Another Gold Attack, then North to $2,000!

Commodities / Gold & Silver Jun 23, 2008 - 07:03 AM GMTBy: Alex_Wallenwein

Ordinarily, gold would be right before a major breakout point at this time, which should occur this week or the following week at the latest – but Wall Street and the entire US financial structure are so near a complete breakdown that another attack on gold must be expected. Here are the reasons why:

Ordinarily, gold would be right before a major breakout point at this time, which should occur this week or the following week at the latest – but Wall Street and the entire US financial structure are so near a complete breakdown that another attack on gold must be expected. Here are the reasons why:

The Dow

The Dow closed on Friday only a hundred points above its year 2000 high and March 2008 low of 11750. That point is so critical that "the powers" are in no position to allow it to be breached while gold is heading north. If that level is breached, non-PM investor psychology will seriously turn back onto itself and eat its own lunch.

There are two additional support levels on the way back down to the 2002 lows near Dow 7000, and those lie at 10,700 and 9,700 or so, respectively. With investor psychology as bad as it is now, a breach of the 11,750-level would kick the legs out from under whatever investor confidence remains so that the Dow will crash through these two additional supports at near free-fall speed.

The Dollar

The dollar has suffered severely from Tricky Trichet's hammer blow. The FOMC meets again this coming Wednesday. They have nothing to offer in support of the greenback - except for talk, that is. Expect that talk to begin early Monday morning, maybe even during overseas trading hours so the powers don't have to fight a dollar-decline and gold spike that has already developed momentum.

With the Dow teetering on the precipice, Bernie can't bump the federal funds rate now. He can only "hint" that he will do so going forward in order to give the dollar a bump so that the coming trashing of gold will look more plausible to the public. He cannot do a repeat-performance of what happened in March this year and drastically lower rates to give the Dow support. That would make gold spike sky-high, while offering only questionable results for the Dow.

Precious Metals Stocks

Telling, here, is that the PM stock indexes haven't followed their non-PM brethren into the danger zone. The XAU has formed a near-perfect diamond, and even the recently laggard HUI is finding nice support. These indexes will break out alongside gold after gold has recovered from the coming assault.

Gold & Silver

Gold is forming a beautiful triangle pattern from which it will probably break out by July 4th, or shortly thereafter.

That is, if we don't get a "false flag" here in the US from the frantic and now ultimately frightened powers. There is a lot of static going around that a major "hit" is in the offing, precisely during the July 4th celebrations in order to drive Americans back into their cage of fear and make them support a US/israeli strike on Iran. If any of that happens, of course, all forecasts about anything economic will be off the table.

US Banks - Deep in Hock!

The stock index for US Banks is about to plow through its own nine-year support level, as can be seen from the chart below, and that is probably the biggest argument for yet another preemptive hit on gold.

Once the BKX rams its head through that floor around 60 or so on the index' scale, there is nothing technical to stop its fall until the 1995 bottom near 30. In other words, Since a little over a year ago, that index has literally halved its value. It could easily halve its current value again within a month according to its most recent plunge into the abyss.

Since today's governments are run from behind closed boardroom doors of the world's top banks', and since most of those banks are of United States' origins, a further catastrophic decline in their market caps cannot be tolerated from their point of view. It would mean that the only way form them to raise needed capital would be to run to other country's sovereign wealth funds – which some notable ones have already done, of course.

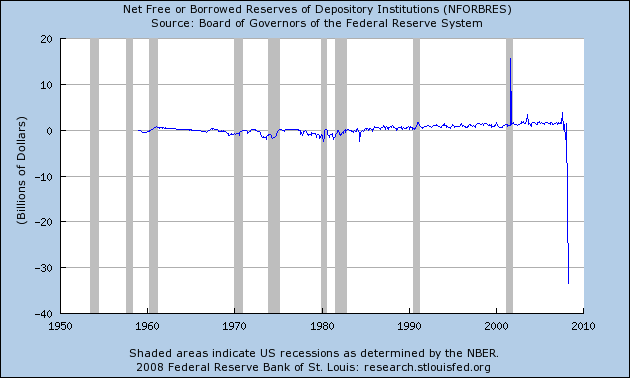

A very un-encouraging picture emerges when one looks at the US banking system's net reserve position . Remember that banks are supposed to have "cash reserves" of a certain size before they are allowed to lend to the public, and lending to the public is how they quite literally make money. This is what the US banking systems' reserves have done in 2008, so far:

When banks can lend enough money, they can "make" enough to stay solvent in that kind of a net-borrowed reserve position. But now, they are forced to tighten lending standards and long term rates are going higher regardless of what the Fed does, so at this time of a historic explosion of borrowed reserves, their ability to stay solvent is well, er ... rapidly dissolving, you might say.

The US banking sector will soon go through a series of high-profile bailouts, consolidations, and eventually bankruptcies. Whoever comes out on top at the end of this meltdown can safely be assumed to have had its fingers deep in the engineering phase of it. Goldman Sachs is high on the list of those most likely to survive. Say "hi" to your future masters!

The ludicrous part is that not that the entire US banking sector as a whole is hopelessly in the red, it's that it is even legal for these "institutions of higher lending" to be in a net-borrowed position when it comes to their so-called "cash reserves". That shows where the real political power is in the world. If you have an industry lobby that is powerful enough to get elected lawmakers to legalize their plainly and obviously wealth-destroying behavior, you have the power to run the country itself. Unfortunately, in the case of the US banking cartel, they are only running this country into the ground.

In the end, if there will be no "false flag" attack inside the US, and if no martial law or its equivalent is going to be imposed here as many fear at this point, gold will take its short-term lumps this week and will then start its run north to the $1,500 - $2,000 range before the year is up. Why $2,000? Just because it's a nice, round number. That doesn't mean it will stop there. Even Goldman won't be able to do anything about that.

As time goes on, the powers' continued ability to delay this process is coming more and more into question. The above chart from the St. Louis Fed shows why. That's why the Fed wants total regulatory power over the entire financial system of the US. More control means even more ability to hide and obfuscate. The very need for such increased power shows how atrocious a shape the US financial system is really in.

Got gold?

Alex Wallenwein

Editor, Publisher

The EURO VS DOLLAR MONITOR

Copyright © 2008 Alex Wallenwein - All Rights Reserved

Alex holds a B.A. degree in Economics and a juris doctorate in Law. His forte is research. In late 1996, he began to research how money is used by some to exert political and economic control over others' lives. In the process, he discovered that gold (along with silver) is the common man's antidote to this effort. In writing and publishing the Euro vs Dollar Monitor, he explains the dynamics of this process and how individuals can harness the power of gold in their efforts to regain their political and financial autonomy.

Just like driving your car, investing only makes sense if you can see where you are going. The Euro vs Dollar Monitor is the golden windshield wiper that removes the media's greasy film of financial misinformation from your investment outlook. Don't drive your investment vehicle without it!

Alex Wallenwein Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.