Money Supply Surge to Lead to US Inflationary Depression

Economics / Stagflation Jun 26, 2008 - 10:39 AM GMTBy: Mark_OByrne

Gold closed at $879.60 in New York yesterday and was down $9.20 and silver closed at $16.48, down 13 cents. Gold fell prior to and shortly after the Federal Reserve's decision to keep interest rates on hold at 2%. However, with rates remaining extremely accommodative and inflation surging gold soon recovered and rallied into the New York close and continued rallying in electronic trading. Gold has continued to rally in Asian and early European trading.

Gold closed at $879.60 in New York yesterday and was down $9.20 and silver closed at $16.48, down 13 cents. Gold fell prior to and shortly after the Federal Reserve's decision to keep interest rates on hold at 2%. However, with rates remaining extremely accommodative and inflation surging gold soon recovered and rallied into the New York close and continued rallying in electronic trading. Gold has continued to rally in Asian and early European trading.

The Federal Reserve indicated growing fears about inflation relative to growth on Wednesday, but stopped short of saying that it saw inflation as the dominant risk. The central bank kept open the option of raising interest rates, without signaling an intention at this stage to do so.

There is the risk that while the Federal Reserve has to an extent ‘talked the talk' regarding inflation, it is failing to ‘walk the walk' by raising interest rates in order to combat the real threat posed by surging inflation.

The probability of a rate increase at the next meeting has diminished and it also retracted an April forecast that stated commodity prices will see a leveling out. And only to emphasise the massive dilemma facing the Federal Reserve was the news that Goldman Sachs stated that it expects Citigroup to write-down $9bln and Merrill Lynch to write-down $4.2bln in Q2 – again showing that the credit crisis is far from over.

Inflation in the U.S. remains higher than interest rates ( interest rate of 2% while inflation is at 4% ) and continuing negative real interest rates could lead to an inflationary spiral and will likely lead to sharply increased investment demand for gold to hedge against burgeoning stagflation.

Today's Data and Influences

The BoE's Monetary Policy Committee meeting along with existing home sales figures and unemployment claims from the US will hold the attention of the market today, as will Eurozone money supply data.

With money supply surging internationally (and this the primary cause of global inflation – see below), the ECB's concerns about inflationary pressures is likely to be underlined by this morning's release of the M3 (the broadest measure of all the cash in the economy) money supply report for May, which is forecast to show that growth in monetary aggregates remains very high at some 10.4%.

CNN Money - Money Supply Surge to Lead to Inflationary Depression in U.S.?

Mark Twain popularized the phrase, "There are three kinds of lies: lies, damned lies and statistics."

When official government statistics are abruptly discontinued and no longer available to the public and when other government statistics like the Consumer Price Index indicate inflation remains contained, many wonder, “is it just me - and everybody else I know – that is paying a lot more for food and energy and just about everything else that we use?"

John Williams of Shadow Government Statistics points out that the government has changed the method of calculating CPI figures, especially within the last fifteen years, lowering inflation figures significantly.

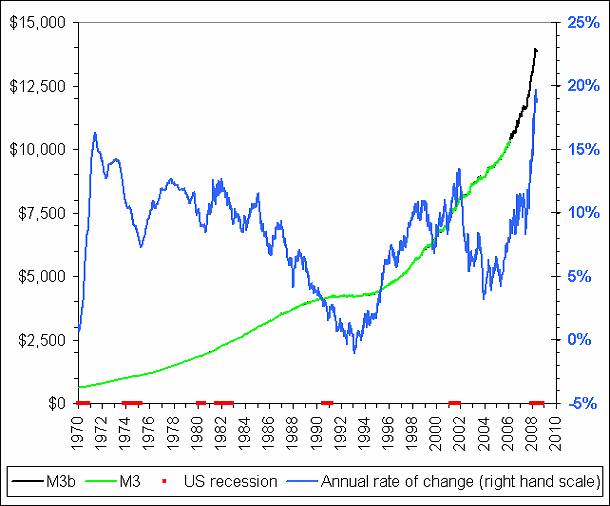

Even more bizarrely and worryingly, the U.S. government has discontinued publishing M3 money supply data. But the diligent analysts in Shadow Statistics have reconstituted and it shows M3 surging by over 20%. John Williams and Shadow Statistics are garnering increasing respect for their excellent research in this regard and were recently featured on CNN .

The interview is excellent and in it Williams outlines his believe that the US will experience an inflationary depression. The interview was in February of this year and since then M3 money supply has surged by even more and is now at over 20% as seen in the chart below.

In the CNN Money interview, Williams recommends that investors become more defensive and sell equities and bonds and become more liquid and move to cash and hold gold in order to protect against inflation.

Silver

Silver is trading at $16.86/16.90 per ounce (1100 GMT).

PGMs

Platinum is trading at $2043/2049 per ounce (1100 GMT).

Palladium is trading at $466/470 per ounce (1100 GMT).

By Mark O'Byrne, Executive Director

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@www.goldassets.co.uk Web www.goldassets.co.uk |

Gold and Silver Investments Ltd. have been awarded the MoneyMate and Investor Magazine Financial Analyst of 2006.

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Mark O'Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.