New Hedge Fund Buying Enters Crude Oil Market

Commodities / Crude Oil Oct 12, 2015 - 06:03 AM GMTBy: Dan_Norcini

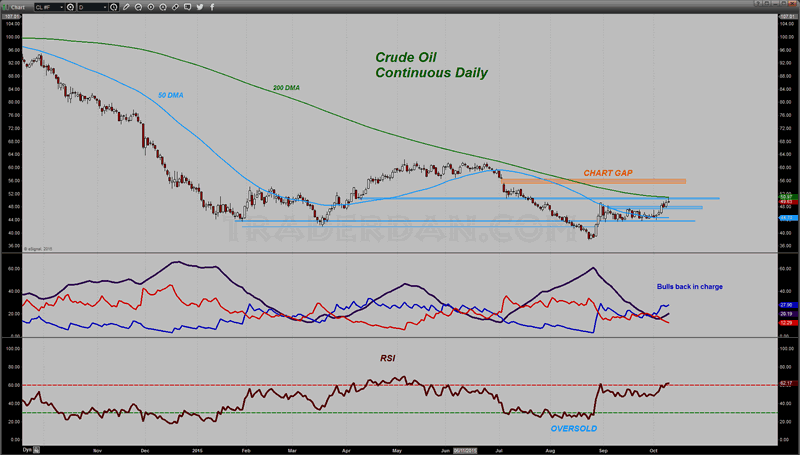

First, let's start with an updated chart of the WTI Crude oil.

First, let's start with an updated chart of the WTI Crude oil.

Crude has been in a range for most of the month of September oscillating near the 50 day moving average. It had been unable to do much in the way of additional upside however until this month, when it finally broke out above resistance at the top of the range near the $48 level. Friday it managed to best 50 on an intraday basis but then faded well off the highs heading into the close.

Notice that the rally was stopped dead in its tracks by the falling 200 day moving average. That will serve to reinforce Friday's high as a significant technical inflection point moving forward. If crude is going to be able to extent this month's push higher, it will have to clear that level. If it does, a goodly number of shorts will come out as they have all been watching how this market handles itself near that 200 DMA.

Crude Oil Continuous Daily Chart

From a fundamental standpoint, I cannot point to anything in particular that seems to be strongly bullish for the oil. While the rig count has declined and US production has fallen off in recent months, demand has also been weak due to sluggish economic growth. We were once again reminded of this by the release of the FOMC minutes this past week detailing how dovish the Fed has been.

I view this crude rally as more of a Dollar-induced move higher. The dovish Fed has cut the legs out from beneath the greenback sending it lower and as it has dropped down, hedge funds have ramped up their buying of the beaten-down commodity class. It is back to same old, same ol' - namely, WEAK DOLLAR - BUY Commodities; STRONG DOLLAR - SELL Commodities.

You will also notice that the shares in the energy sector have done well recently as have the shares in the materials class (any company dealing with commodities). All of this is tied directly to the Dollar.

I am beginning to embrace even more strongly my personal belief that this current Fed DOES NOT WANT FALLING COMMODITY PRICES AT THIS JUNCTURE. Yes, falling commodity prices have generally been good for the US Consumer but at some point, they decline so far as to begin to wreak havoc among the companies engaged in their production, distribution, etc. That results in job layoffs, cutbacks in exploration, credit rating issues, etc. In other words, once commodity prices decline past a certain point, any benefit that might ensue to the consumer is outweighed by the harm done to the overall economic growth prospect. Translation - I believe the Fed has been and will continue to TARGET the US Dollar in an attempt to prevent a further meltdown in the commodity sector.

By the way, this also means that the Fed, DOES NOT WANT A FALLING GOLD PRICE. Yes, you have read that correctly - this view strikes directly at the heart of the never-ending, nauseating "Gold is always manipulated all the time (GIAMATT) claptrap that like a stinking, festering oozing wound, never stops occurring and issuing forth from the cult of gold. A sinking gold price means DEFLATION and this Fed has made it abundantly clear that they do not want DEFLATION. How many times, must they say, and must we read, that the goal of the Fed is to achieve an annual inflation rate of 2%? Now, one either takes them at their word or ones does not. I happen to believe them. I also happen to believe that the reason that they are so afraid of hiking a piddly 25 basis points is because they are scared to death that they will negate any inflation prospects on account of the impact that such a move would have on the US Dollar. The greenback would start moving higher again and as it did, commodities in general would start moving lower once more.

