Stock Market Technical Weakness Continues

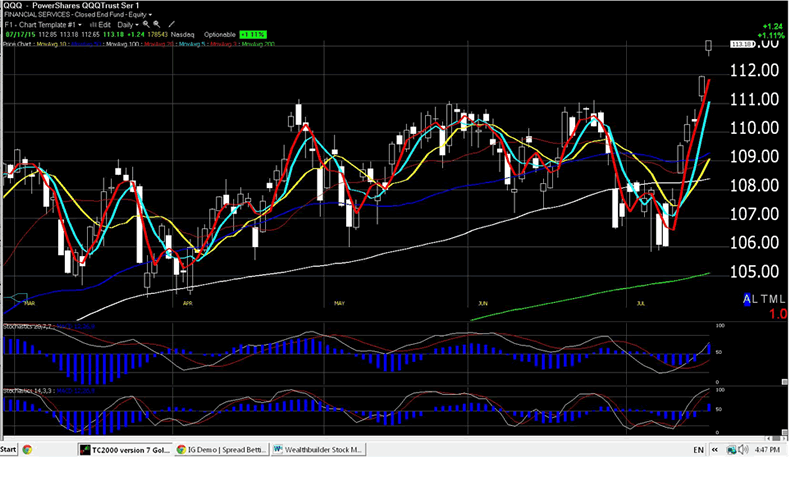

Stock-Markets / Stock Markets 2015 Jul 18, 2015 - 03:59 PM GMT The expected “oversold technical bounce” due to recent market weakness materialized this week. With the good news from Greece spurring sentiment on, the NASDAQ has just jumped to new highs with the Dow 30 and S & P 500 not too far behind. Nothing unusual here. However, just like a clay mound in the Australian desert that is being burrowed out by termites the American stock market’s apparent strength is actually being hollowed out by technical failure.

The expected “oversold technical bounce” due to recent market weakness materialized this week. With the good news from Greece spurring sentiment on, the NASDAQ has just jumped to new highs with the Dow 30 and S & P 500 not too far behind. Nothing unusual here. However, just like a clay mound in the Australian desert that is being burrowed out by termites the American stock market’s apparent strength is actually being hollowed out by technical failure.

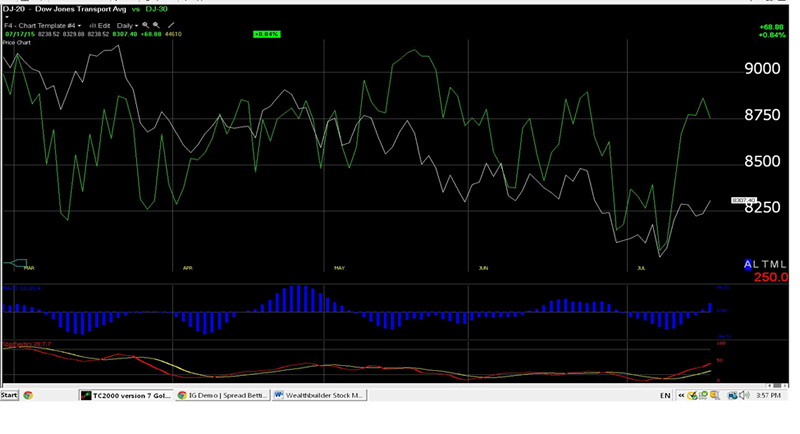

Despite a collapse in the price of oil, the Dow Transports continue to languish and if ever you needed an example of Dow Theory divergence “in the flesh” just look at the comparison chart below. This discrepancy in price behavior is not good and the longer it persists the more risky the market is going to become.

The % of stocks below the 200 PMA (Price Moving Average) continues to consolidate below its 200 DMA (Daily Moving Average). This price action is bearish.

