Ignore The Media Bullsh*t – Retail Implosion Proves We Are In Recession

Economics / Recession 2015 Oct 15, 2015 - 12:31 PM GMTBy: James_Quinn

Here we go again. The dying legacy media will continue to support the status quo, who provide their dwindling advertising revenue, by papering over the truth with platitudes, lies, and misinformation. I have been detailing the long slow death of retail in America for the last few years. The data and facts are unequivocal. Therefore, the establishment and their media mouthpieces need to suppress the truth.

Here we go again. The dying legacy media will continue to support the status quo, who provide their dwindling advertising revenue, by papering over the truth with platitudes, lies, and misinformation. I have been detailing the long slow death of retail in America for the last few years. The data and facts are unequivocal. Therefore, the establishment and their media mouthpieces need to suppress the truth.

They spin every terrible report in the most positive way possible. They blame lousy retail results on the weather. They blame them on calendar effects. They blame them on gasoline sales plunging. That one is funny, because we heard for months that retail spending would surge because people had more money in their pockets from the huge decline in gasoline prices.

September retail sales were grudgingly reported by the Census Bureau this morning and they were absolutely dreadful. This followed an atrocious August report. The MSM couldn’t blame it on snow, cold, flooding, drought, or even swarms of locusts. So they just buried the story in their small print headlines. The propaganda media machine had nothing. They continue to spew the drivel about a 5.1% unemployment rate as a reflection of a booming jobs market. If we really have a booming jobs market, we would have a booming retail sector. The stagnant retail market reveals the jobs data to be fraudulent. The 94 million people supposedly not in the job market can’t buy shit with their good looks.

Despite the storyline about consumer austerity being the reason for sluggish spending, the facts prove otherwise. Consumer spending accounted for 68% of GDP in 2008 at the peak. Seven years later it still represents 68% of GDP. The difference is the spending has shifted dramatically towards services since the Wall Street created financial crisis. Spending on services has grown by 31% versus 20% for goods since 2008. Guess what has caused that surge?

OBAMACARE

Spending on healthcare has skyrocketed for the average person. Rent, taxes, utilities and educational expenses have all exploded higher. Meanwhile, real median household incomes are 7% lower than they were in 2008. They are 7% lower than they were in 2000 and equal to the level of 1989. And the bubble headed bimbos on CNBC can’t understand why retail sales aren’t booming? Did they get their journalism degrees from the University of Phoenix or Trump University?

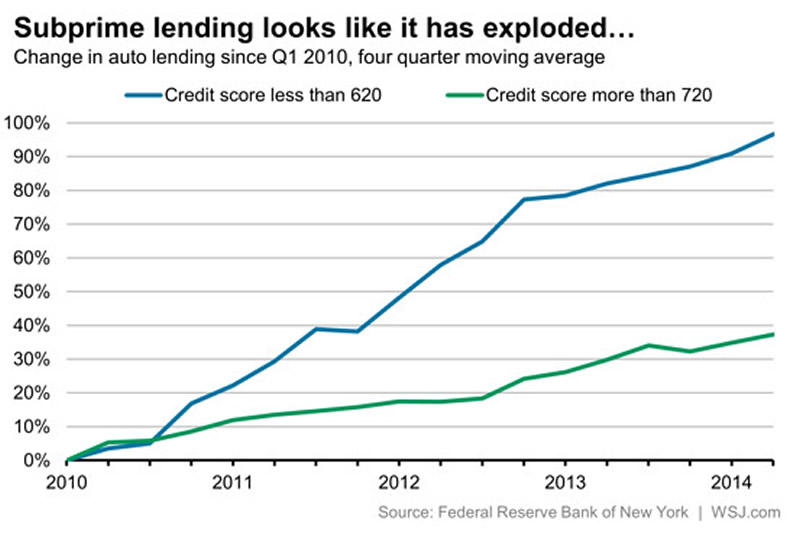

Let’s dig into the data for some shits and giggles. First off, you need to realize how bad it really is when you consider US automakers are essentially giving away vehicles to anyone who can fog a mirror, as long as they are willing to obligate themselves into never ending debt enslavement. The average amount financed of $27,000 and the average length of loan of 65 months are both record highs. As the automakers get more desperate by the day, 7 year 0% loans are now becoming the norm. Dealer incentives in the thousands proliferate. And subprime auto loans now constitute over 20% of all sales. The pace of subprime auto loans has more than doubled the pace of prime loans since 2010.

The Fed, Treasury and Wall Street decided auto sales would be the tonic to cure our economic ills, so they opened up the debt floodgate to get everyone and anyone into a new vehicle. They needed booming auto sales to provide the appearance of economic recovery. So, while overall consumer expenditures increased by 21% since 2010, auto loan debt grew by an astounding 41%. An this is just the debt side of the equation.

Over 27% of all vehicle “sales” are actually leases. Calling a three year rental a car sale stretches the concept of sale to the limits. Anyone who finances a car over seven years or leases a car, can never escape the chains of monthly payment debt. They will always be underwater, just the way Wall Street likes it. The proof these “strong” auto sales are just another debt based scheme are the non-existent profits of automakers and stock prices at 2010 levels. If auto sales are so healthy why would GM stock be down 18% since 2013 and Ford stock down 14% in the last year?

