Gold – The More Hate, The More Bullish We Become

Commodities / Gold and Silver 2015 Aug 03, 2015 - 01:02 PM GMTBy: SecularInvestor

After gold’s breakdown on Sunday July 20th, we have seen an avalanche of negative commentaries. Admittedly, from a chart perspective the breakdown does not bode well. We have to get that straight. The technical breakdown is going to lead the price of gold in US dollar terms towards $1,000 /oz, potentially lower.

After gold’s breakdown on Sunday July 20th, we have seen an avalanche of negative commentaries. Admittedly, from a chart perspective the breakdown does not bode well. We have to get that straight. The technical breakdown is going to lead the price of gold in US dollar terms towards $1,000 /oz, potentially lower.

But if we compare this breakdown in gold with the one in April and June of 2013, we would say the one from last week is a small dip on the long term chart while the one of 2013 was a real collapse. However, the negativity that was triggered by the latest small price drop is much stronger.

Consider the following mainstream media headlines of the last week:

- “Let’s Be Honest About Gold: It’s a Pet Rock” (Wall Street Journal)

- “Gold is Doomed” (Washington Post)

- “Gold Is Only Going to Get Worse” (Bloomberg)

- “Two Reasons Why Gold May Plunge to $350 an Ounce” by (Market Watch)

- “Gold’s tumble is far from over” (CNBC)

- “Deutsche Bank says gold’s fair value is $US750 an ounce” (AFR.com)

- “Wall Street Bets Gold Drops Below $1,000″ (Barron’s)

- “Are There Any Reasons to Own Gold?” (Bloomberg)

From those articles, we selected the three most impressive quotes:

- “Gold is a weird relic of antiquity.”

- “Gold won’t just drop below $1,000 an ounce but, eventually, to a far, far lower price.”

- “Gold is out of fashion like flared trousers: no one wants it.”

News headlines are a great way to gauge sentiment. And they are simply telling a ‘hate story’ currently.

In particular, that one last quote of the ones above is very interesting: “no one wants it.” Really? Nobody? As in, “this time must be different?”

Let’s face it. Markets can become extreme, but markets do not remain endlessly at extreme levels. They also do not trade endlessly in one and the same direction.

Along the same lines, sentiment as measured by statistical methods is simply confirming what we see in the news headlines. Sentimentrader’s optimism index for gold stands at 12 on a scale from 1 to 100 (the latter being the highest value). And guess what, gold has currently the lowest reading from all assets (including currencies, commodities, stock market sectors).

The bullish percent index for gold miners, which measures the number of stocks in a bullish trend, is standing at zero.

The sentiment surrounding gold can’t almost get worse. But if ‘everyone’ is bearish, and there are no more sellers left to sell, what will take place in such an environment? Indeed, buyers will pop up.

Although we do not believe that markets trend higher or lower based on ‘reasons’, we still think there are two signals that indicate there is not much downside left for gold.

First, there are smart market participants, always. They also see the current sentiment. If the majority of market participants do not want to buy gold, then smart investors will do the opposite at the time selling is exhausted: go long in that market.

