China’s Total Gold Holdings Much Higher – Owns Gold In SAFE and CIC

Commodities / Gold and Silver 2015 Jul 20, 2015 - 01:42 PM GMTBy: GoldCore

- China revises up its stated gold reserves in bid for IMF membership and reserve currency status

- China revises up its stated gold reserves in bid for IMF membership and reserve currency status

– China announces a 604 tonne increase in gold reserves

– First public disclosure re reserves in since 2009

- China officially owns around 1,660 tonnes of gold reserves – true total figure is likely much larger

- Playing long game – protecting USD reserves and positioning RMB as global reserve currency

- China true gold holdings much higher as also owns gold in SAFE and CIC

China officially revised its gold reserves upward for the first time since 2009 on Friday. The People’s Bank of China (PBOC) stated on Friday that it had added 604 tonnes of gold to its official reserves last month.

Gold is no longer used to back paper and digital money of today, however it remains an important part of monetary reserves internationally. This can be seen in the People’s Bank of China’s (PBOC) announcement of an increase in their gold reserves.

China’s official reserves are now almost 1660 tonnes of gold. Analysts, including Bloomberg and ourselves, had been expecting a sharp jump to at least 2,000 tonnes and possibly as high as 3,000 or 4,000 tonnes.

It is clear by the secrecy surrounding China’s reserves that they view gold as a vital strategic asset. Chinese gold reserves increased by 57 percent and China’s holdings have now surpassed those of Russia to become the fifth-largest. The U.S. is believed to have the biggest reserves at 8,133.5 tons. The current official holdings rank them as the fifth largest holder of gold in the world (see chart).

Many analysts believe this figure to be an understatement given the enormous volumes of gold that have been passing through Hong Kong – and through Shanghai in more recent years – and the large amounts that have been produced and bought domestically.

It is important to remember that as we have long pointed out two other entities, besides the PBOC, have also been buying gold – the State Administration of Foreign Exchange (SAFE) and the China Investment Corporation (CIC).

Although if the combined holdings of the PBOC, SAFE and CIC were added together, China may well be the second largest holder of gold bullion – after the U.S. – assuming that U.S. gold reserve figures, which have not been publicly audited in over 60 years, are accurate.

It is likely, that in total and between the three China’s financial institutions, China may in fact be holding between 3,000 tonnes and 6,000 tonnes of gold.

China is playing the long game and they could be low balling their total gold holdings – official central bank reserves and non official holdings – in order to maintain confidence in their substantial US dollar holdings and to aid their bid to join the IMF.

China became the world’s second-largest economy in 2010 and has stepped up efforts to internationalize its currency – the yuan. The Chinese are pushing for full convertibility of the RMB and increasing their gold holdings will create confidence in the fledgling reserve currency and aid them in this regard.

China, regardless of its ambitions, is not currently in a position to challenge the the dollar’s reserve currency supremacy. The absence of a deep and liquid bond market is one impediment that they need to overcome on this regard.

On the other hand, it certainly is strong enough to take its place at the IMF and have the yuan included in the currency basket that makes up Special Drawing Rights (SDRs).

Whoever has the gold makes the rules. While gold is denigrated at every opportunity by some commentators – frequently Keynesians anti gold ideologues – it is clear that the true power-brokers in the world – leading international banks and central banks – still adhere to that adage.

To demonstrate its fitness to join the IMF, China must demonstrate its financial and monetary strength by declaring sufficient gold reserves which it has now done.

The bloated, debt-based international monetary system faces huge challenges and the scale of debts globally could indeed lead to collapse. In time China may disclose its true gold holdings and partially back its currency with gold to discourage capital flight.

Gold is no longer used to back the trillions and trillions of paper and digital money of today, however it clearly remains money contrary to assertions to the contrary. Gold bullion remains a substantial part of central bank reserves in the U.S. and Europe.

The PBOC gold announcement is the continuation of the trend of China positioning the yuan as global reserve currency. China’s gold reserves remain miniscule as a percent of their massive $3.7 trillion foreign exchange reserves – less than 2%. In marked contrast to the U.S., Germany and even France and Italy when gold’s share of national forex reserves is over 70%.

