Euro Uncertainty Reflected in COT Report

Currencies / Euro Jun 22, 2015 - 08:35 AM GMTBy: Dan_Norcini

First of all, Happy Father's Day to all you Dads out there. There is no greater or fulfilling calling in life than being a dad. Everything else pales in comparison.

First of all, Happy Father's Day to all you Dads out there. There is no greater or fulfilling calling in life than being a dad. Everything else pales in comparison.

Secondly, Dad's must make a living to provide for their family and that forces us back to the reality of dealing with the markets and trying to get a read on what is driving what and WHY.

It is no secret to anyone that has been following the markets this year that the Forex arena has been one filled with confusion, volatility, uncertainty and at times, sheer chaos. "Is the Dollar bull market dead or it is just resting?" "Is the Euro going to endure or will it collapse?" "Is Greece staying in or moving out?" "Is the Fed going to hike and when?" "What is going on in the bond market?"

These any many other questions along this line have roiled the markets for too long and have led to a trading environment in which price movement is more often than not, choppy, random, unpredictable and oftentimes outright bizarre.

What we are seeing is the reaction of different groups of traders to series of events, most of which are unprecedented in our lifetime. Thus, we have no analogous period to study, no standard to compare to, no previously similar set of circumstances to gauge what might happen next. Just about the time we believe we have sorted it out and have arrived at a set of inputs which can help us to make some good trading/investing decisions, something throws a monkey wrench into the entire scheme and our best laid plans go kaput.

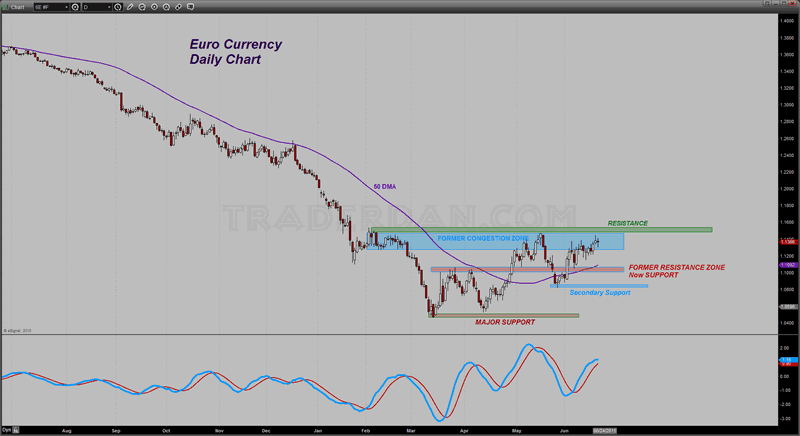

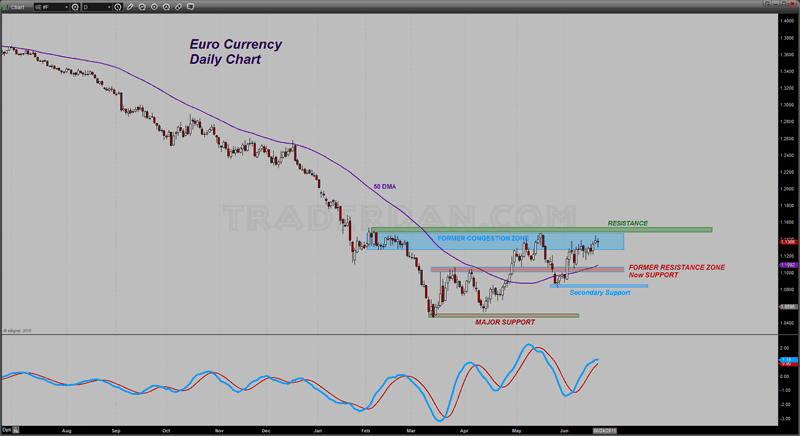

Euro Daily Chart

One can see this reflected in the price action of the Euro which has been buffeted back and forth by nearly every single news story coming out of Europe of late dealing with what Greece might or might not do.

If you look at the price chart you can see the bottom formed in the 1.050 region and the top formed up near the 1.140-1.150 region. The currency has had a higher bias ever the first winds of doubt began to blow in regards to the US Federal Reserve's intention to hike interest rates. From that moment on, the Euro has ground higher even as it has experienced sharp falls in price as news stories about the talks between Greece and its creditors have taken a decidedly negative tone.

Euro Daily Chart

From a trader's perspective, overhead resistance near the top of the former congestion zone is still intact and thus the upside is questionable from these levels. Yet, there is no doubt whatsoever, that the currency has etched out a series of higher lows since March. Thus an objective reading of the chart would have to give the benefit of the doubt to the bulls.