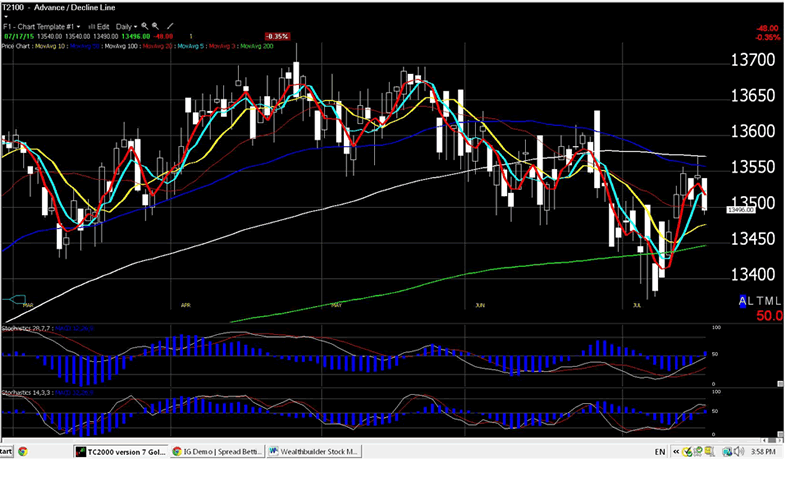

As I have regularly mentioned in the past there will be no significant market correction without a “warning breakdown” in the NYSE Advance/Decline line. Currently the 50 DMA line and the 100 DMA line are trending down with the 100 DMA becoming a point of resistance rather than a point of support. This is bearish price action.

Accordingly as mentioned in the last brief I would advise investors to be cautious with this market. It is my growing belief that the current strength could disappear at any moment like termite dust dissolving in a desert storm.

Chart: Dow 20 Dow 30 Comparison: Daily.

Chart: % of stocks above their 200 PMA: Daily.

Chart: NYSE Advance/Decline Line: Daily.

Chart: QQQ: Daily.

Greek crisis finally resolved, somewhat.

With Greek banks due to reopen next Monday by agreement it appears the “Grexit” crisis has finally been sorted out by the Euro partners. What a terrible three weeks it has been for Europe. I have never been so ashamed that Ireland was a member of the European Union. To observe 17 Euro-Group countries, (with the exception of France), gang up and humiliated a small nation of 12 million souls was utterly disenchanting. How did it come to this I asked myself? Poor pensioners were made to stand in line for up to 5 hours, in sweltering heat, to receive a paltry pension. Average citizens, who had many thousands of Euros in their bank accounts, were made to queue to withdraw a maximum of 60 Euros per day, whether they lived alone or had a family of 10 children to feed. Businesses were forced to close due to the lack of proper commercial import/export clearing services. All of this ordered, not by Greek parliamentary rule, but by decree from the ECB, Berlin and the German Bundesdag. Greek citizens finally woke up to a new Euro reality. For them European democracy had been reduced to a fantasy. Greek citizens finally came to realize that their sovereignty had been stripped bare by a foreign financial oligarchy. Force had replaced agreement and consensus. Living had become survival.

Cynicism had destroyed hope.

Despite the anguish described above by no means has the fundamental problems underlying the Greek crisis been tackled. No, today Greece merely has received emergency funds to allow their banks re-open until mid-August, subject to a more comprehensive third bail-out package being negotiated. Greece will now be saddled with a new round of unsustainable debt and more crushing austerity. No country has ever repaid a debt level that is 200% of GDP. Every international banking institution knows this yet no debt leniency has been granted to the Athens government. As we speak a “civil war” of sorts has broken out between the IMF and the ECB. Last week the IMF leaked an internal report outlining the need for significant debt relief being granted to Greece to allow the Government return to the international bond market. Berlin will hear none of this. Wolfgang Schauble, the German Finance Minister, has put it on the record that he fears that granting debt forgiveness to Greece will create a precedence that will motivate requests for debt “hair-cuts by Ireland, Span, Portugal, France and Italy. This development, he believes, will lead to the collapse of the Euro-Bond market. How all this will play out is anybody’s guess.

I believe the heart and soul of the European Union was publically destroyed over the last three weeks in Athens. Accordingly I reckon it is only a matter of circumstance, probably the crises of the next major world recession, which will force the Euroland body to finally give up the ghost.

Charts: courtesy of Worden Bros.

By Christopher M. Quigley

B.Sc., M.M.I.I. Grad., M.A.

http://www.wealthbuilder.ie

Mr. Quigley was born in 1958 in Dublin, Ireland. He holds a Bachelor Degree in Accounting and Management from Trinity College Dublin and is a graduate of the Marketing Institute of Ireland. He commenced investing in the stock market in 1989 in Belmont, California where he lived for 6 years. He has developed the Wealthbuilder investment and trading course over the last two decades as a result of research, study and experience. This system marries fundamental analysis with technical analysis and focuses on momentum, value and pension strategies.

Since 2007 Mr. Quigley has written over 80 articles which have been published on popular web sites based in California, New York, London and Dublin.

Mr. Quigley is now lives in Dublin, Ireland and Tampa Bay, Florida.

© 2015 Copyright Christopher M. Quigley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Christopher M. Quigley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.