The Fed induced Stock Market Farce

Stock-Markets / Stock Markets 2015 Nov 19, 2015 - 03:24 PM GMTBy: James_Quinn

The minutes from the last Fed meeting were released on Wednesday afternoon. The minutes, along with a squadron of jabbering Fed heads lying about the economy doing great, pretty much locked in the most talked about .25% interest rate increase in world history. Evidently the Wall Street titans of greed have convinced the muppets higher interest rates are great for stocks, as the market soared by 250 points. As institutional money exits the market on these rigged up days, the dumb money retail investor buys into the market with dreams of riches just like they did with Pets.com in 2000, McMansions in 2005, and Bear Stearns in 2007.

The minutes from the last Fed meeting were released on Wednesday afternoon. The minutes, along with a squadron of jabbering Fed heads lying about the economy doing great, pretty much locked in the most talked about .25% interest rate increase in world history. Evidently the Wall Street titans of greed have convinced the muppets higher interest rates are great for stocks, as the market soared by 250 points. As institutional money exits the market on these rigged up days, the dumb money retail investor buys into the market with dreams of riches just like they did with Pets.com in 2000, McMansions in 2005, and Bear Stearns in 2007.

The Fed has lost any credibility they ever thought they deserved by delaying this meaningless insignificant interest rate increase for the last three years, so they will make this token increase in December come hell or high water. They want to give themselves some leeway for easing again when this debt saturated global economy implodes in the near future. The Fed is trapped by their own cowardice and capture by the Wall Street cabal. If they raise rates the USD will strengthen even more than it has already. The USD is already at 11 year highs. It has appreciated by 25% in the last year versus the basket of world currencies. The babbling boobs on the entertainment news channels authoritatively expound with a straight face about the rise in the dollar being due to our strong economic performance. It’s beyond laughable, as the economy has been sucking wind since the day the Fed turned off the QE spigot in October 2014.

Anyone with a working brain and an IQ over 100 (eliminates the bimbos and boobs on CNBC) can see the USD isn’t strengthening of its own accord. We’ve had 0% interest rates for the last six years, real median household income is lower than it was in 1989, consumer spending (which accounts for 67% of GDP) has been dreadful for at least a year, Obamacare is destroying the finances of middle class households, small businesses, and the nation, and the percentage of people in the labor market is the lowest since 1978. In other words, the U.S. economy is in recession. The reason the USD has been strengthening is because Europe, China, Japan, Russia, Brazil, and the rest of the world are either in recession or depression, and their “solution” to their woes is to debase their currencies.

The Japanese continue to redefine insanity as they wallow in their second decade of recession while debasing their currency and rolling out QE 9 – because it will surely work this time. The Chinese “miracle” is coming apart at the seams as their debt based mal-investment is revealed by the crash in global trading. Their solution is for the government to buy stocks and bad debt, while executing short sellers. Brazil is on the verge of revolution as their oil/commodity based economy implodes. Russia has been in recession for over a year as $40 oil doesn’t pay the bills. And lastly, the EU continues to crush their citizens with negative interest rates, debasement of the Euro, suicidal immigration schemes, and an ever growing mountain of unpayable debt, in order to prop up their mega-banks and the corrupt political establishment.

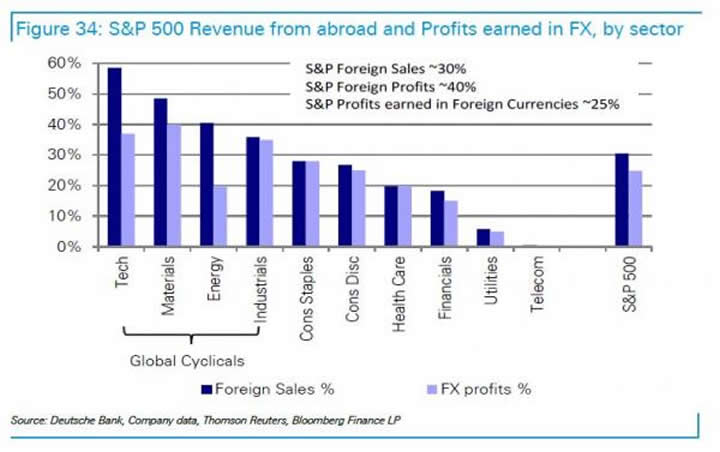

When every country in the world debases their currency in order to boost exports, the USD appears strong. It’s like being the best looking horse in the glue factory. The problem for the Fed and the mega-corporations in the S&P 500 is that a strong dollar makes our exports much more expensive to foreigners and reduces their profits from their overseas markets. You won’t see the talking heads on CNBC, Fox, or CNN truthfully analyzing the impact of a 25% increase in the value of the dollar. But it seems the buyback happy CEO’s of the S&P 500 conglomerates have used the strong dollar as their excuse de jour for their profits falling. Good old globalization has not only resulted in millions of good paying jobs being shipped to foreign lands, it has now made the S&P 500 corporations dependent on foreign markets for 30% of their sales and 40% of their profits. The continued appreciation of the dollar will result in lower profits for our mega-corporations, which will prompt the CEOs to fire more Americans and ship their jobs to the Far East, while ramping up the billion dollar buybacks of their stock. It’s the American way.

The Fed has created a dead end street for everyone not in their .1% clientele. They have kept rates too low for far too long and with the 99.9% already experiencing a recession, their desire to raise rates will hit a brick wall of reality. Their easy money schemes to enrich their owners has resulted in the issuance of trillions more in debt by the government, corporations and consumers. The $60 trillion of total credit market debt will implode if rates go up by even 1% or 2%. The corporate titans are now facing huge headwinds, as consumers have nothing left to spend, the strengthening dollar is sapping their profits, and higher interest rates will put an end to the faux housing recovery.

The Fed has destroyed the finances of senior citizens, savers and the pension plans of corporations and local governments with their 0% interest rates. The Wall Street bankers and their Fed puppets can surely see the writing on the wall. They will drive stocks as high as possible so they can cash out before the next collapse. They don’t care about their clients, the middle class, or the future of the country. We’re all muppets to the banking cabal running this morally and financially bankrupt military empire of debt.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.