The Demise of the American Auto Industry and the Rise of Toyota - Quality vs Quantity

Companies / US Auto's Mar 12, 2007 - 09:08 AM GMTWhen Elisabeth and I lived in Japan many years ago, the tender loving care of our host family, the Kondos, is a memory we will always cherish. So right now, we're delighted to have the chance to reciprocate while we host the next generations of Kondos at our home here in Florida.

In a moment, I'll show you how their story may intersect with yours — and with America's as a whole. But first, I want to tell you about one of the most sweeping megatrends of our time:

The Demise of the American Auto Industry and the Rise of Toyota

This is a megatrend rooted in more than economics. It's a clash of cultures — a battle that pits quality against quantity.

But right now, for Detroit, it's a much more mundane problem — a disaster that, in the absence of a dramatic turnaround, threatens to wipe out millions of jobs ... destroy tens of millions of pensions ... and even drag down the broader U.S. economy.

And for those who invest beyond our shores, it's a bonanza that promises to continue delivering more profits and prosperity.

You already know about this. You've seen it in the news. You may have even experienced it yourself — as a consumer or as an investor.

But what you may not be aware of is how extreme the facts have been ... and how consequential they could become ...

Fact #1 Why the Torrent of Red Ink At Detroit's Big Three Is NOT Ending ...

Ford lost $12.6 billion in 2006, with $5.8 billion lost in the fourth quarter alone.

DaimlerChrysler's North America operations lost $1.5 billion in 2006, with prospects so dire that the company is trying to dump its Chrysler division like a hot potato.

General Motors lost $3 billion through the first nine months of last year and $10.5 billion in 2005. It's expected to report some net income for last year's fourth quarter, but industry analysts are offering scant hope that this is a new trend.

Fact #2 Detroit's Vicious Cycle of Losses and Contraction

All this red ink has been flowing despite repeated — sometimes massive — efforts to restructure, reduce costs, and engineer a turn-around.

Last year alone, the U.S. auto manufacturers laid off 150,000 workers. And looking ahead, their plans for downsizing sometimes look more like blueprints for liquidation.

DaimlerChrysler: 13,000 layoffs and two North American plant closures.

General Motors: 30,000 layoffs and 12 closures.

Ford: 30,000 layoffs and 14 closures.

But it's a vicious circle — more losses forcing more cutbacks ... and more cutbacks bringing still larger losses. The main reason ...

Fact #3 Detroit's Market Share Is Shrinking — and Fast

As recently as 1998, the combined market share of Detroit's Big Three in North America was 70 percent. Just seven years later, it was down to roughly 50 percent, and it's still shrinking. That means ...

- Detroit is losing economies of scale, making it harder to manufacture each car at a competitive price.

- Detroit is losing loyal customers, making it harder to regain market share in the future.

- Worst of all, Detroit's Big Three are shrinking in size overall, shrinking their war chest of capital and reducing their future chances of catching up technologically.

Right now, for example, Toyota's market cap is nearing $250 billion. In contrast, even if General Motors and Ford were to merge into one monolith, their combined market cap would barely reach $35 billion.

By this measure, GM and Ford are already small players; while Toyota is already the largest auto maker in the world — a warning of possibly similar future scenarios for measures like assets and sales.

Fact #4 Toyota: The World's Most Profitable Auto Manufacturer

Toyota's Camry is America's best-selling car.

Its Lexus is America's most popular luxury brand.

In sales, Toyota is already bigger than Chrysler in the U.S. and is about to pass Ford — a trend so obvious and so inevitable that Automotive News, the industry bible, no longer refers to the “Big Three.” From now on, it's going to call them simply “The Detroit Three.”

According to CNN Money , Toyota's presence in the U.S. is now so routine that the 3,322 business leaders surveyed by Fortune have named Toyota as one of America's Most Admired Companies for the second year in a row, boosting it to third place overall, behind General Electric and Starbucks.

Other foreign auto manufacturers, including Chinese and European companies, following in Toyota's footsteps, are also gaining as Detroit retreats.

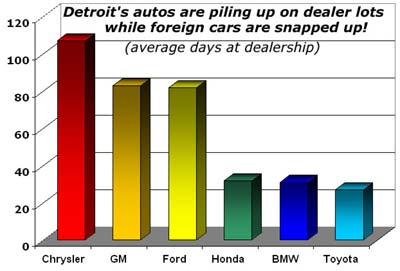

Fact #5 Detroit's Cars Are Piling up on Dealer Lots. Japan's Are Being Snapped Up!

