Precious Metals Microcosm Expanding

Commodities / Gold and Silver 2015 Aug 20, 2015 - 02:17 PM GMTBy: Gary_Tanashian

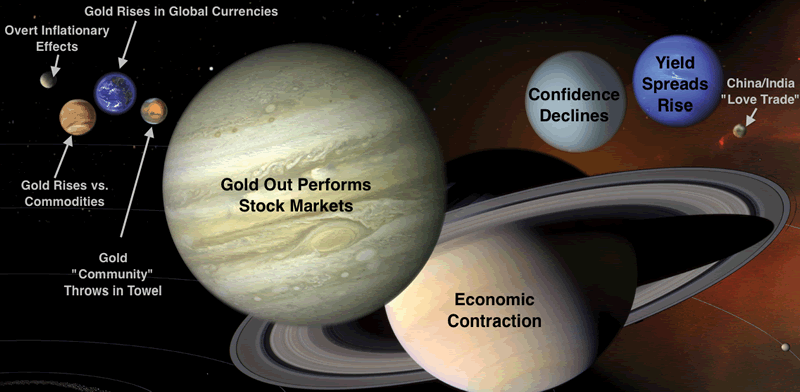

NFTRH 353 introduced the idea of a Macrocosm, a planetary representation of elements that need to come into place for a real investment stance on the gold stock sector (as opposed to the imagined elements cooked up by perma-bulls over the last few years). The Macrocosm idea came to me when the gold sector was acting firmly counter-cyclical on a day that most other markets were suffering. Then it happened again.

NFTRH 353 introduced the idea of a Macrocosm, a planetary representation of elements that need to come into place for a real investment stance on the gold stock sector (as opposed to the imagined elements cooked up by perma-bulls over the last few years). The Macrocosm idea came to me when the gold sector was acting firmly counter-cyclical on a day that most other markets were suffering. Then it happened again.

Yet again yesterday, and this morning, with stock markets red, crude oil red and negativity in the air for positively correlated markets, the microcosm is expanding incrementally. These are snapshots in time, as the gold sector displays a different character, as it should, when the global macro backdrop grinds toward a counter-cycle. At some point, the Micro is going to become a trend and hence, the Macro.

This has been NFTRH’s primary thesis during the post-2011 economic expansion and precious metals bear market. Simply understanding that a positive economic cycle was willed into being by decree of man (and woman) with ultra-aggressive and innovative global inflation policy kept us out of the way of the gold bear, but it also keeps us watchful for the next bull. Post-2012 especially, has been a positive economic cycle (to varying degrees globally, and consistently though unspectacularly in the US).

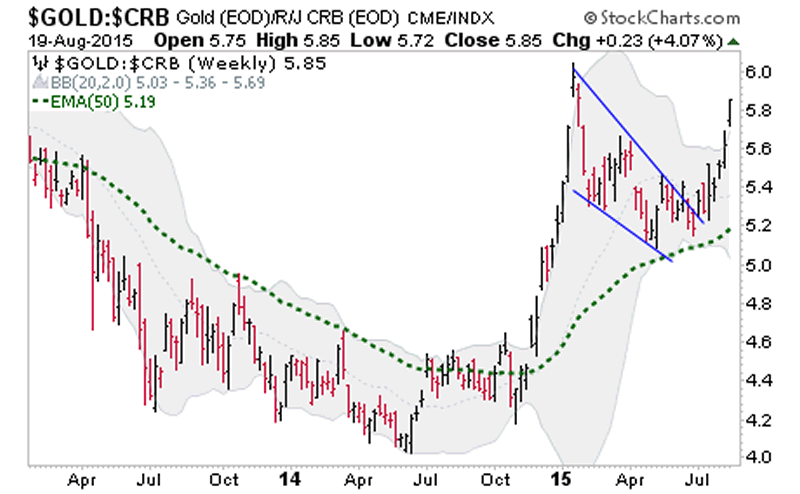

The first negative signal that has since shown up on the macro was gold’s rise vs. general commodities in 2014. That started the clock ticking, although its implications of global economic contraction were felt globally, but not yet in the US.

