Gold and Silver Spot Prices Increasingly Detached from Reality

Commodities / Gold and Silver 2015 Jul 08, 2015 - 02:46 PM GMTBy: MoneyMetals

Clint Siegner writes: An insolvent Greece has defaulted. On June 30th, officials missed repayment of billions in lMF loans and declared a banking holiday. Predictably, many Greek citizens responded to the crisis and bought gold coins. So did a lot of people here in the U.S. and around the world. You just wouldn’t know it by looking at spot prices.

Clint Siegner writes: An insolvent Greece has defaulted. On June 30th, officials missed repayment of billions in lMF loans and declared a banking holiday. Predictably, many Greek citizens responded to the crisis and bought gold coins. So did a lot of people here in the U.S. and around the world. You just wouldn’t know it by looking at spot prices.

The regular disconnect between the futures markets, where spot prices are set, and the physical markets reveals a growing problem. The link between the spot price and physical demand is thin at best. That is why the base price for gold coins in an Athens coin shop can get cheaper, but the all-in cost of buying the coins goes up as the line of buyers grows.

The availability of metals in a retail form is one cause. But the disconnect also has to do with the mechanism for setting the spot price – the futures markets.

The exchanges are supposed to be a meeting place for rational buyers and sellers evaluating fundamentals and making decisions about what is a fair price. But, in reality, the exchanges are dominated by major banks and brokerages employing high-frequency trading computers, derivatives, and other tools to manufacture a price.

These powerful market players aren’t trading physical metal, and they care very little about the fundamentals that motivate the rest of us. They trade paper contracts, a claim for future delivery of physical metal that’s supposed to be in an exchange vault. But the number of contracts swapped in a single day can represent more physical metal than world mines will produce in a year! So the claim could be all but worthless the minute holders start asking for delivery.

Wall Street invented high frequency trading a few years back. These algorithms now generate a huge portion of daily trading volume. Computers with special access can see and front-run the trades of human investors. The topic has gotten some coverage in the financial media and many investors are aware.

Fewer are familiar with developments in the derivative markets for gold and silver futures. These markets, primarily for options, further detach the underlying spot price from physical reality. A put or call option is twice removed from the bullion bars they are supposed to represent, and the leverage used is exponential. Instead of buying a futures contract directly, options traders buy the right to buy or sell a futures contract. And this further multiplies the potential number of claims against actual metal in exchange vaults.

These options significantly influence on the underlying spot price. Heavy buying of call options at a higher strike price will tend to drive spot prices upward, while lots of short selling or buying of put options will drag spot prices down.

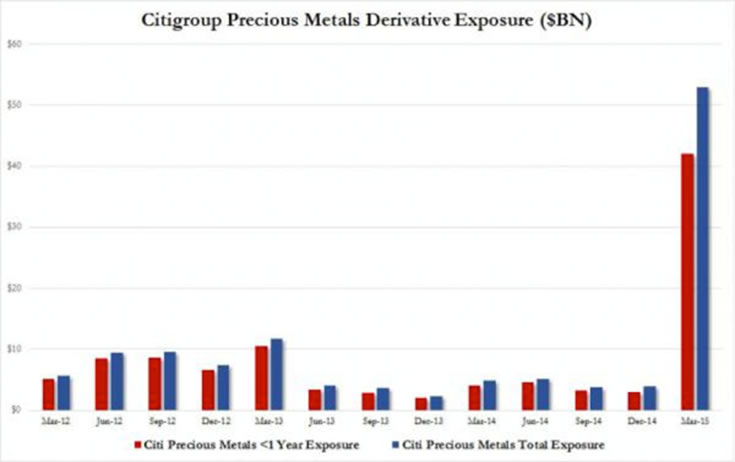

Citigroup Is Making a HUGE Bet on Price Moves in Precious Metals

Right now, Citigroup is loading up on options for precious metals. Zero Hedge reports the bank now has $50 billion in total exposure – more than ten times what it had at the beginning of the year. Investors have to guess about Citi’s intent with regards to price – they report only on the size, not the composition, of their options exposure. We don’t know whether they are betting on higher or lower prices.

Perhaps the bank is betting on a move either way. The bank could be using either a straddle or a strangle strategy involving the purchase of both put and call options to capture a big move in either direction. This technique limits the downside to the cost of the options that expire worthless on the wrong side a price move, while providing for potentially unlimited gains on the options in the right position.

Some speculate that Citi is betting neither on higher nor lower prices – that the bank simply wants to see prices hold inside a range. The strategy would be to take huge positions both long and short in order to dilute the influence that smaller trades might have in one direction or the other. We consider this strategy less likely. It implies Citi spent a fortune on put and call options they intend to expire worthless.

One thing is for sure. Citigroup has almost nothing in common with a worried Greek standing out front of the local coin shop. Greeks are switching cash for gold coins because of the growing certainty their government will confiscate a portion of what they have on deposit and then replace the remainder with newly re-issued drachmas worth far less. People around the world concerned about events in Europe are turning to physical gold and silver. But those folks aren’t setting spot prices.

But Citigroup is betting big time. Right along with JPMorgan Chase and the other major players in the futures markets.

The ounces of metal printed on futures contracts dwarf the actual number in exchange vaults. High frequency trading and concentration in derivatives positions makes the connection between the paper price and the physical supply and demand even more tenuous. Just ask any coin shop owner from Athens.

Premiums on gold and silver coins in Greece have jumped significantly, as buyers and sellers struggle to find a more realistic equilibrium price. Investors should expect the same here in the U.S. if demand holds up while spot prices languish.

By Clint Siegner

Clint Siegner is a Director at Money Metals Exchange, perhaps the nation's fastest-growing dealer of low-premium precious metals coins, rounds, and bars. Siegner, a graduate of Linfield College in Oregon, puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

© 2015 Clint Siegner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.