The growing gap between U.S. and foreign auto makers flows not only to the bottom line ... but also to the thousands of dealerships across the U.S.A.

Chrysler cars sit on dealer lots for an average of 103 days — more than a full quarter of a year!

GM cars don't get sold for 83 days, and Fords for 82 days.

In contrast ...

New Hondas, BMWs and Toyotas are being driven off the lots by U.S. consumers within 32, 31 and 27 days, respectively.

Never before have I seen such a drastic contrast between the turnover rates of U.S. and foreign made cars! And never before have I seen such a huge gap in the popularity of these cars among most American consumers!

Fact #6 A Weaker Dollar Is No Salvation

Recently, the yen has been rising against the dollar, raising the possibility that it will pinch Toyota's ability to price its cars competitively in the U.S.

As a result, some people in Detroit and on Wall Street are hoping that maybe — just maybe — this could still help save the day for Detroit's Big Three.

The reality: The dollar has been sinking and the yen rising — in fits and starts — for decades. But over the long term, the cheaper dollar has done virtually nothing to help make U.S. car makers more competitive.

Quite to the contrary, when American auto manufacturers have faced adverse market conditions, they have typically resorted to offering easy money and discount financing. In contrast, when Japanese auto makers have faced adverse conditions, they've responded by pouring more capital into quality control.

How the Story of the Kondos

Intersects with Ours — and Yours

Sixty-three years ago, a young teenage girl, walking down a narrow street in Tokyo, heard some shouts, looked up into the sky, and witnessed an event she would not forget for the rest of her life.

An American fighter pilot had just been shot by Japanese anti-aircraft fire. He was parachuting down to where she stood. And as soon as he hit the ground, he was attacked by an angry mob of onlookers.

In her mind, the young girl knew America was dropping bombs. But in her heart, she did not hold the young American responsible. She screamed silently for his safety, but could not utter a word to save him. She was powerless to prevent his death by blows, but vowed someday to right that wrong in some other, still-unknown way.

Three decades later, with the surname Kondo and as a widow with two teenager daughters of her own, she saw her chance to do just that: She invited me and Elisabeth to live with them in their unusually spacious home in the heart of Tokyo.

That's when we witnessed, first hand, the massive investment that Japan and its citizens were making in energy conservation and quality control — three-year-olds taught to turn off lights ... octogenarians bearing cold winters with less heating ... and every company, especially big manufacturers like Toyota, investing massive sums in energy-efficient technology.

We witnessed a second wave of quality control investment in the 1990s, even as Japan's economic bubble was bursting and the country was sinking into depression.

And now, if the dollar plunges and the Japanese yen surges, don't be surprised if the new generation of Japanese, like the Kondos that are staying with us this week, respond with still a third wave of quality control investments — to reduce costs, improve efficiency and maintain Japan's competitive powers.

We talked about this very subject over Sunday breakfast yesterday. And I told our just-arrived guests from Japan that I was writing you about it. Their big question:

“When are America's big industrial companies going to learn the simple lesson we learn as children — that, in the long run, quality is more important than quantity?”

I hope it happens before too much more damage is done. But don't hold your breath. And if you're investing now, it makes no sense to wait.

Toyota Shares Double, GM and Ford Fall in Half, And More!

In January of 2001, if you had invested $10,000 in Toyota's shares, your investment would now be worth close to $20,000.

Considering Japan's long depression, which persisted well into the early 2000s, that's not exactly a bad result.

In contrast, if you had

invested that same ten thousand dollars in General Motors, you'd have less than $6,000 today, even after a substantial rally in the stock this year.

And with Ford's shares, you'd be down to your last $3,000, with no sign of a bounceback any time soon.

This single picture sums up, better than any other, the long-term consequences for investors who fail to invest in quality ... who limit their horizons to the U.S. ... and who do not take advantage of the many new opportunities beyond our shores.

If you're among them, consider that lesson carefully. The quality of your life — plus that of nearly all Americans — could very well depend upon it.

Good luck and God bless!

By Martin Weiss

P.S. On Saturday, I showed you one excellent way to profit from these megatrends. I sent it to you via e-mail at 8 a.m. Eastern Time. The subject: “Greatest International Deals of All Time.” Check your inbox.

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.