 U.S. economic growth was revised downward to 2.2 percent from 2.6 percent which may have added to safe haven bid for gold. The U.S. non farm payrolls report is at the end of the week and market participants will look to it for further evidence that the US is slowing down.

India will introduce gold deposit accounts to utilise the 20,000 metric tonnes of gold in the country and launch a sovereign gold bond, the finance minister said on Saturday. A further sign of gold being remonetised.

India kept the import duty at the record 10 percent in a setback for jewellers and a boon for smugglers.

Gold in London in late morning is trading at $1,216.65 or up 0.31 percent, while silver is at $16.65 or up 0.37 percent and platinum is at $1,185.50 or up 0.14 percent.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL

63

FITZWILLIAM SQUARE

DUBLIN 2

E info@goldcore.com |

UK

NO. 1 CORNHILL

LONDON 2

EC3V 3ND |

IRL +353 (0)1 632 5010

UK +44 (0)203 086 9200

US +1 (302)635 1160

W www.goldcore.com |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Gold in US Dollars – 5 Years

Gold in US Dollars – 5 Years