How 4,000 Roman Coins Found Buried in Swiss Orchard Reinforce Gold Ownership Today

Commodities / Gold and Silver 2015 Nov 24, 2015 - 06:20 PM GMT “The coins’ excellent condition indicated that the owner systematically stashed them away shortly after they were made, the archaeologists said. For some reason that person had buried them shortly after 294 and never retrieved them. Some of the coins, made mainly of bronze but with a 5% silver content were buried in small leather pouches. The archaeologists said it was impossible to determine the original value of the money due to rampant inflation at the time, but said they would have been worth at least a year or two of wages.” – The Guardian/11-19-2015

“The coins’ excellent condition indicated that the owner systematically stashed them away shortly after they were made, the archaeologists said. For some reason that person had buried them shortly after 294 and never retrieved them. Some of the coins, made mainly of bronze but with a 5% silver content were buried in small leather pouches. The archaeologists said it was impossible to determine the original value of the money due to rampant inflation at the time, but said they would have been worth at least a year or two of wages.” – The Guardian/11-19-2015

I was initially at a loss to explain why anyone would go to so much trouble to hoard so many coins with such a low silver content – about 5%. The only rational explanation is that the hoarder had decided that even worse debasement was on its way. And, a quick review of Roman history tells us that this indeed was the case.

In the next generation of the denarius, issued by Emperor Diocletian, bronze coins were simply dipped in silver and passed into circulation. By 294AD, the latest date in the hoard, Diocletian abandoned silver coinage entirely and began issuing bronze coins instead. Prior to that, prices had risen over a roughly twenty year period by 1000%. Value-conscious barbarian troops hired by the emperors demanded to be paid in gold aureus and for good reason as you will discover below. By the end of the third century, the currency was crumbling and along with it the empire.

For a fascinating short course on the connection between the fall of the Empire and inflation, I would recommend this lecture by professor Joseph Peden in 2009, titled “Inflation and the Fall of the Roman Empire” and published at the Mises Institute. Peden quotes a 5th century account of the Roman inflation by a Christian priest named Salvian. Says Peden,

“Salvian tells us, and I don’t think he’s exaggerating, that one of the reasons why the Roman state collapsed in the 5th century was that the Roman people, the mass of the population, had but one wish after being captured by the barbarians: to never again fall under the rule of the Roman bureaucracy. In other words, the Roman state was the enemy; the barbarians were the liberators. And this undoubtedly was due to the inflation of the 3rd century.”

It is instructive to note that for Rome, as has been the case in a myriad of episodes through history, inflation was not an event but a process. The ancient Roman version unfolded over a more than a 200 year period. “By the time of Trajan in 117 AD,” says Peden, “the denarius was only about 85 percent silver, down from Augustus’s 95 percent. By the age of Marcus Aurelius, in 180, it was down to about 75 percent silver. In Septimius’ time it had dropped to 60 percent, and Caracalla evened it off at 50/50.”

By the end of the third century, as demonstrated by the Swiss find, the denarius had gone to 5% silver, then, as mentioned above, a thin coating of silver, then no silver at all, only bronze. In short, a chart could have been constructed at the time showing an ounce of silver in a steady upward progression in terms of denarii from 117 AD through 300 AD. One wonders if the pundits at the time would have deemed it to have been in a bubble.

About 1200 years later, Thomas Gresham would draft “Gresham’s Law” stated simply as ‘bad money drives out good.’ Had Gresham the opportunity to visit the British Museum and study ancient Roman coinage, he would have found a ready example of his law in action. One expert told The Guardian newspaper that the original owners hoarded the Roman coins found in Switzerland because “the silver contained in them guaranteed a certain value retention in a time of economic uncertainty.”

