Euro, Dollar, Buy the Rumor and Sell the News Alive in Forex Markets

Currencies / Forex Trading Dec 05, 2015 - 10:12 AM GMTBy: EconMatters

ECB Disappoints

ECB Disappoints

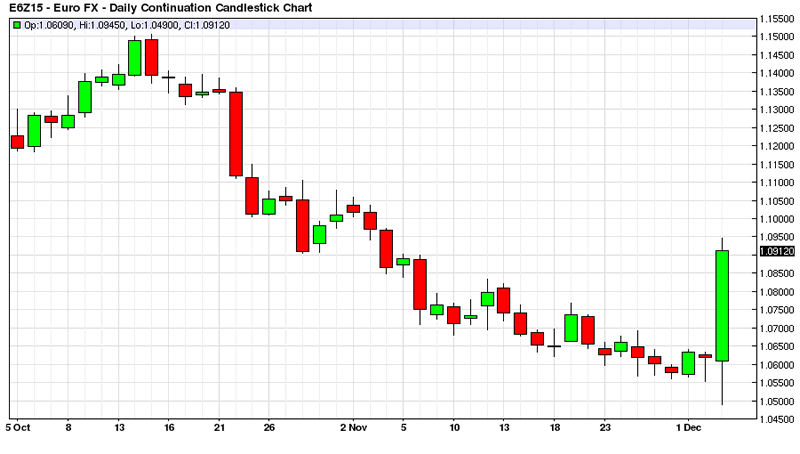

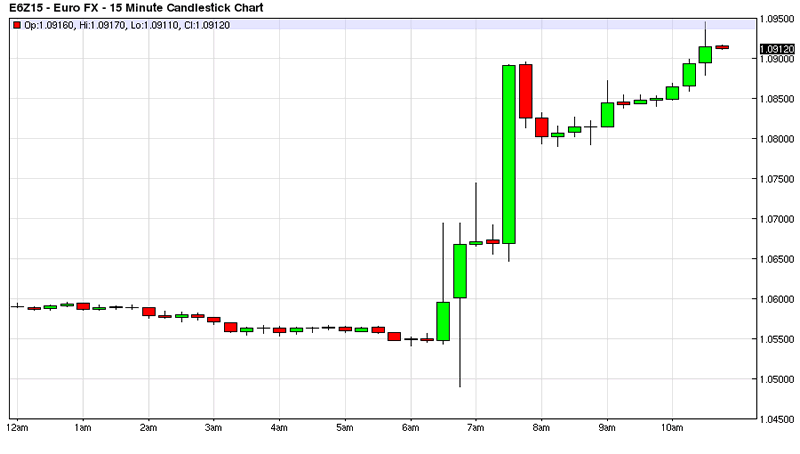

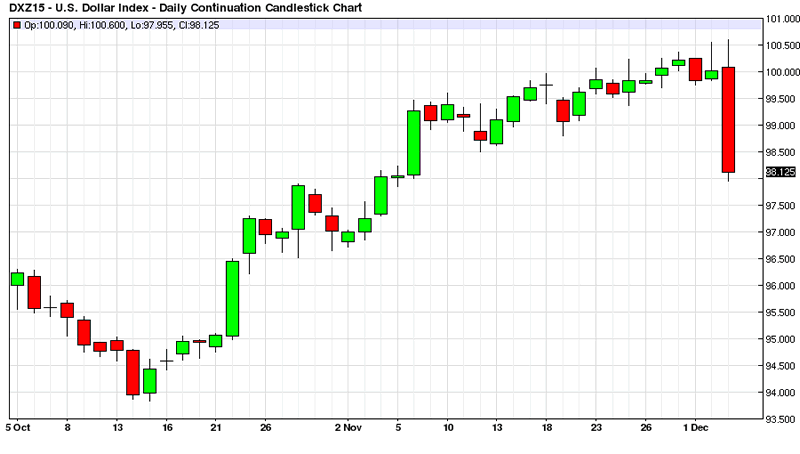

All those who continue to forget this trading maxim were royally punished on Thursday morning as the ECB could not match the trading enthusiasm built into the move in shorting the Euro and thus going long the US Dollar for the prior 7 weeks lead up into the ECB Monetary Policy Decision.

This is such a strong trading maxim to buy the rumor, and sell the actual news that it is the exception rather than the rule where an event over delivers. The best move is to take profits the day before the event as opposed to getting crushed on the news which happened today in the Euro and US Dollar forex trades. Literally the amount of crushing that some traders took this morning regarding giving up a month`s worth of profits in an hour is stomach churning.