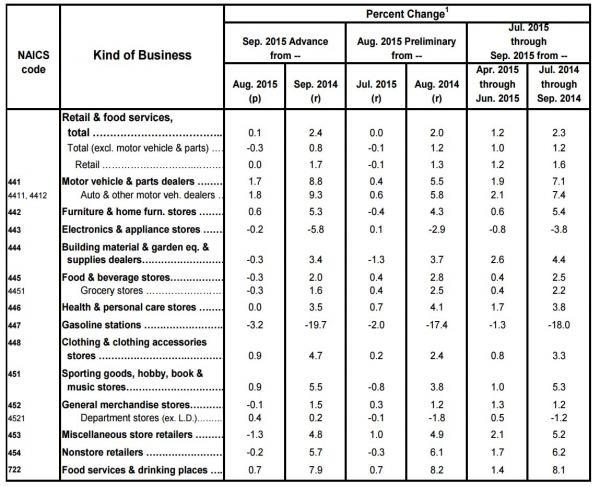

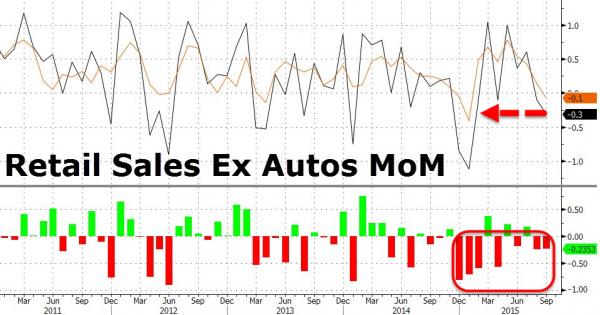

If you strip out the debt financed auto bonanza, retail sales are pitiful on a monthly and annual basis. I thought the later Labor Day was the reason for poor August sales. Maybe kids didn’t go back to school this year. The categories with NEGATIVE monthly sales was immense: Electronics & appliances (what about that housing boom), Building materials & garden equipment, Food & beverage, Gasoline stations, General Merchandise (Wal-Mart), Misc stores, Nonstore (Amazon). Overall, retail sales excluding autos was down 0.3% over the prior month. August sales were down 0.1% over July. The news just gets worse and worse as the government reports lower and lower unemployment. A fascinating dichotomy.

The annual and year to date figures are even more disturbing. The annualized and year to date numbers show 0.8% to 1.2% increases. If you believe your government that there is no inflation (Social Security recipients will get a 0% increase in their benefits next year – should do wonders for retail sales), then those pitiful increases are valid. If you live in the real world where your costs to live are going up by 5% or more, real retail sales are negative. The way to figure out who is lying is to look at the profits of retailers. They are plunging, so shockingly the government is lying about inflation.

Retail sales have missed the expectations of highly paid Wall Street economists 7 out of the last 10 months and 10 out of the last 15 months. But they guarantee sales will be strong next month. Maybe they should double seasonally adjust retail sales like they did GDP because it gets cold in the winter. How could the retail sales be so pitiful when the unemployment rate has fallen from 8.9% to 5.1% over the same time frame? Maybe someone could ask Obama at his next press conference.

The fact of the matter is that year over year retail sales at these levels only happen during recessions. It’s really that simple. Without the crutch of subprime auto loans and student loan debt being spent by pretend University of Phoenix students on iGadgets, fitbits, hookers and blow, this economy would already be in free fall.

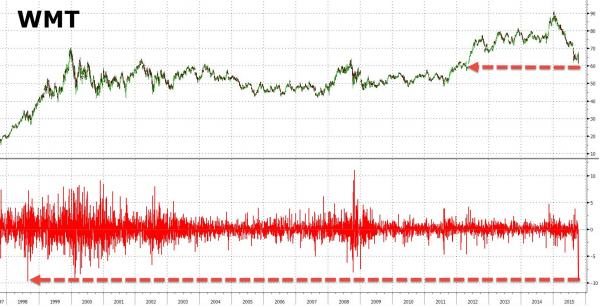

Look no further than what happened to Wal-Mart today for confirmation we are in the midst of a worldwide recession, if not depression. Their stock fell by 10%, the largest one day loss in their history as a public company. Their stock is down 30% this year.

Make no mistake about it, Wal-Mart is a global retailer whose annual sales dwarf the GDP of most of the countries on the planet. They announced flat revenue for the current year and slashed next year’s earnings expectations by 12%. As usual, they blame external factors for their failures. The strong dollar seems to be the excuse de jour among the multi-national corporations who rule the globe. If they didn’t want to deal with currency risk, they shouldn’t have gone global. It’s a cost of doing business, not an excuse.

I found it amusing that Marketwatch had their headline as Wal-Mart to Buyback $20 Billion of Stock, rather than reporting that Wal-Mart’s profits are crashing by billions. The propaganda machine just doing their job. Every clueless highly educated CEO of floundering corporate behemoths follows the exact same game plan. Borrow money as your profits are in decline to buyback your stock near record highs to give the appearance that EPS is growing. If you can’t make profits, fake them. At least the executives will get their million dollar bonuses while announcing more layoffs. That always delights Wall Street.

All economic indicators are flashing red and warning of recession. Retail sales, that account for two thirds of economic activity, are falling. Corporate profits are plunging. Middle class Americans haven’t seen their household income rise since 1989. The last two employment reports were horrific. The number of job layoff announcements by corporations is up 36% year to date and has already exceeded the total for 2014.

The only people who refuse to acknowledge recession reality are the Wall Street hucksters, looking to fleece a few more muppets before their party is over. They’ve created a short covering rally, despite the awful economic news, ridiculously high valuations, record levels of margin debt, and a public who left the markets years ago. Rigging the markets, utilizing free money from the Fed, producing fake profits through government sanctioned accounting fraud and using high frequency trading machines to manipulate the market can only get you so far.

Propaganda and lies can’t stop this recession. The Fed never took their foot off the gas, so we are headed for the cliff at 100 miles per hour. I wonder what happens next.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.