We would not be surprised if the PBOC begins to accumulate a minimum of 100 metric tonnes in gold reserves a month going forward as the Russians have done in recent years. Alternatively, they may elect to continue accumulating gold bullion quietly through SAFE and the CIC – indeed they have been buying hundreds of gold mines in South America, Africa and internationally in recent years – likely securing another important source of supply.

Central banks internationally still hold physical gold as financial insurance. Investors and savers should do the same and have an allocation to gold bullion outside of the banking system, in the safest vaults in the world.

Must-read guides to international bullion storage:

Essential Guide to Gold Storage in Switzerland

Essential Guide to Gold Storage in Singapore

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,115.00, EUR 1,029.17 and GBP 717.41 per ounce.

Friday’s AM LBMA Gold Price was USD 1,143.00, EUR 1,049.25 and GBP 730.68 per ounce.

For the week, gold was lower in dollars and pounds but eked out slight gains in euros. Gold fell 2.5% to $1133.90 per ounce and silver fell 4.4% to $14.89 per ounce.

This morning, massive concentrated selling in the futures market again led to sharp price falls and at one stage gold fell nearly 5% to below $1,100 per ounce. Gold in Singapore for immediate delivery fell sharply while gold in Switzerland bounced higher from the intra day lows.

In what looked like another successful bid to manipulate the gold market lower, there was massive selling of gold futures contracts – some 700,000 ounces worth of gold futures in mere seconds. The equivalent of one-fifth of a whole day’s trade in a normal session, was sold in a concentrated manner in less than two minutes – pushing prices lower again.

ANZ Bank analyst Victor Thianpiriya said in a note that the“nature, size and timing of the heavy selling” suggests someone “was taking advantage of low liquidity or some sort of forced selling had taken place.“

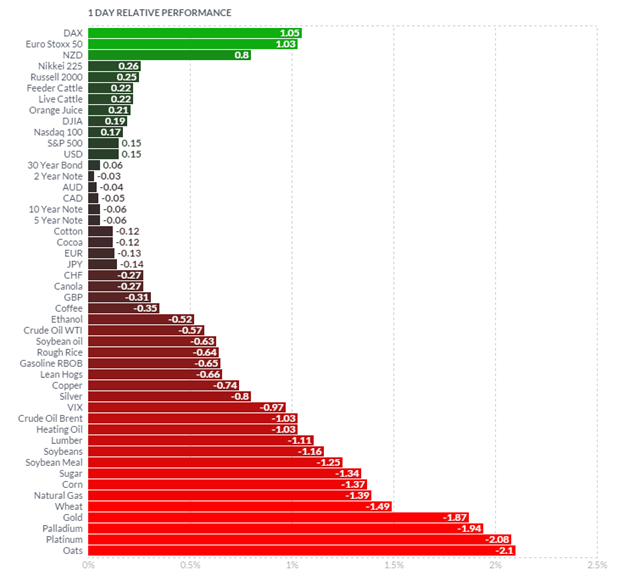

The sell off in the gold market spooked other commodities and most commodities are seeing sharp selling today, while stocks have continued to eke out further gains.

This is somewhat counter intuitive as the sharp falls in commodities in recent days suggest the global economy is weakening and threatened by deflation. Thus, stocks should be falling too. However, it appears that stocks are being supported by ultra loose monetary policies and currency debasement for now.

Gold looks horrible technically after having a fourth weekly loss last week. This is the longest series of price falls since February.The price falls are despite strong coin and bar demand internationally. U.S. Mint gold bullion coin sales remain very robust and dealers, mints and refineries report robust demand – particularly in Germany and wider Europe and indeed in the U.S.

This suggests that we are close to capitulation and a bottom and gold looks very oversold. Gold mining stocks absolutely collapsed last week with the XAU index down 8.1% and the HUI index down 9.3% – another indication that we may be close to a bottom.

Although as ever we caution to never ‘catch a falling knife’ and $1,000 per ounce remains possible on the down side. Dollar cost averaging into a physical position remains prudent.

Silver for immediate delivery fell 0.6% to $14.84 an ounce. Spot platinum fell 1.1 percent to $984.51 an ounce, while palladium fell 1 percent to $611 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.