Yet, in looking into this market with the benefit of the Commitments of Traders report, what we find is not so much a case of traders becoming wildly bullish on the Euro as it is a case of them becoming decidedly less bearish. In other words, the bears have lost their courage and are unwilling to press this market at this time.

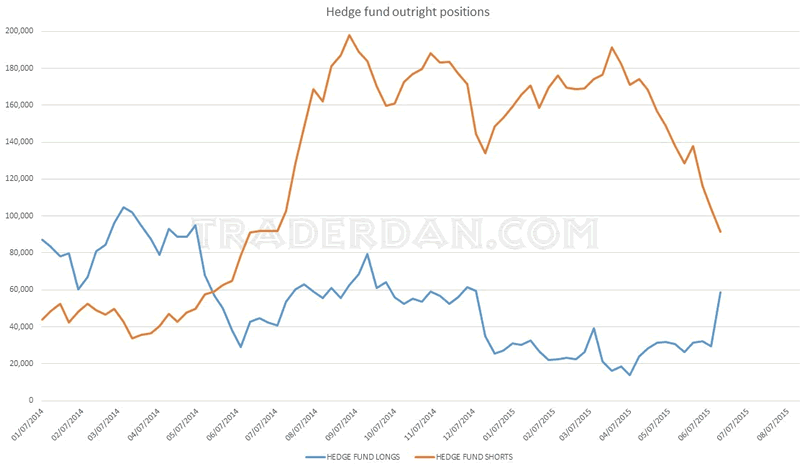

Hedge Funds Outright Positions

Take a look at this chart noting the OUTRIGHT POSITIONS of the Hedge funds. Since the bottom in the Euro was made in March down near the 1.050 level, the short covering on the part of the Hedgies has been enormous. Over a whopping 100,000 shorts have been covered by this group over against the addition of 45,000 new longs. By a more than 2 to 1 margin, the hedge funds have been exiting short positions.

It is that short covering which has pushed the Euro higher.

This is very similar to that which I noted about the crude oil markets a while back when we looked into the COT reports to see what was taking place behind the rally off its low down near $43. As was the case then, and is the case now, both crude oil and the Euro are rising, not because the sentiment towards both has become wildly bullish but rather because the sentiment towards both has become less bearish. As the bears depart and head for their lairs, the price rises.

The point to be made in this case, as was the case with crude oil, that for either of these markets to continue strongly higher and begin a trending move upwards, it is going to take a lot more than short covering. It is going to take a shift in the sentiment away from "LESS BEARISH" to "STRONGLY BULLISH". Such a development would see a rush of new longs, especially hedge funds, that would send them higher.

We are going to have to wait and watch developments in both the Greece situation and here in the US in regards to the economic data to try to get a sense of how that sentiment is going to shape up.

For now, expect the Euro to be completely news event driven which means traders must be prepared to be chopped up if they hang around too long on any side of this market.

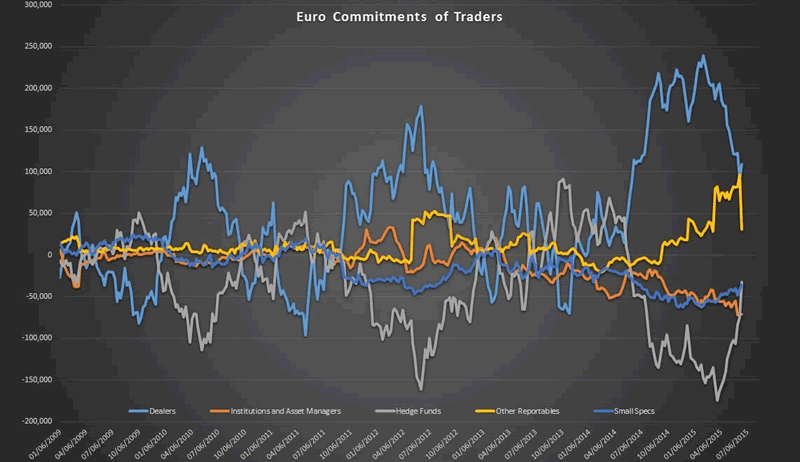

Here is the latest chart showing the net positioning of all the various categories of traders for the Euro. Notice the sharp reduction in net positions by the Dealers, the Hedge Funds and the other Large reportables category.

Both longs and shorts have been exiting due to the lack of conviction and uncertainty. Such a development translates into violent and frequent reversals, a very dangerous environment in which to build large positions.

Euro COT

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.