Currency Markets Anticipating a U.S. Interest Rate Hike Next Week

Interest-Rates / US Interest Rates Dec 10, 2015 - 10:50 AM GMTBy: Dan_Norcini

Watching the price action in the currency markets it is becoming clearer to me that the Forex crowd has now moved beyond any expected rate hike by the Fed next week and has shifted its focus to "WHAT COMES AFTER THAT?"

Watching the price action in the currency markets it is becoming clearer to me that the Forex crowd has now moved beyond any expected rate hike by the Fed next week and has shifted its focus to "WHAT COMES AFTER THAT?"

In other words, we have probably seen the high in the US Dollar for a bit since the impact on the currency has effectively already been discounted into its price. Seeing the Fed Funds futures showing a probability of a Fed rate hike next week above 80%, for all practical trading purposes, it is now a done deal.

What this means is that the guys who bid up the Dollar and sold down the Euro in anticipation of a hike by the Fed are now taking profits (what is left of them) and liquidating both longs in the greenback and shorts in the Euro.

Think about it this way. We know the rate hike is coming based off the last two payrolls report. If it WERE NOT TO COME for any reason, the impact on the Dollar would be instantaneous and brutally negative. The thing would fall apart on the crosses. If it does come however, and again, the thinking is that it is coming, what else would the Fed do for an encore performance? Many of us have been begging and pleading for the Fed to get us off these ridiculously low interest rates and we all know how reluctant and cautious they have seemed to be in so doing (I use the word 'timid'). Based on this alone, can anyone really make the case at this juncture that the US economy is going to grow so strongly that another 1/4% rate hike is going to be necessary, say next January or February, or even March for that matter?

What this means is that at least for a while, there is no more threat of another rate hike coming down the pike anytime in the near foreseeable future from the Fed.

That has traders heading for the exits and in so doing, they are changing the chart patterns for both the Euro and the Dollar index.

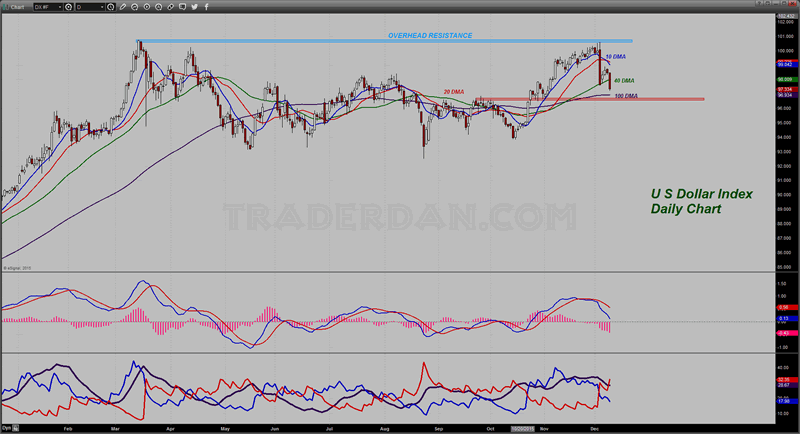

US Dollar Index Daily Chart

Case in point, here is the US Dollar index. The 10 day moving average has now made a bearish downside crossover of the 20 day moving average with both of these shorter term moving averages now turning lower. The intermediate term 40 day moving average is still rising but with continued weakness a possibility, we might soon see the 10 day cross down below the 40 day as well.

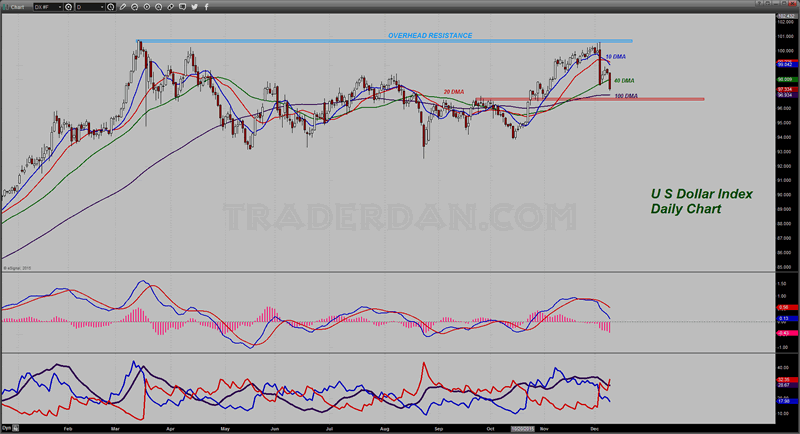

US Dollar Index Daily Chart 2

Also, the overhead resistance zone near 101 has proven to be a double top and halted upward progress for the time being. The MACD is now negative and the ADX/DMI line has turned lower indicating an interruption in the former bull trend. Also, -DMI is well above +DMI noting that the bulls have ceded control of the Dollar to the bears.

What we now have is a market probing lower to see at what level support will be uncovered.

The 100 DMA is near the 97 level which is just slightly above 96.70-96.50. If price cannot hold there, and if it does indeed fall below the 100 DMA, we could very well see the Dollar back at 95 with a move to 94 not impossible.

The point to make in this is that the interest rate differential story is still in play; however, it has been factored into the current price levels and thus, when traders who anticipated this begin to book profits and close out positions, the price will fall until traders feel that the interest rate differential now needs to be focused on once more.

I think it safe to say that the ECB is not going to be hiking rates anytime soon. While Draghi and company did indeed set the market up for a huge disappointment and unleashed all the chaos they did last Thursday, they did lower the deposit rate further into negative territory and they did extend their QE program out an additional 6 months until March 2017. That flies in the face of a Fed that will have made its first rate hike with little likelihood, at this time, of slashing rates again or instituting another round of QE.

Thus, over the long haul, we can still expect the Euro to lose ground against the Dollar but from what level the Euro will fall once more is unclear. That is why we need to pay attention to the price charts and see when we get some indication that the technical are shifting back once more in favor of the US Dollar. For now, no sense in arguing with the price charts as the easy money is over in the Dollar/Euro for a while with two-sided trade more likely, especially as we head further into the year end and more and more traders head to the sidelines and liquidity begins to suffer.

I feel very confident that Draghi and the ECB will not long tolerate a Euro that stubbornly refuses to head lower on account of speculators bidding it higher, whether due to short covering or bottom picking or whatever, so at some point Draghi will start making noises once a certain level of discomfort is reached within the halls of the ECB, and especially from the Germans.

We'll just have to stay tuned and closely monitor the price action and see where and when that dictates we position.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.