The Consequences of The Fed's Interest Rate Hike

Interest-Rates / US Interest Rates Apr 17, 2015 - 04:23 PM GMTBy: Arkadiusz_Sieron

Although sometimes we doubt whether the Fed is going to increase interest rates soon, it is worth analyzing the consequences of such a game-changing move. The hike would be the first in nearly a decade. Theoretical effects of rising interest rates are well-known: higher interest rates mean higher borrowing costs (something to consider: if you have a variable rate mortgage and believe that Fed will eventually hike interest rates, think about locking in at current low rates with a fixed-rate mortgage), lower asset prices, reduced risk-premium and a stronger greenback. All of these are relatively bad for the stock market. Higher discount rates mean lower stock prices, while reduced risk-premium makes equities less attractive compared to new issues of bonds. Higher borrowing costs hurt indebted companies, while a stronger greenback negatively affects the exporters and international businesses, which are a significant part of the U.S. stock market. This is why the equity indices were generally falling in March in anticipation of the Fed's hike and surged after the publication of the dovish FOMC statement.

Although sometimes we doubt whether the Fed is going to increase interest rates soon, it is worth analyzing the consequences of such a game-changing move. The hike would be the first in nearly a decade. Theoretical effects of rising interest rates are well-known: higher interest rates mean higher borrowing costs (something to consider: if you have a variable rate mortgage and believe that Fed will eventually hike interest rates, think about locking in at current low rates with a fixed-rate mortgage), lower asset prices, reduced risk-premium and a stronger greenback. All of these are relatively bad for the stock market. Higher discount rates mean lower stock prices, while reduced risk-premium makes equities less attractive compared to new issues of bonds. Higher borrowing costs hurt indebted companies, while a stronger greenback negatively affects the exporters and international businesses, which are a significant part of the U.S. stock market. This is why the equity indices were generally falling in March in anticipation of the Fed's hike and surged after the publication of the dovish FOMC statement.

There are sound arguments for the Fed's hike being priced in stock market and U.S. dollar indices. This is how markets generally work: investors buy the rumor and sell the actual event. In a sense, the Fed may be forced to hike interest rates since the February report has already caused the rise in market interest rates and decline in stocks prices. It means that global investors are not waiting for the Fed to raise interest rates and are already betting that interest rates are going to increase in the U.S. this year. Indeed, according to CME Fed Watch (on March 19), the Fed's funds futures contracts suggest a 12 percent probability of a June rate hike, a 49 percent probability of an increase in September, a 70 percent probability of a rate hike in October, and an 79 percent of December rate hike.

The hike has also been priced to some extent into the U.S. dollar index, as the currency investors are future-oriented. Typically, the currency movements are the very leading indicator. Indeed, the history of the past three tightening cycles teaches us that the greenback gains in the six to nine months preceding the first interest rate hike over the cycle.

It does not mean, however, that the Fed's hike will not cause the further appreciation of the greenback (and decline in stock prices). Everything depends on the timing and magnitude of the possible monetary tightening. At the moment, markets are pricing in a slower path than the median Fed's official projection. The history of the past Fed's tightening cycles shows that investors did not always fully price to the extent the Fed had planned on raising rates. The cycle from 1999 to 2000 was generally anticipated correctly, however in 1994 the scale and pace of the Fed's tightening surprised markets and hurt almost all asset classes. Soon, the long-term interest rates increased sharply and the assets were repriced accordingly. The last tightening cycle from 2004 to 2006 was a different story, because the longer term interest rates hardly moved due to strong demand for U.S. assets from foreign investors.

What are the conclusions for the gold market? As we have pointed out in an earlier edition of the Market Overview, the Fed's hike alone would not negatively affect gold prices. The real interest rates or U.S. dollar index are much more important for the gold market than single changes in the federal funds rate. According to Barclays analysts, apart from the "hiking cycle of 2004-06, gold prices tend to fall 2% in the three months leading up to the rate hike," but everything depends on the economic context.

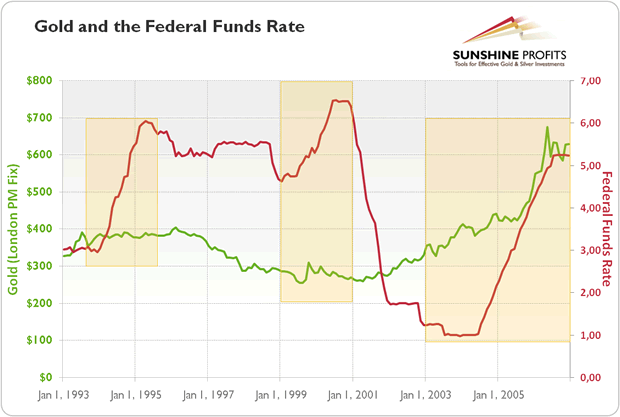

After the surprising announcement of the interest rates hike in 1994 the gold prices fell from $388 to $380 (see the chart below), however during the whole tightening cycle the yellow metal was traded sideways, because the U.S. dollar was falling during the whole of 1994. The last tightening cycle from 2004 to 2006 did not disrupt the gold boom in 2000s. Again, it was a time of a falling U.S. dollar. For most of 1999 the gold price was falling only to rise from $270 to $323 in October 1999 following an agreement to limit gold sales by 15 European central banks. It shows that the gold prices depend on many factors and may rise on worries about the Eurozone economy, despite the Fed's tightening.

Graph 1: Gold prices (London PM Fix, green line) and Federal Funds Rate (red line) from 1993 to 2006.

Indeed, with ultra-low yields on European and Japanese bonds, investors should shift their capital to the U.S. bond market. A possible demand for U.S. Treasuries would keep long-term interest rates low, which would support the gold prices. In other words, if the Fed's tightening is gradual and correctly anticipated, and interest rates remain low by historical standards, the impact on gold should not be huge. This is exactly what the economists are expecting right now. The first move will be rather small, probably a quarter of a point, and it will be carefully signaled to the market to prevent any surprise. However, the strong U.S. greenback seems to be a headwind for the yellow metal, at least in the coming months before the Fed's hike.

If you’re interested in reading our thoughts on other gold-related topics, we invite you to our website. We focus on the global macroeconomics and fundamental side in our monthly gold Market Overview reports and we provide also Gold Trading Alerts for traders interested more in the short-term prospects. Sign up for our gold newsletter and stay up-to-date. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.