Gold Advanced During 2015 in Most Major Currencies

Commodities / Gold and Silver 2015 Jan 04, 2016 - 01:54 AM GMTBy: Jason_Hamlin

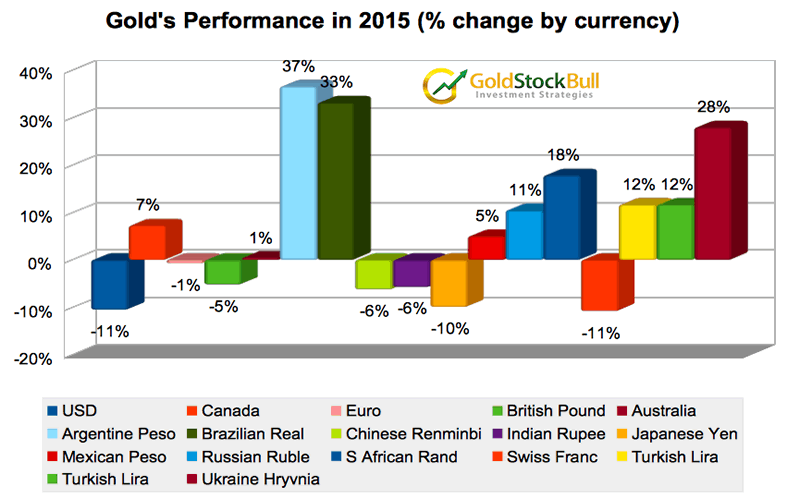

Sentiment towards gold has been so bearish lately that you might think the yellow metal declined by 50% or more during 2015. In fact, it was only down 11% in U.S. dollar terms and gold actually advanced in most major currencies. Out of the 17 currencies tracked, gold was up in 10 of them and down in only 7 of them.

Sentiment towards gold has been so bearish lately that you might think the yellow metal declined by 50% or more during 2015. In fact, it was only down 11% in U.S. dollar terms and gold actually advanced in most major currencies. Out of the 17 currencies tracked, gold was up in 10 of them and down in only 7 of them.

Gold advanced in both Canadian and Australian dollars, rocketed higher in Argentine pesos and Brazilian real, climbed higher in Mexican pesos, Russian Rubles, South African Rand, Turkish Lira and Ukrainian Hryvnia.

Some of the larger gains were driven by high inflation in each respective currency, but gold also advanced in currencies that were relatively stable during 2015. The biggest decline for gold came in U.S. dollars and Swiss francs, both down 11%. The next biggest loss was in Japanese yen, down 10% for the year.

The bottom line is that while most people price gold in dollars and therefore have a gloomy assessment of gold’s performance during 2015, it actually performed fairly well globally. It has been an effective inflation hedge in many of the countries where their currencies weakened during the year.

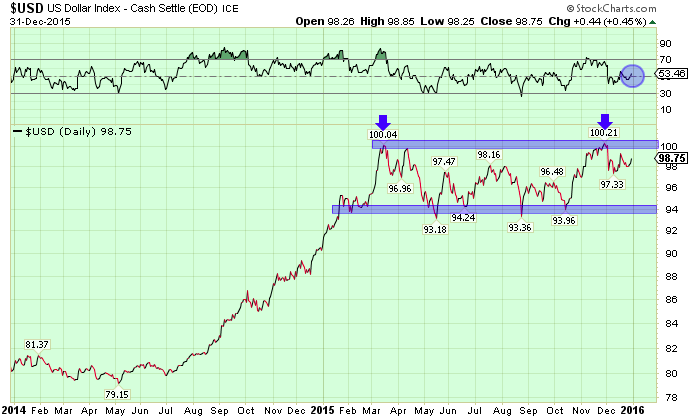

With gold’s biggest decline coming in U.S. dollars, this could be an excellent opportunity to buy gold with dollars during 2016. After a strong start to the year in 2015, the dollar effectively topped out and traded sideways for most of the year. The USD put in a double top during late November around the 100 level, the same resistance it faced in March.

There are some bullish factors that could propel the dollar higher in 2016. Rising interest rates should be bullish for the USD and if the stock market drops sharply as we anticipate, investors are likely to turn to dollars as a safe haven in the short term.

But one could argue that the dollar is currently overbought and the factors mentioned above have already been priced into the USD index. Eventually, I think people are going to realize that the dollar is not the safe haven that they believe it to be. There is an accelerating trend of de-dollarization around the globe, as a growing number of nations have opted to drop the dollar and use local currencies in trade. BRICS nations in particular are leading this charge and creating their own economic unions, collective banks and trade agreements to bypass the dollar.

Some believe that the dollar is the best of the fiat currencies, backed up by U.S. military might and willingness to enforce the petrodollar. But the U.S. is being challenged in the Middle East by an emergent Russia that will no longer allow the United States to dictate policy and dominate the energy trade.

And while the official debt-to-GDP ratio in the United States looks better than other nations, it does not factor in unfunded liabilities or the off-sheet derivatives time bomb that continues to tick. Eventually, I believe that investors around the globe will lose faith in the U.S. dollar and instead turn to precious metals or even Bitcoin as a preferred store of wealth during turbulent times.

While I can’t predict exactly when this will happen, I see this outcome as inevitable and a question of when, not if it will occur. In the meantime, I think the currently depressed prices for precious metals offer long-term investors an excellent opportunity to buy in tranches and continue stacking. Rising investment demand during 2015 suggests this is exactly what is occurring.

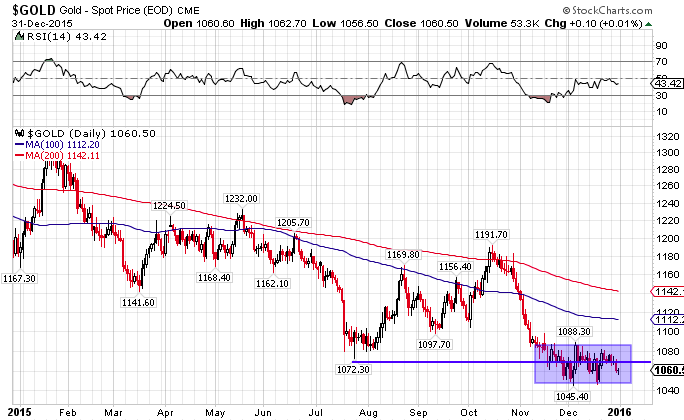

The gold chart for 2015 is undeniably bearish. The failure of support at $1,072 was significant and suggests more downside ahead. That being said, the price appears to be carving out a bottoming pattern and has bounced back above $1,072 several times since the support was initially breached. This gives some bullish color to our outlook on gold, especially if the price can climb back above $1,100 in the near term.

Get our insider trade alerts, monthly newsletter and model portfolio by becoming a Gold Stock Bull premium member.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. Click here for instant access!

Copyright © 2015 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.