What Can’t Go On Won’t Go On, Part 1: Corporate Leverage

Companies / Corporate Earnings Nov 03, 2015 - 03:24 PM GMTBy: John_Rubino

By now everyone knows the corporate share repurchase story, about how major companies are engineering higher per-share profits and share prices by buying back their stock and raising their dividends. But just how much they’re spending may still come as a shock.

By now everyone knows the corporate share repurchase story, about how major companies are engineering higher per-share profits and share prices by buying back their stock and raising their dividends. But just how much they’re spending may still come as a shock.

Today’s New York Times quotes Laurence Fink, CEO of mutual fund giant of BlackRock, bemoaning the short-sighted behavior of his peers: “Mr. Fink noted that companies in the Standard & Poor’s 100-stock index are paying out 108 percent of their earnings to shareholders.”

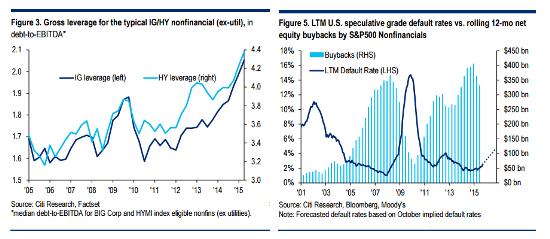

That’s a lot of cash flowing out the door, and leads to the obvious question of where the excess is coming from. This morning Bloomberg provided the answer, via a chart from Citigroup analyst Stephen Antczak, which is of course that they’re borrowing it:

Gross corporate leverage for both investment-grade and junk borrowers is at record levels, and defaults are, not surprisingly, now projected to start rising. The implication: borrowing terms are going to become a lot less favorable, staring with low-quality names and then moving up the ladder to the Blue Chips doing most of the repurchasing. Says Citi:

“The robbing Peter to pay Paul dynamic that has dominated the investment landscape in recent years may be coming to an end as the credit cycle begins to turn and a meaningful pickup looms in the corporate default rate.

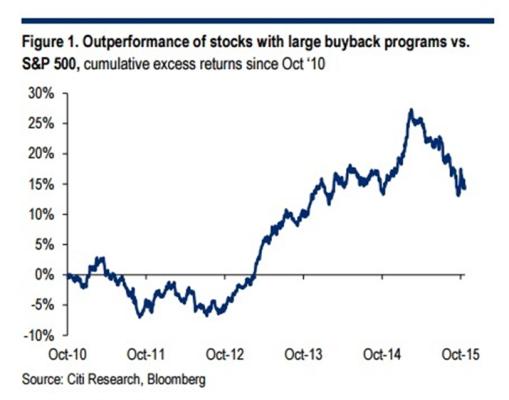

Recent conversations that we’ve had with equity [portfolio managers] suggest that they have become far more focused on revenue growth, and are placing far less of a premium on any financially engineered EPS growth. The fact that a basket of stocks that [has] been reducing shares outstanding is meaningfully underperforming the S&P 500 on a beta-adjusted basis suggests that this view may not be that of just the investors we talk to, but far more broadbased.

Now the question becomes what, if anything, takes up the slack when corporations stop buying back their shares. One candidate is an inflow of foreign capital fleeing the even bigger messes now being made in China and Europe. But barring that, US share prices will have lost a huge source of support.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.