Financial Markets are a Game

Stock-Markets /

Market Manipulation

Oct 29, 2015 - 06:00 PM GMT

By: EconMatters

Forget about Market Multiples: Totally Meaningless Sell-Side Crap

Forget about Market Multiples: Totally Meaningless Sell-Side Crap

Anyone thinking about investing in financial markets should realize that most of the professionals who are on the inside, i.e., have power and access to information and capital to move markets, do not view financial markets as investment vehicles, decisions about P/E ratios, equity multiples, etc. but rather see financial markets as a giant game of making money.

Financial Markets are Giant Criminal Playgrounds

Consequently the first thing all ‘investors’ need to realize is that markets are crooked, always have been, and always will be despite year after year of new regulations trying to prevent ‘crooked behavior’! Once you understand that the market is a giant game, and you stop thinking about the market from a valuation sense or a fundamentals standpoint; your next task is to identify the rules of the game, or the way the game is being played during your ‘investment horizon’ as in, when you as an investor are risking your capital in the markets.

Market Makers Never Risk Anything: They Make Markets Move Directionally

Most of the games in the market are about fooling other investors and taking their money, but there are all types of games, some actually can benefit average investors who actually believe in the fundamentals and a fair market. The problem is that you as an average investor will be thinking that the fundamentals are why an asset is going up, which can be the case, but the party will end while you are still looking at the same fundamentals that are in place, and the game players have already sold the stock or asset and bought derivatives in the opposite direction because they are Making the party to be over, there is no guess work involved on their end as they are Market Makers!

Sell Dungarees to the Gold Rush Crowds

In short, fundamentals do not matter in financial markets! This is the hardest thing that investors have to learn about financial markets because they have been so conditioned to believe that the financial markets are based upon the fundamentals because of all the folks who sell shovels and axes to the market participants. The amount of money made off of the financial markets over its history probably surpasses the amounts of money made from financial assets. Again the game within the game.

An Example of Game Playing

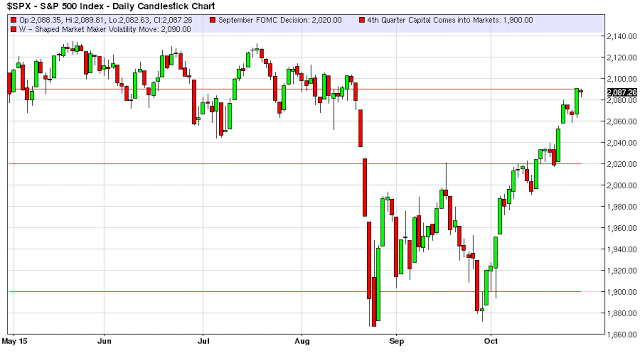

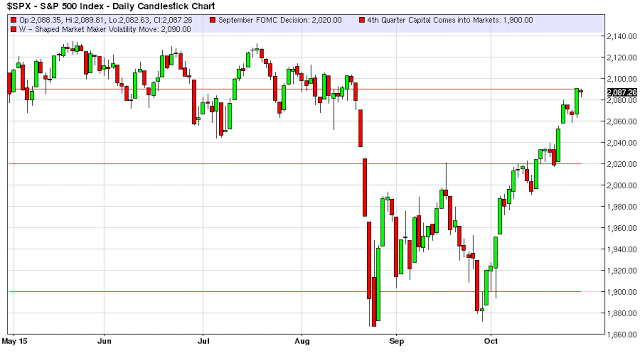

I will give you an example of a recent game just to get your mind to start thinking in terms of the games behind the financial markets. So remember when the Federal Reserve was dovish at the September Meeting and the markets had sold off in a tizzy fit, don`t be fooled there was a game already in place, and it played out according to the predetermined script.

