Stock Market Tanks as US Unemployment Rate Soars to 5.5%

Stock-Markets / Financial Markets Jun 07, 2008 - 03:53 PM GMT

The unemployment rate rose from 5.0 to 5.5 percent in May, and nonfarm payroll employment continued to trend down (-49,000), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. In May, employment continued to fall in construction, manufacturing, retail trade, and temporary help services, while health care continued to add jobs. Average hourly earnings rose by 5 cents, or 0.3 percent, over the month.

The unemployment rate rose from 5.0 to 5.5 percent in May, and nonfarm payroll employment continued to trend down (-49,000), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. In May, employment continued to fall in construction, manufacturing, retail trade, and temporary help services, while health care continued to add jobs. Average hourly earnings rose by 5 cents, or 0.3 percent, over the month.

The CES Birth/Death Model added 217,000 hypothetical jobs in May, so the real number may have been –266,000 in May instead of the –49,000 enumerated by the BLS. According to the government statistics, we added 77,000 hypothetical leisure & Hospitality jobs and 42,000 hypothetical Construction jobs in the month of May. At the same time, those marginally attached to the workforce (seeking full-time work, but only employed part-time) increased in May.

In summary, the U.S. lost jobs for a fifth month and the unemployment rate rose by the most in more than two decades, as an influx of students into the workforce drove the biggest jump in teenage joblessness since at least 1948.

You can't have it!

This is what the major investment banks are saying to their clients in auction rate securities . At least 24 proposed class action suits have been filed since mid-March against brokerages over claims investors were told the securities were almost as liquid as cash. Even investors who are willing to take a haircut in order to get out are being refused their money by the investment banks, who told them it was “as safe as cash.” The problem is, losses in a fire sale establish claims for damages in lawsuits, which will surely follow. So investors who thought they were in a “cash equivalent” are in limbo instead.

The market is repelled at resistance.

Last week I mentioned that, “It seems the market “remembers” certain stopping points on its way up or down. When those points are revisited, it creates an inflection point that needs a decision…up or down? This is also known as support, when the market is above, and resistance, when the market is below.” You can now see very clearly that 1400 was a very important resistance area. Now the market has decided and it won't be pretty for the bulls. The next question is, “Will the March lows hold?” Stay tuned!

The Treasury Bond sell-off is not over yet.

The difference in yields between two- and 10-year Treasuries narrowed for the first time in a week as investors increased bets the Federal Reserve will raise interest rates to curb inflation.

That makes bonds a poor bet both in real (inflation adjusted) terms and in constant dollar returns, as well. Where have thew safe havens gone?

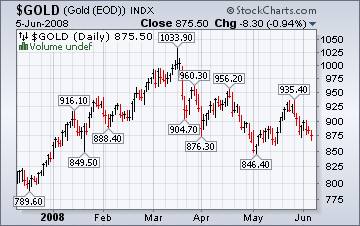

A big surprise ahead for gold investors.

Gold jumped the most in six months after the U.S. jobless rate had the biggest gain in more than two decades, spurring a drop in the dollar. Silver also rose. investors. Gold also gained as a surge in energy prices added fuel to inflation speculation. The problem is, it was a counter-trend rally, also known as a “sucker's rally.” I suggest that gold investors dance very close to the door on this rally.

Gold jumped the most in six months after the U.S. jobless rate had the biggest gain in more than two decades, spurring a drop in the dollar. Silver also rose. investors. Gold also gained as a surge in energy prices added fuel to inflation speculation. The problem is, it was a counter-trend rally, also known as a “sucker's rally.” I suggest that gold investors dance very close to the door on this rally.

Is the Nikkei in a recovery?

Japan 's Nikkei Index rose to a five-month closing high, marking a second straight positive week for investors. But there was some well-founded hesitation as the Nikkei closed before the U.S. markets opened and the employment report was released.

The rally was premised on the stronger dollar giving Japanese exporters pricing power. But the dollar sank today, which may take the wind out of the sails of the Japanese who believe that a stronger dollar will keep the Japanese economy going.

China has a mess to clean up.