That would hit the bottom line of any company involved in the commodity business as well as negatively impact the profits of US multinationals. Thus, the Dollar rise must be halted or at the very least, postponed.

Back to my point however about the gold price - the LAST thing this Fed wants is the key DEFLATION/INFLATION barometer signaling more Deflation worries.

This is also the reason one has to shake their head in wonder at the blockheadness of the gold cult which continues to blame every single, solitary setback in the gold price and tie it to the phrase, "Flash Crash" or some other emotionally charged but economically ignorant expression. For some perverse reason, they have gotten it into their minds, that the price of gold must always move higher, no matter what, and whenever it does not, it is because of some evil, sly, sinister attempt by the powers that be to control it.

In my view, the exact opposite is true at this time - namely, the Fed does not want the price of gold, nor the general price of commodities collapsing for the reasons I just cited.

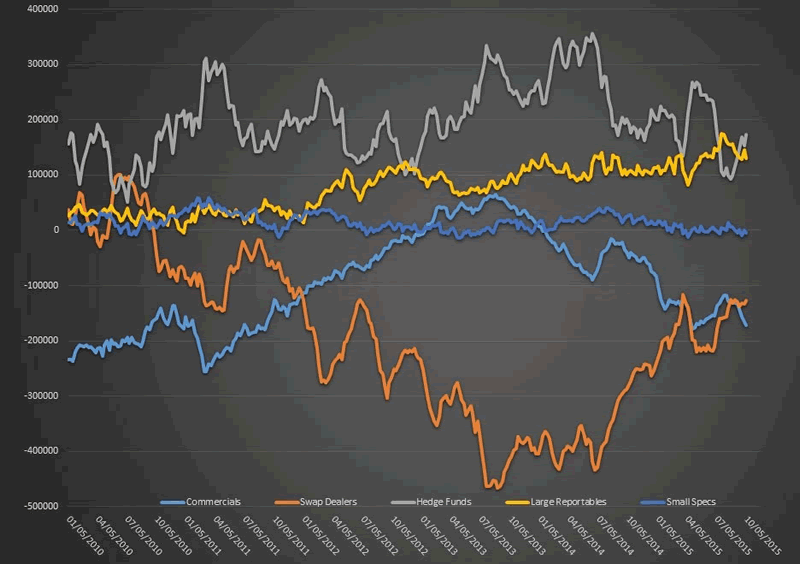

Back to crude oil and the Commitment of Traders to show where the buying has come from.

Here is the latest chart:

Crude Oil COT

Look in particular at the Hedge Fund positioning. You can see the size of their NET LONG Position has increased rather dramatically since the end of August. I broke out their total long and short positions separate from the rest of the players and included those on this chart showing the TOTAL LARGE SPEC positions.

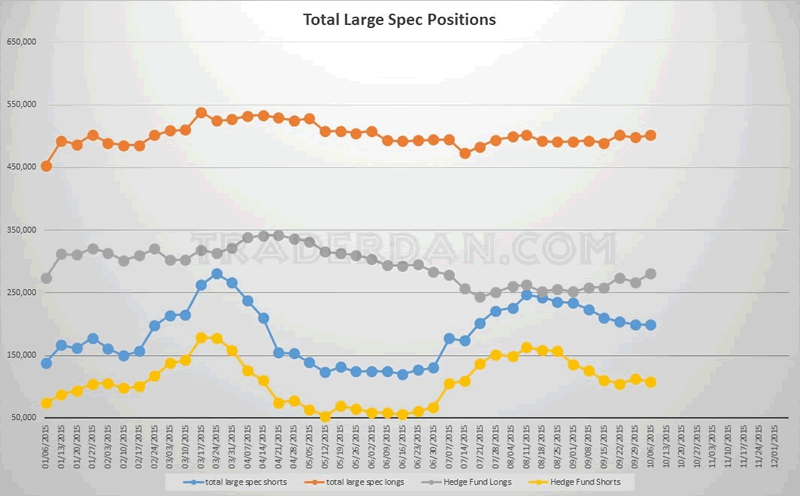

Crude Oil Total Large Spec Positions

You can see that the hedgies have been both building new longs as well as covering or reducing existing shorts pretty consistently since the last of August.