What you have to realize is that this game, and the entire game of selling the markets off because of “China Turmoil” had very little to do with China and a whole lot to do with pushing the financial markets down into quarter end. So when the new money came into financial markets for the Christmas Rally of the 4th quarter the game players have a low base from which to work from and have a monster fourth quarter. Most of the real money is made in derivatives off of the movement in the core assets due to the massive amount of leverage that can be attained. Therefore if you know where the market is going ahead of time because you are the market maker and are the one pushing prices up or down; (conveniently you also know where and when markets are going to stop going down because you are the one pushing them down) you can bet that as these same game players were selling the market down towards the end of the third quarter in September, these same game players were building massive derivative positions in the opposite direction before they covered their shorts and went long with the rest of the Long Only Money that came into financial markets on October 1st.

What is so special about October 1st?

Just think what kind of money comes into financial markets October 1st: Monthly 401k allocations, 4th Quarter Capital, and financial markets were at a discount relative to most of the year, plus the natural short covering in the markets, this is the type of game these market makers love to play. They get a much bigger return for their buck, than just buying at the top of the market and pushing financial markets up another 3% to all time new highs with the same amount of initial capital. This is why these same market makers pushed the financial markets down in the third quarter to begin with, these moves were already pre-determined well in advance and had very little to do with china or growth concerns or the Federal Reserve. Those were just excuses, it’s not like any of those factors suddenly changed and were fixed magically on October 1st. It’s all a game folks, try and figure out how the game is being played and get on the same side as the power of the market makers who are moving asset prices all around the game board!

Beware of Clearing Out Stops in Opposite Direction of the “Real Move”

If you remember in September the markets didn`t go straight down right after the dovish announcement, in fact the market makers pushed the S&P up 20 points real fast in a final clear out all the overhead stops before taking it down big time about 145 S&P points. And you can bet they were taking the other side of the derivatives market on that overhead stops clear out move, so they were positioned at the best possible price to make a fortune on the slam down into the end of 3rd quarter selling where the average investor probably thought the world was coming to an end! And voila October 1st comes around and all the world`s problems are solved, bad employment number, bad economic data, all viewed in a positive light because the real thing that matters is who is positioned for the 4th quarter rally, the Market Makers that`s who!

Try and Discover as many Games and Rules of the Game as possible and What Different Games Structures Look Like so you can understand Price Action of Assets

There literally are so many games that are played within financial markets that it would take a 500 page book to outline them all, from the micro, micro option games to the spoofing tricks, to the coordinated functioning of Algos across entire unrelated asset classes, to afterhours games, to market close games.

In the end, Remember it is A Game

It may be serious business to you as an investor, this may be your retirement savings here. However, the players who move the market are already set for life, they could retire today and never have to work another day in their life and still have 5 homes. These people play the game more out of habit, the joy of making more money, and the prestige and power that comes from being a player in the markets and moving even higher up the food chain. But rest assured what happens on a daily, weekly, quarterly, yearly basis doesn’t really affect their quality of life one bit.

It is just the icing on the cake, they have already won the game of life by being market makers in the first place. They rarely lose, it takes an outlier even to catch them off guard like a natural disaster that came out of nowhere, and they have even been known to buy up markets or hold markets up, until they can get positioned on the right side of the natural disaster trade.

The large Financial Institutions who are major players have a different motive as public entities with shareholders to keep happy. They make most of their trading money by front running order flow, traditional market making activities, front running clients and their proprietary research with the goals of having good profitable quarters, meeting bonus targets and not getting caught rigging markets when colluding. Also, limiting and isolating the damage from the inevitable collusion when they do get caught! They are playing the Corporate Game as well as the Game of the Financial Markets.

Pragmatic Approach to Financial Markets

It is very hard for you the average investor because you are trying to figure out what markets Should do, you are a Market Taker. Market Makers on the other hand dictate what the market Does, they define the rules of the Game! Thus your goal as an investor isn`t to study charts, the fundamentals or economic tea leaves, but rather to figure out what the large Game Players are doing, and can you piggyback on their coattails or Market Moves, as they Move Price like pawns on a Chess board!

By EconMatters

http://www.econmatters.com/

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2015 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Forget about Market Multiples: Totally Meaningless Sell-Side Crap

Forget about Market Multiples: Totally Meaningless Sell-Side Crap