In ‘The Story of Money for Understanding Economics” researcher Vincent Lannoye tells us that during the Roman inflation, “The less debased gold coins had been stashed under the mattress for decades, maybe centuries. These precious and valuable coins hardly circulated, as it can be deduced from their high concentrations in hoards discovered by archaeologists.” Peden puts a finer point on the role of gold during the Roman inflationary period:

“Now one interesting thing with all this inflation should be a great comfort to us: historians of prices in the Roman Empire have come to the conclusion that despite all of this inflation — or perhaps we should say, because of all of this inflation — the price of gold, in terms of its purchasing power, remained stable from the first through the fourth century. In other words, gold remained, in terms of its purchasing power, a stable value whereas all this other coinage just became increasingly worthless.”

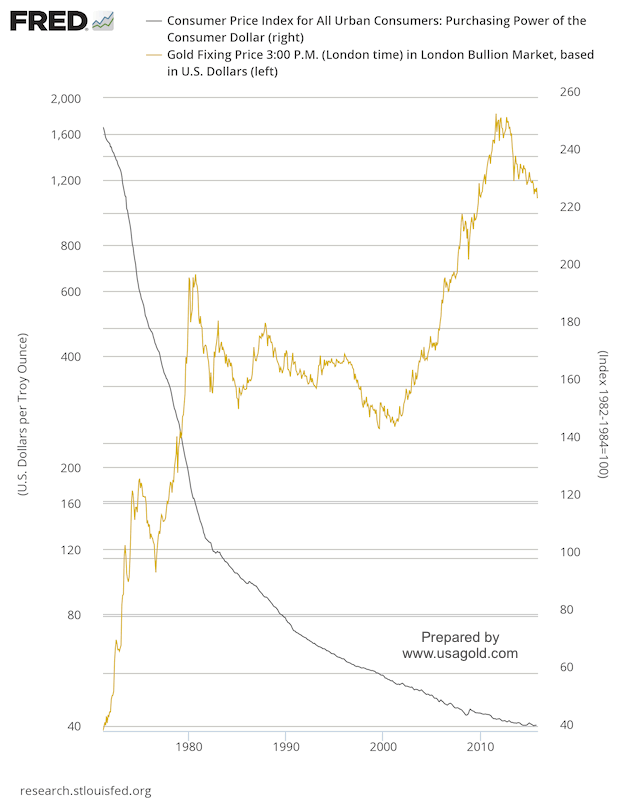

In 1700 years, as you can see in the chart above, not much has changed. Since 1971, when the United States detached the dollar from gold and ushered in the era of fiat money, the dollar has lost 83% of its purchasing power. The 1971 dollar is now worth 17¢. Gold in the meanwhile has risen from $35/oz. then to roughly the $1100 level today (with a stop at $1900/oz in 2011.) Over the long run, gold in the modern era has maintained its purchasing power as it did in Roman times, while the dollar, like the denarius, has been steadily debased. So it is by the circuitous route just taken, you now know why 4000 Roman coins recently found buried in a Swiss orchard reinforce gold ownership today.

Final Note 1: We should not become desensitized to the prospects of future inflation as a result of the lull we have encountered in recent years. Even though price inflation is relatively subdued of late, monetary inflation continues unabated with consequences yet to be determined. In the inflationary process, it should be remembered that the line between cause and effect is not always a straight one. History teaches us that when inflation does arrive, it comes suddenly without notice and with a vengeance.

Final note 2: I should add that at any point along the way in the Roman inflationary period, the hoarder who had stashed away earlier silver coinage would have effectively hedged the event, as this article illustrates. In the modern era, though more volatile than gold, silver has functioned effectively as a safe-haven asset in the portfolio. A chart like the one above could be drawn with silver as the overlay instead of gold.

Reader invitation: If you like this type of gold-based analysis, you might want to consider becoming a regular visitor to this page – our live daily newsletter. Please bookmark if you have an interest. For free, in-depth analysis and special reports, we invite you to subscribe free of charge to our regular newsletter. New release notifications are sent by e-mail and our upcoming issue will be out soon.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.