Eurozone Economy & Growth

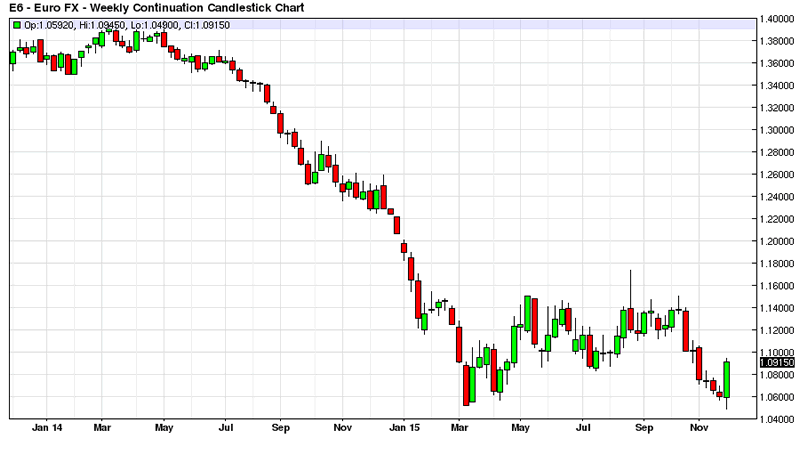

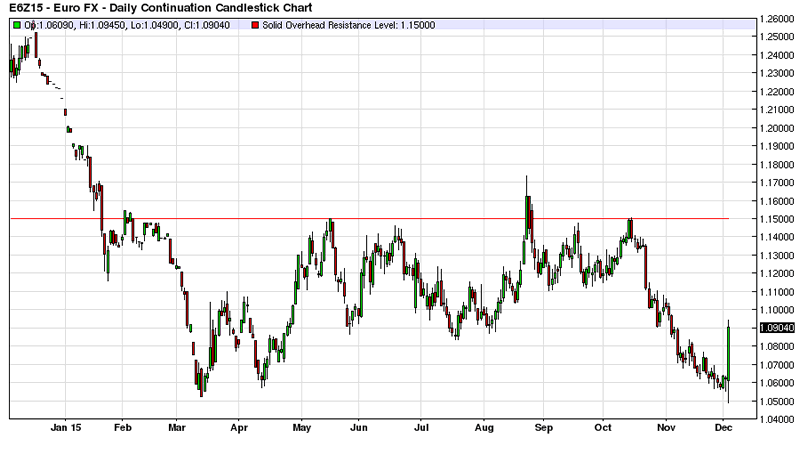

If one looks at the uptick in economic numbers the Eurozone economy is outperforming the rest of the world including the US on a relative basis since the devaluation program pushing the Euro Dollar Cross from the 1.40 area to the 1.05 level that began 17 months ago by Mario Draghi.

This has been a concerted effort to devalue the Euro by Mario Draghi, namely against the US Dollar and Japanese Yen to some extent. This is why many countries continue to do this practice because for the short term to medium term it is an effective tool to make currency related gains that juice up the economic numbers; at least from an artificial currency standpoint.

Currency Wars Work in the Short Term

It helps tourism, and this is a mainstay of European revenues, and the Eurozone has definitely benefited from being more affordable to tourists due to a much weaker currency. It also helps German cars be more competitive from an exports standpoint, especially when previously they were getting hammered by the Japanese Yen devaluation program that started before Mario Draghi. The BMW Lexus pricing dynamic of two years ago has definitely shifted and become more favorable for Germany. It also helps European exports become more affordable and competitive around the world. Of course, these are all artificial short term currency fixes that don`t address the real drivers of economic growth from a structural long term perspective.

German Unemployment Levels & Inflation Expectations

At any rate, I expect Inflation to pick up in 2016 for Europe as the energy comps become more favorable year over year, and the effects of the currency devaluation program continues to percolate through the European economies. Forget about 2017 the ECB will be raising rates long before this date, discussion of ECB rate rises will probably start towards the back half of 2016. Have you seen the German Unemployment numbers? I look for wage pressures and increasing housing costs to affect Germany and much of the core European countries, and the overall inflation numbers to trend higher for 2016. I think this is the big surprise for economists in 2016, the rise in overall core inflation readings in the developed world.