SHANGHAI'S stocks fell for a fourth consecutive day yesterday, dragged down by blue chips in oil and airlines amid growing fears of higher crude oil prices. "People expect a good start this month but the market simply has no incentives to support a rebound," said Zhang Qi, an analyst with Haitong Securities Co. "The declining transaction volumes show people's weak sentiment, while some are waiting to see where the direction heads for the key economic barometers, especially consumer prices."

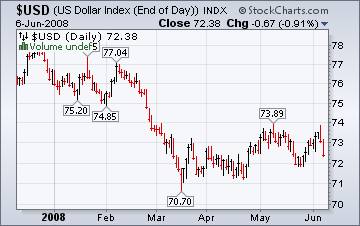

Does the rising Dollar signal an improving economy?

June 6 ( Bloomberg ) -- The dollar fell to a one-week low against the euro after a government report showed the U.S. unemployment rate increased the most in more than two decades, adding to evidence the economy may not be rebounding.

June 6 ( Bloomberg ) -- The dollar fell to a one-week low against the euro after a government report showed the U.S. unemployment rate increased the most in more than two decades, adding to evidence the economy may not be rebounding.

The U.S. currency dropped yesterday as Trichet said policy makers are in a state of ``heightened alertness'' over inflation. His remarks more than erased the dollar's gains that came after Fed Chairman Ben S. Bernanke said on June 3 that the central bank is ``attentive'' to the implications of the weakened currency.

From the “What were they thinking?” department…

Judges are now finding Foreclosure actions where the borrowers cannot be located. “The ones that caught my attention very early on were the ones that said they didn't have driver's license information or they didn't have employment information for the borrower,” the judge said in an interview. “Did someone just walk in off the street and say, ‘Gimme money?' ” a judge asked sarcastically. “I don't think that's possible.”

Judges are now finding Foreclosure actions where the borrowers cannot be located. “The ones that caught my attention very early on were the ones that said they didn't have driver's license information or they didn't have employment information for the borrower,” the judge said in an interview. “Did someone just walk in off the street and say, ‘Gimme money?' ” a judge asked sarcastically. “I don't think that's possible.”

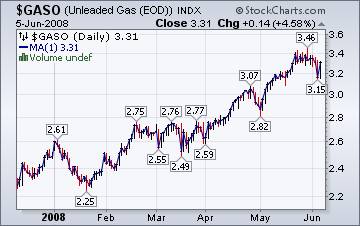

Diesel heading to a $2 milestone…That is, $2 pere gallon more than a year ago.

The Energy Information Administration's This Week In Petroleum tells us that; “The U.S. average retail price for regular gasoline increased for the tenth straight week. Although its upward momentum slowed, the U.S. average price still climbed another 3.9 cents to hit 397.6 cents per gallon.”

The Energy Information Administration's This Week In Petroleum tells us that; “The U.S. average retail price for regular gasoline increased for the tenth straight week. Although its upward momentum slowed, the U.S. average price still climbed another 3.9 cents to hit 397.6 cents per gallon.”

The market is telling us that gasoline has climbed 3.9 cents too far. What do you think?

Low stockpiles and speculators keep prices high.

The Energy Information Agency's Natural Gas Weekly Update states, “ The summer-like temperatures across much of the Lower 48 States and concerns over natural gas supply boosted prices in most market locations in the Lower 48 States. As of yesterday, prices at most trading locations had increased on the week by 50 cents per MMBtu.”

Is Bernanke losing support?.

The bailout of Bear Stearns and their cronies did nothing to stop the continued hanky-panky behind closed doors of the major banks and brokerages. Mike Shedlock reports that there is now a revolt among the ranks of the Federal Reserve Board. The question about withholding aid to misbehaving financial institutions is finally getting aired.

" The danger is that the effect of the recent credit extension on the incentives of financial-market participants might induce greater risk taking," Lacker said in a speech to the European Economics and Financial Centre in London . That "in turn could give rise to more frequent crises," he said.

Lacker urged that the central bank now "clearly" set boundaries for its help to financial markets. In an interview yesterday on the themes of his speech, Lacker said even those new boundaries may not be believed by investors unless a financial firm fails "in a costly way."

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.