Crude Oil Price Is Going to Fall by 50%… Again

Commodities / Crude Oil Sep 29, 2015 - 11:37 AM GMTBy: ...

Michael Lewitt writes: We’ve talked about the massive Debt Supercycle and why it can only end in the market crash I’m now predicting. (If you want a refresher, download my “Super Crash Report.”)

Michael Lewitt writes: We’ve talked about the massive Debt Supercycle and why it can only end in the market crash I’m now predicting. (If you want a refresher, download my “Super Crash Report.”)

But there’s one connection we haven’t made yet.

The same thing just happened in the energy market.

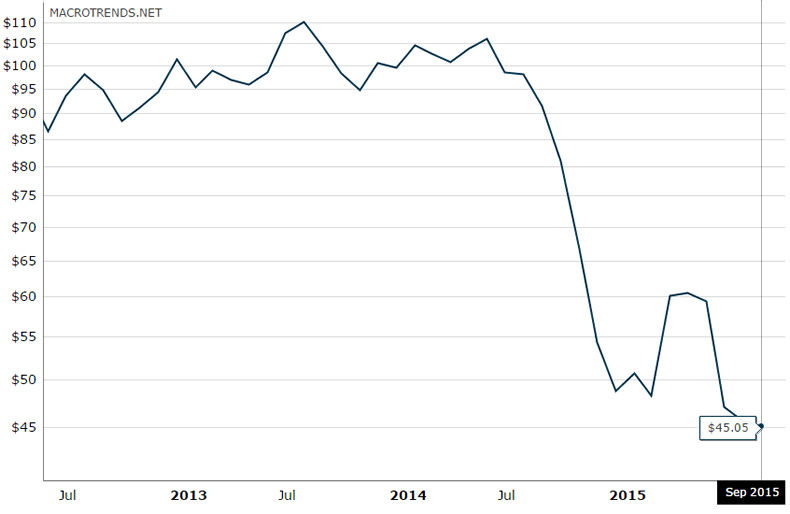

The 50% collapse in WTI crude oil spot prices over the second half of 2014 caught most investors by surprise. It wiped out billions of dollars of value from the accounts of investors who owned energy stocks and junk bonds. But if you knew the reality of the debt situation in energy, the outcome was clear as day.

This is one of the reasons my institutional and high net worth clients didn’t own a single energy stock or bond at that time. We’re going to be, of course – there’s a window approaching where we can make a killing in energy, and I’ll show you when – but 2014-2015 was not a good time to be long in a highly speculative and leveraged energy market.

And it’s about to happen again.

Today I want to show you exactly how debt crashed the energy market. It’s a story few investors understand, and it’ll really put this whole “Debt Supercycle” concept in sharp relief for you.

And then get ready. First thing next week you’ll get my immediate profit protection plays… the key indicator to tell when oil has hit bottom… and see how we could make 300% riding it back up.

How Oil Prices Got So High in the First Place

First it is necessary to understand how prices got so high in the first place. After all, a little more than a year ago, WTI crude oil was trading well over $100 per barrel. And it had only flirted with $80 per barrel a couple of times since the 2008 financial crisis, when it hit $82 per barrel in 2011 and $83 in 2012.

How did this happen? The Federal Reserve’s Herculean post-crisis efforts to lower interest rates in order to revive the U.S. economy was occurring at exactly the same time that a new technology for extracting oil from the ground came into existence. This new technology was called fracking, and it revolutionized the U.S. oil industry.

The combination of endless amounts of cheap money and new technology is something we have seen before. For example, in the late 1990s, the Fed opened the monetary spigots at the same time that the first phase of the Internet came on the scene. Many Internet and telecom companies used cheap debt to finance themselves – and ended up borrowing themselves into bankruptcy.

Corporate managers prefer to finance themselves with debt rather than equity in order to keep the value of their company for themselves. Low interest rates allow them to do this more easily. Again, I saw this first-hand during the Internet Bubble when companies that had limited revenues were able to borrow hundreds of millions of dollars from gullible investors to build Internet hosting facilities or enough cables to wire the universe.

The same thing happened in the energy industry since the financial crisis.

Everyone believed that oil prices would stay at $100 per barrel forever. This expectation was based on the bogus belief that the global economy was strong, when in fact it was very weak and was only growing because central banks were printing trillions of dollars/euro/yen/yuan of money. Even worse, their governments were in many cases the biggest buyers of that new debt in massive Ponzi schemes that are now coming home to roost.

When these schemes started to reach their limits in 2014, the global economy hit a wall and commodity prices – including oil – started to collapse. (Supply and demand factored in too, of course.) We saw the impact of this almost immediately in U.S. markets.

When WTI hit a low of $44.12 per barrel on January 29, 2015, the consensus figured that prices had hit bottom. And for a while it looked like they were right. WTI rallied back up to $61.36 per barrel on June 10, a strong 39% recovery.

In the interim, a large number of energy companies raised billions of dollars of new equity and debt in order to try to survive the worst oil downturn in decades. And they found willing investors who believed that oil prices couldn’t possibly go any lower.

I am sorry to report that all of these bright minds were 100% wrong. There was never any doubt that oil prices were going lower – much lower than their January 2015 prices.

And predictably, as we speak, WTI is back at $45 per barrel.

Energy companies comprise about 17% of the U.S. high-yield bond market (roughly $200 billion face amount of debt). In the summer of 2014, the average yield on the energy sector of the Barclays High Yield Bond Index was roughly 5% but by the end of the year, the yield had moved above 10% for the first year and it is now higher. Many bonds dropped by more than 50% and thus far at least eight companies have filed for bankruptcy.

But believe me, there is going to be much more blood in the water.

The Dollar’s Effect on Oil

There is another big reason why oil has not reached a bottom – the U.S. dollar is going to keep getting stronger.

Again, the U.S. dollar is likely to continue to strengthen against other major currencies, including the euro, the yen, and the yuan. China has begun devaluing its currency. Europe and Japan are engaged in major QE programs that will devalue their currencies. The Brazilian real is plunging. The world is engaged in a massive currency war and the dollar will be the winner among all the paper currencies (gold will be the ultimate winner but that’s a topic for another day).

Oil is traded in dollars and a stronger dollar means lower oil. You cannot be long the dollar and long oil – they move in different directions.

Instead you may want to be long the dollar and short oil (as I’ll show you next time). These two trades fit together.

Oil Is Likely to Fall Another 50% from Here

Right now bankers are reviewing the loans secured by oil and gas assets, something they do twice a year. With oil prices back down at their January lows, banks are likely to limit the amount they are willing to lend to the industry. Even worse, regulators are breathing down the necks of bankers in a well-intended but misguided attempt to substitute their judgment in determining how much credit to extend to energy companies in the current environment. The Office of the Comptroller of the Currency is unqualified to make such decisions yet has the power to prevent banks from extending additional credit to energy companies and is aggressively asserting that power. The result is likely to be to push companies that could survive into bankruptcy unnecessarily, which will put further downward pressure on oil prices.

The price of oil (WTI) is likely to drop into the $20s before the current cycle ends.

And that’s when we pounce.

I’ll be back with you Monday. Don’t miss this one.

Source http://suremoneyinvestor.com/2015/09/oil-is-going-to-fall-by-50-again/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.