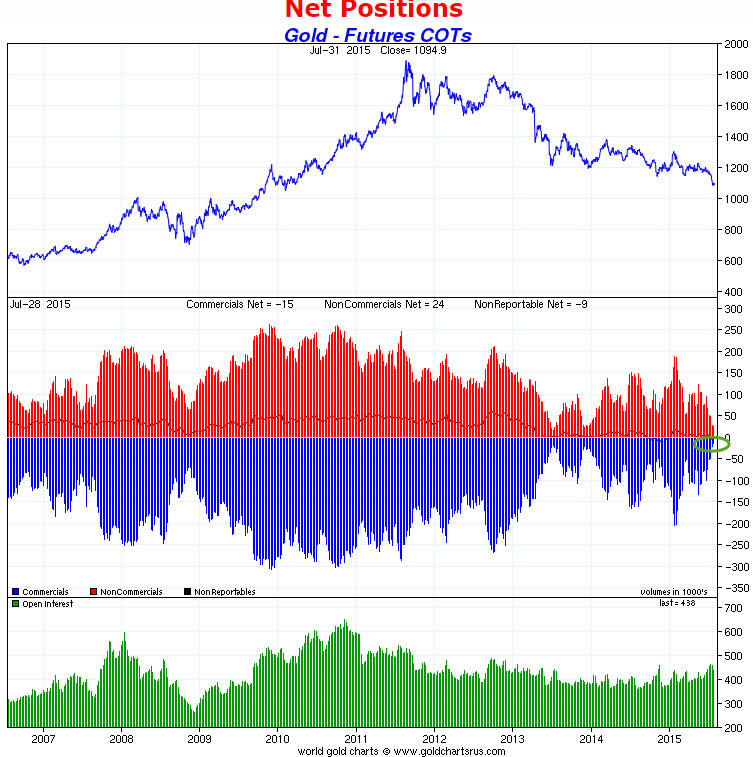

We believe those ‘smartest’ participants are the commercial traders in the COMEX futures market. Please note that we do not promote COMEX, as we firmly disagree with the way COMEX works (price discovery in gold is meaningless given the futures market). But the positions of market participants at COMEX provides interesting insights. Today, we see that commercial traders are writing history: they hold the smallest net short position ever (since the COT report has been published in 2006).

In other words, they are positioned for a rally. And they are doing so right at the time the mainstream media is screaming that “no one wants gold.”

Source: Sharelynx

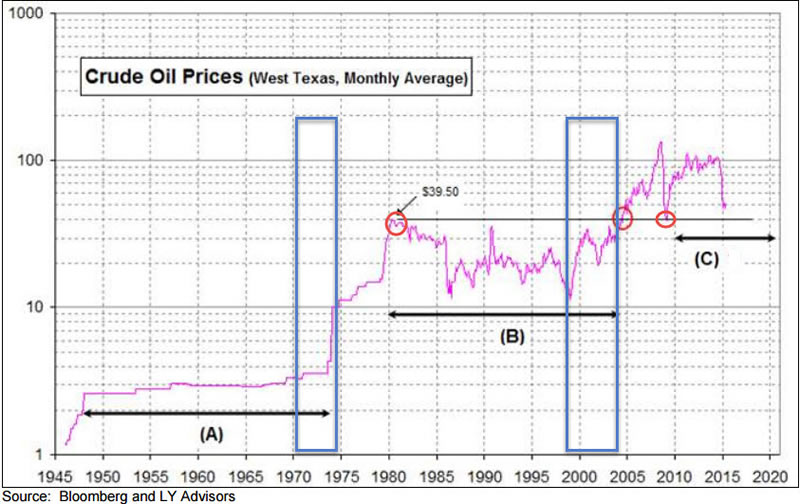

The second indicator we rely on is the top of crude oil and gold in 1980. Even if gold would go towards $850 /oz, it would be acceptable to believe it remains in its long term bull market, as it would simply retest the 1980 high.

From a secular point of view, the 1980 top was the highest point of the previous secular bull market.

We find a similar situation in the crude oil market. The price of crude oil peaked in 1980, after which it was tested 24 years later (when it broke out) and 29 years later (support did hold). Crude is now close to test that price level again.

Source: LY Advisors

Let’s not forget that the price of gold and crude oil are reflecting the world around them. The only possibility to have oil and gold prices in the trading range of the 80s and 90s, is a deflationary bust of historic proportions. The monetary masters of today are doing ‘whatever they can’ to avoid deflation, and that should, in the end, translate in the price of oil and gold.

Please mind that we are not saying that gold is about to start a strong bull market right away, similar to the one between 2004 and 2007. Our point is that the downside is limited. Even after a bear market rally which we anticipate in the short term, the price decline can continue, but it should have sufficient stopping power around the $850 /oz level. That makes for a 15% to 20% downside potential.

So rather than panicking, we look at the level of hate surrounding the gold market, and we become more bullish by the day.

We believe that smart investors should be preparing their shopping list right now, instead of reading mainstream media headlines about gold. At Secular Investor we are providing assistance by selecting the very best gold and silver miners.

Secular Investor offers a fresh look at investing. We analyze long lasting cycles, coupled with a collection of strategic investments and concrete tips for different types of assets. The methods and strategies are transformed into the Gold & Silver Report and the Commodity Report.

Follow us on Facebook ;@SecularInvestor [NEW] and Twitter ;@SecularInvest

Source - http://goldsilverworlds.com/

© 2015 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.