Markets Macrocosm

Stock-Markets / Financial Markets 2015 Jul 28, 2015 - 02:18 PM GMTBy: Gary_Tanashian

Below is the opening segment of this week's edition of Notes From the Rabbit Hole, NFTRH 353. After this theoretical exercise we got down to nuts and bolts analysis, which provided logical 'bounce' targets (provided a bounce is indeed what is in play) for Gold, Silver and HUI, a compelling trend in the Commitments of Traders data and more talk about the trends that will need to be in place before a favorable macrocosmic environment is in place for the gold sector.

Not one to obsess on the gold sector in a vacuum, NFTRH also covered US and global stock markets, commodities, macro indicators and currencies as usual.

Macrocosm

This week we boldly take NFTRH where no other market report has gone before. :-)

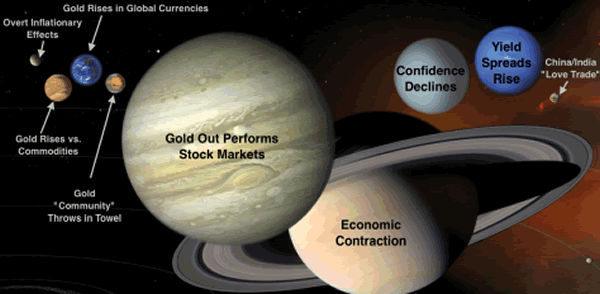

In Friday's NFTRH Update we noted that what happened on that day was a microcosm of what would be the optimal backdrop for a real change in the macro environment. On that day risk continued to come 'off' in the equity markets, stayed 'off' in commodities and reversed to 'on' in the precious metals. This is what the macro will look like one day when the planets are aligned correctly for gold bulls.

Of course, there was likely a lot of short covering going on in the gold sector as you and I were not the only ones who saw the trend line intersecting the 110 area on HUI. So it was a logical over sold reversal at a logical point. It also proves nothing other than the anticipated bounce has a chance to play out over the short-term.

A true investment environment in the precious metals sector will include what we saw on Friday, but this will be a trend as opposed to the flash we saw last week. I am not saying that we did not witness the beginning of such a macro trend, but again 110 was the bounce point on HUI and its ultimate downside target (itself not set in stone either) has been 100 .

Let's see how the gold "community" responds to the bounce. If the pompom brigade emerges in the form of bullish chart reading, admonitions against stock market participants and bullish gold projections well, you know the drill. It would paint Friday as a reversal on end of week short covering. Similarly, the stock market (which should be more or less inverse to gold in the next macro phase) is getting the correction it should have gotten before it was interrupted by the bullish sentiment reset (to over bearish) that came from the Greece hysterics.

So let's realize that Friday was a start. HUI got within hailing distance of its ultimate downside targets, but a short covering bounce in the coming days/weeks could reset the scene for a final decline. Similarly, the stock market is correcting but still in its big picture up trends. The rounding look of some indexes and outright daily downtrends in others (with momentum in the mix in the Internets and an unbroken uptrend in Healthcare) along with the fading participation we have noted in the Bullish % indexes showed the market was vulnerable to correction. For now, that is all it should be labeled (though cycles analysis puts markets in a topping window now).

On a real change in the Macrocosm, gold would establish an uptrend vs. the S&P 500, the Euro STOXX 50, the TSX, etc. US Treasury yield spreads would bottom and begin new up trends as stress (inflationary or deflationary) would be indicated within the financial system and the Federal Reserve would not be held in high regard and taken seriously by the average market participant. In short, confidence would be on the wane.

On Friday, confidence was in short supply. The patient will need regular check ups so that we can be on the spot and ready for the time when the likes of Friday's microcosm becomes a trend in the macrocosm. As it stood, gold was down vs. stocks on the balance of the week, yield spreads eased again and people took Janet Yellen seriously when she Jawboned about interest rate hikes. Those are the existing trends.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.