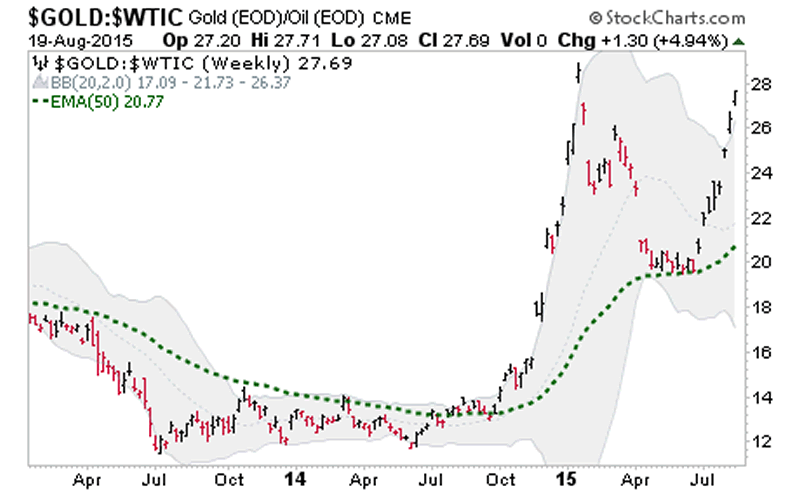

Within this, we have noted that while the global macro has not fully come in line for gold mining, sector fundamentals have been improving. Gold vs. crude oil is but one example of a fundamental underpinning being built into energy-intensive gold mining operations.

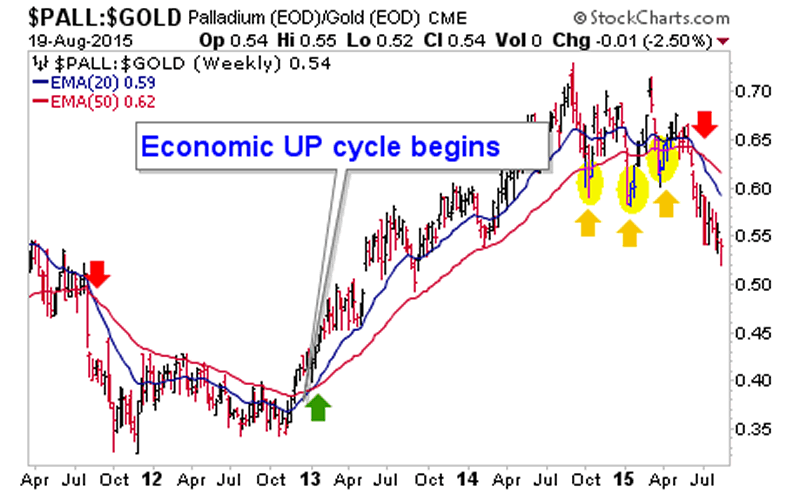

Then an important macro signal was registered earlier this year as cyclical Palladium began to drop in relation to counter-cyclical gold. For the past year NFTRH has been noting the jagged up and down whipsaw of this cyclical indicator and then as it triggered a down signal amid an ‘as good as it’s gonna get’ economic backdrop, we did not argue with it. We incorporated its message of coming global economic problems.

In early 2013 it paid to heed the positive signal. In 2015, it pays to heed the negative signal, although no one indicator should be taken in a vacuum as a mystical be-all, end-all.

The Microcosm is accumulating signals that call for a coming change in trends and a shift to a counter-cyclical Macrocosm. The gold sector would be the right one for investing in this environment (quality stocks only please). While improvements are being made this week, as I write in real time, not all signals are in line yet for a new long-term trend.

Indeed, NFTRH anticipated and has managed the current ‘bounce’ in the gold sector. Only when all sector and macro fundamentals come in line will we call it a Macrocosmic investment enviroment for the counter-cyclical gold sector. But it does appear that things are in transition.

We will be managing the proper signals on a weekly basis with as many (or as few) in-week updates as required to be positioned correctly. It is possible that a new bull market is beginning right here, right now in the Microcosm. When all sector and macro funda are in line and technical parameters are registered, then we will state so. Until then, it’s all management, perspective and patience… as usual.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.