What you can also see, is that when you combine their total positions with the positioning of the other large reportables, it becomes obvious which group of LARGE specs has been buying - it is the hedge funds and not so much the other large reportables. It seems that the hedge funds have a proclivity at this point in being long crude oil. As long as that is the case, crude will work higher. The question is, are they willing to take it through the 200 day moving average and do the production cutbacks and rig count reductions have enough of an impact on the SUPPLY side to offset the continued sluggish DEMAND SIDE?

Also, what percentage of this hedge fund activity is do solely to the MACRO TRADES, namely, buying crude and other commodities in general when the Dollar weakens? That trade in particular pays no attention to anything in the fundamentals world but instead is a reflexive trade that is nearly automatic in nature.

As noted in previous posts this week, the markets have already dialed in sluggish growth prospects, especially when the FOMC released its statement coming out of its meeting last month where they inserted the phrase "global developments". That means players know the bearish side very well. The problem for the bears at this juncture is that it is going to take further deteriorating economic news to embolden them once more. After all, once you have already priced in a worst-case scenario, what then? That means you draw in bottom pickers and short covering because the market stops going down and therefore the path of least resistance is then upwards.

Keep in mind however that this does not mean the market is becoming bullish - it merely means it is becoming less bearish and that is always sufficient to attract bottom fishers and pickers. We will however actually need to start seeing something positive on the demand side of this equation or even more drastic cutbacks in production to turn the sentiment in crude oil strongly bullish.

Whether we get that or not is unclear. For now, as long as the crude oil price remains above the 50 DMA, one can make the case that the price has found a longer term bottom and thus will remain in a new and higher range.

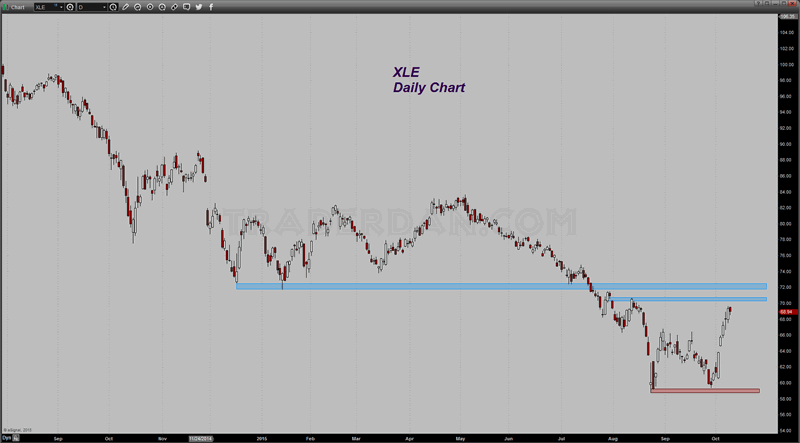

The same thing can be said for the XLE - the ETF has produced a Double Bottom down near 59-58 and is currently working into chart resistance near 70 and proceeding towards 72-73.

XLE Daily Chart

That latter region should prove to be formidable resistance without some sort of shift in the fundamentals. That was a strong downside support level going all the way back to December of last year. When it finally gave way in July of this year, the energy sector was obliterated. Now, it is working its way back up towards that level. When it did so in August, it failed to even reach it for a test. Will the same thing occur this month?

If it does, we have a new trading range with a bit of a higher basis but one that nonetheless should find support at a higher downside level since investors seem to want to be friendly towards this sector (those with a longer term horizon). The thinking is simple - crude oil has seen the largest supply it is going to have in some time based on the smaller rig count and the fact that Iran has already been factored into the price. That means, in their minds, that while the market may not move higher in the near term, over the longer term, demand should slowly pick up while the supply drops off. That is a recipe for higher prices looking further out. Thus, those investors, who are somewhat underexposed to energy in their portfolios, are adding shares in that sector now, since they believe the downside is limited. They are willing to wait and exercise patience.

That is, in my view, a wise decision. Keep in mind that investing is different than trading. Traders have a shorter term horizon due to the extreme leverage and risk of adverse price movements. Investors, especially those who look for value and are not leverage up, can have the leisure of trying to Buy Low and then waiting for the inevitable turn in crude.

The thing that might work to give their patience a run for its money is if we do indeed see further negative global economic news not only here domestically, but globally as well. That will serve to cap the upside in crude oil and depending on its nature, might actually push it down far enough to give some of the investors second thoughts about tying up too much capital in a sector that could struggle for a while longer than they had originally anticipated.

One simply has to adjust to changing circumstances and changes in fundamentals if they are going to be successful, whether trading or investing. That means you have to follow the markets and know what is taking place.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.