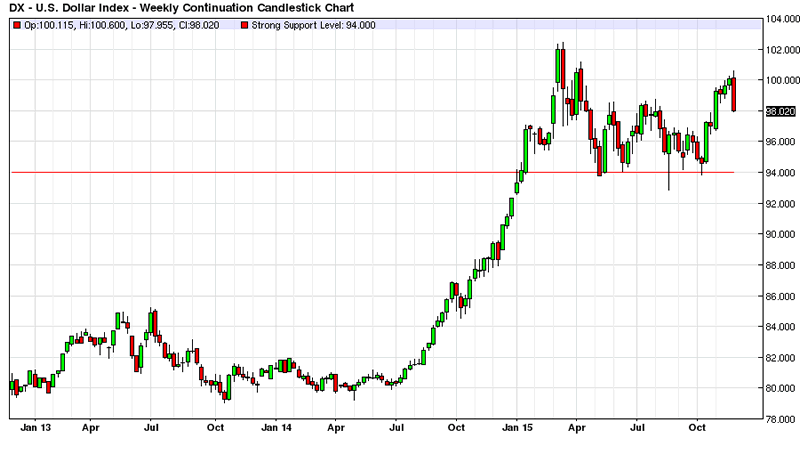

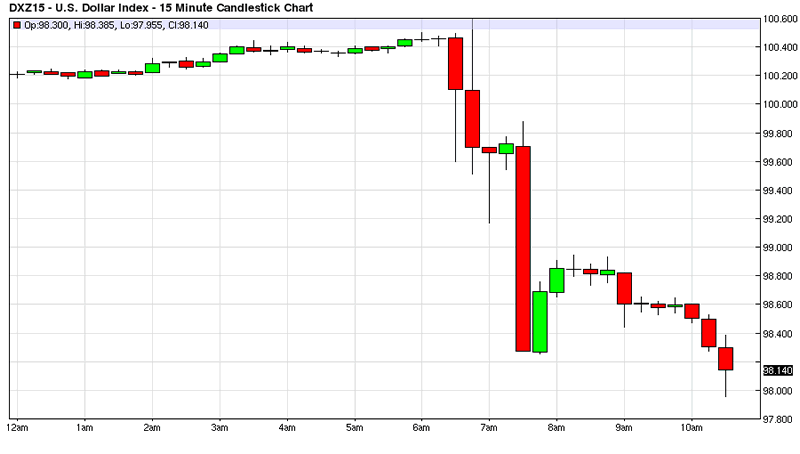

With regard to the US Dollar, I expect a few days of trying to find a support level against the Euro and then traders running the US Dollar Index up into the FOMC Meeting on Wednesday December 16th. On the day of the FOMC Meeting, I also expect either a quick spike to clear out the overhead stops on the Policy Announcement, followed by a prolonged selloff into year end. Or alternatively, a complete slam down of the US Dollar on the FOMC Meeting Policy Announcement. However, it is worth noting that even today in the US Dollar Index chart there is a long wick on the third 5- minute bar following the initial ECB Policy Decision. This is clearing out the overhead stops in the US Dollar Index, and protecting a few participant`s positioning so they can get back on the right side of today`s trading action – nice if you have the resources to trade in this manner!

This is a common Financial Market trading truism where you have manipulated markets, and all markets are manipulated; they always have been, and always will be. The truism is to clear out stops in the opposite direction of the big move that is going to occur for the day. But at any rate, I expect traders to try and run up the US Dollar into the FOMC event. Only to sell the US Dollar off for a prolonged period as Janet Yellen makes it abundantly clear to financial markets that although the FOMC wants to save face and actually show that the they can conduct a rate hike, they aren`t about to stand for a strong dollar in a world where it is a competitive advantage to devalue currencies from a multinational profits, tourism and global trading perspective.

Protective Stops

So again pay attention to buying the rumor, and selling the news as this trade has been a mainstay of financial markets since the Tulip Market Fiasco. The market dynamics of profit taking, priced in news, market hype, and herd mentality all contribute to why the old trading maxim of buying the rumor and selling the news comes to fruition more often than not in financial markets. Another truism as can be seen by today`s action in the Euro and the US Dollar Index is the necessity for stops in trading and investing. I cannot over emphasize this point for market participants. I guarantee you there were some professional traders today who got caught wrong-footed by the ECB Rhetoric leading up to today’s meeting, and didn`t utilize protective stops which could have saved them a hefty sum of money. Therefore do your analysis, take a position, and protect your profits or limit your losses with strict protective stops.

Euro Policy Tools at Zero Bound

I expect the US Dollar Index to trade back to the 94 level sometime over the next three months, and then we will see who outperforms in 2016. As what we are really looking at is whether Europe or the United States experiences the biggest relative pickup in inflation, and inflation expectations since the Euro makes up the biggest weighting in the US Dollar Index. I think inflation and inflation expectations are both going to be higher than economists think for 2016 in Europe and the United States. And given the low starting point for European Monetary Policy with a negative deposit rate, and effective funds rate differential between Europe and the United States after the Fed hikes 25 basis points in December, I expect the biggest turnabout from the ECB in terms of quickly pivoting to meet these higher inflation readings for 2016. But it is too early to tell whether my assumptions regarding inflation expectations for 2016 surprising financial markets to the upside comes to fruition.

The 1.15 Level in Euro Dollar Cross

But my early forecast is that the Euro surprises to the upside against the US Dollar sometime during 2016, and eventually reaches up to the 1.20 to 1.25 level in the Euro Dollar Cross for my counterview. I realize this prediction is against the current trend, and against the forecasted currency projections for 2106. However it is something to pay attention to if the Euro breaks the 1.15 level with purpose, as the entire currency market will be off sides on this move above the 1.15 level. In conclusion, compared to many of the markets that have dried up, the currency markets remain some of the most vibrant and alive markets for trading and investing.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2015 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.