Metals Market Trend Analysis 2008 to 2009- Part 1

Commodities / Metals & Mining Jun 20, 2008 - 12:27 AM GMTBy: John_Lee

Oftentimes I talk to investors, even sophisticated ones, and I realize that they treat metals as a group. Particularly in the subset of base metals, most point out the price action of copper and conclude that all base metals are in a raging bull with no signs of slowing down.

Oftentimes I talk to investors, even sophisticated ones, and I realize that they treat metals as a group. Particularly in the subset of base metals, most point out the price action of copper and conclude that all base metals are in a raging bull with no signs of slowing down.

Close examination of correlation between various metal prices reveals a very different story, as we shall illustrate. (most charts here are from my friends at Kitco.com)

Phases of a market

"There is nothing new in Wall Street. There can't be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again." - Jesse Livermore, Reminiscences of a stock operator

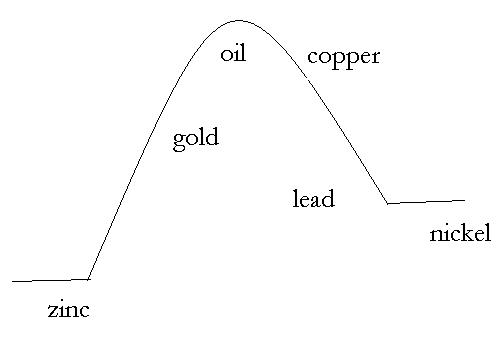

Each market invariably goes through different phases of a bull. Starting with bottom , accumulation, rise, mania, rolling over, crash , sucker's rallies, and then it starts all over again. People can attribute various reasons along the way for the rise and crash. The fact is price patterns are repetitive and can be observed time and again. Let's start with oil:

Mania

?

?

Does oil seem stretched and entering a short term mania phase? Yes.? I wouldn't go short, but I would certainly put a tight stop if I were long.

Rolling over

Copper seems to be rolling over and unable to convincingly overcome the $4 level.? $200 oil (possible, but not too probable in my opinion) could propel copper past the $4 level. Conversely, a correction in oil could break copper back to $3 in a hurry.

Crash

Lead staged a spectacular crash in early 08 as prices went from $1.80 to now 80 cents in under 6 months.

Sucker's Rally

Nickel resembled Lead, except the peak was established in mid-?07 instead of early ?08. Since the $23 peak, Nickel has staged several sucker's rallies and seemed to be settling down at the $10 level.

Bottom-Accumulate

Zinc peaked ahead of Nickel at over $2 in late 2006. Since then many have lost their shirts calling for Zinc's bottom. Given Zinc peaked ahead of lead and nickel, it will likely be on recovery mode faster with less risk of downside from here.

Accumulate - Rise

Gold has been on a steady rise since the bull began in 2001. Throughout the bull it has stayed above 200 day moving averages and yet it exhibits parabolic action, as oil did; consequently, the chart suggests the blow-off phase for gold is yet to come.

Fundamentally, while gold is not as cheap as zinc when measured in oil, nonetheless, based on historic relationship, a $130 oil calls for a gold price that is substantially higher than today's $900/oz.

The ratio of Gold to Oil from 2006 to present (sitting at 6 currently). The chart is showing an ?extreme bargain of gold relative to oil. If the ratio were to restore to the peak in 1999 of 26, today's $130 oil price will equate to a gold price of $3380/oz .

Here is a chart of where I see various metals markets are:

Correlations between Price and Inventory Unclear

Some accuse me of being overly technically oriented and ignorant of fundamentals. Fine, there are some that attribute base metal price action to inventory levels. If such a relationship is held true, zinc should not be trading at roughly 1/3 of its 2007 high of $2.2/lb, because the difference of inventory levels between now and then is negligible by historical standards.? In fact, inventory levels have never been a good forecast for future metal prices.

Buy Low - Sell High

To borrow the overused Buffett line, ?buy low, and sell high?. This is ?particularly applicable in commodity investment since metals such as zinc will never be made obsolete in my lifetime. Against rapid currency debasement and $4 trillion held at central banks of emerging-growth countries around the world, my view is:

Oil and Copper - risky investment

Gold and Silver - Good value and entering a blow off phase.

Zinc, lead, and nickel - Current prices will prove to be extreme bargain (particularly zinc at 80 cents) looking back 2-3 years from now.

Metals investment was the focus of my workshop at the Cambridge House Investment Conference in Vancouver (June 15-16). For those interested, the write-up of the conference and my workshop presentation can be accessed here.

In part II, we shall examine how various resource equities (energy, base metals, precious metals) fared against the respective underlying commodities. Stay tuned!

John Lee, CFA

johnlee@maucapital.com

John Lee is a portfolio manager at Mau Capital Management. He is a CFA charter holder and has degrees in Economics and Engineering from Rice University. He previously studied under Mr. James Turk, a renowned authority on the gold market, and is specialized in investing in junior gold and resource companies. Mr. Lee's articles are frequently cited at major resource websites and a esteemed speaker at several major resource conferences.

John Lee Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.