Ron Paul Warns “They Can’t Print Money Forever”

Commodities / Gold and Silver 2015 Jun 25, 2015 - 11:46 AM GMTBy: GoldCore

- Former U.S. Congressman blasts Fed’s role in markets

- Former U.S. Congressman blasts Fed’s role in markets

- Gives scathing analysis of modern economics and markets

- Highlights complete disregard of economic fundamentals in investment decisions today

- As will be the case with Greece, U.S. will eventually be forced to liquidate debt

- Attempts to forecast day of reckoning are futile as it is a function of psychology

- “They can’t print money forever”

- Gold and silver will weather and thrive in currency devaluation

Ron Paul, former congressman for Texas, laid plain the absurdity of central policy towards the markets in a recent interview with Amanda Diaz on CNBC. He believes a day of reckoning is in the cards because the central banks “can’t print money forever.”

Dr. Paul blasted the role of the Federal Reserve in markets where superficial pronouncements herd speculators to and fro: “I am utterly amazed at how these Federal Reserve Chairman reports can play havoc with the market: one word – what they say and what they don’t say and who’s going to interpret it,” he said.

He believes this manipulation of markets by the Fed is having very negative consequences for the economy. Speculators are chasing Fed-induced momentum rather than making investment decisions based on analysis of what is happening in the real world. Savings, once the bedrock of American capitalism, have been replaced by easy credit leading to “a lot of malinvestment and a pyramiding of gigantic debt”, adding, “People don’t depend on savings for their capital – they depend on the Fed!”

He states that at some point the financial elites are going to have to admit that Greece’s debt is unpayable and will have to be liquidated. He sees the same thing eventually unfolding in the U.S. also, saying, “there will be an unwinding of this pyramiding of debt and all this malinvestment that has occurred for a good many years.”

The interviewer – abandoning any pretence that the markets are in anyway independent – states, “This is a Fed that has held this market up for quite some time now” and then asks Dr. Paul to indicate when he thinks the crisis will unfold.

He states that it could happen any time – maybe tomorrow, maybe two years from now. “It all depends on a psychological acceptance of this system. So, a lot of people who are still making a lot of money know that it is not going to last but they figure ‘well, everybody else thinks it’s going to last…’ and they just keep owning bonds and buying stocks.”

He therefore believes that it is impossible to gauge when the day of reckoning will come.

“So no, I don’t think there is anyway to know what the time is but after thirty five years of a gigantic bull market in bonds: believe me, they cannot reverse history and you cannot print money forever and deceive the markets forever. Eventually, the markets will rule and that’s only a question of when that will happen and of course I’m running a little bit scared because I think there will be a day of reckoning.”

In the event of currency devaluations, physical gold and silver – which cannot be printed and devalued by central banks with reckless abandon – will not only survive but thrive.

Must Read Guide: 7 Key Gold Must Haves

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,174.60, EUR 1,052.51 and GBP 748.80 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,175.75, EUR 1,048.93 and GBP 744.71 per ounce.

Gold fell $3.20 or 0.27 percent yesterday to $1,174.40 an ounce. Silver climbed $0.07 or 0.44% percent to $15.90 an ounce.

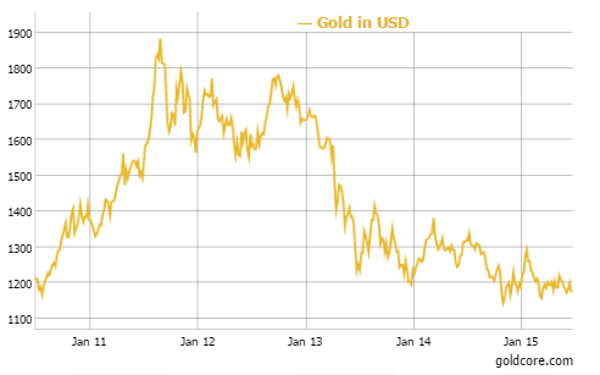

Gold in U.S. Dollars – 5 Years

Gold in Singapore for immediate delivery was up 0.2 percent to $1,176.80 an ounce.

Gold’s move lower is counter intuitive as the poor GDP number, while expected, allied to lower stock markets on continuing Greek concerns should have provided a boost to gold.

It suggests that the gold market is still largely controlled by speculative, fast trading money going long and short and trading the range between $1,150 per ounce and $1,225 per ounce. Passive allocations to physical gold and global physical demand is not impacting prices at this time.

Even the introduction of a gold dinar as currency by the ISIS fanatics has been greeted with a huge yawn as traders hold sway for now.

Gold in U.S. Dollars – 5 Years

China’s Industrial and Commercial Bank of China (ICBC) is making a move to be part of the London gold price benchmarking process, the bank said during the LBMA bullion market forum.

Only last week, the Bank of China (BOC) became the first Chinese bank to participate in the LBMA Gold Price, which formally replaced the 100 year old London Gold Fix on March 20th.

Standard Chartered and Morgan Stanley will join present members JPMorgan Chase Bank, Scotiabank, HSBC, Société Générale, UBS, Barclays and Goldman Sachs including the two Chinese banks.

The ICE Benchmark Administration (IBA), was established in April 2013 to administer benchmarks, and currently provides the price platform, methodology and overall administration and governance for the LBMA gold price after a price fixing scandal.

Chinese banks are ramping up their commodities business while some western banks are exiting them.

In late morning European trading gold is U.S. dollars is down 0.01 percent at $1,175.23 an ounce. Silver is down 0.30 percent at $15.85 an ounce and platinum is up 0.21 percent at $1,076.44 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.