The “Hanging in There” Game for Oil Producers

Commodities / Oil Companies Jan 11, 2016 - 04:04 PM GMTBy: EconMatters

9.2 Million Barrels

9.2 Million Barrels

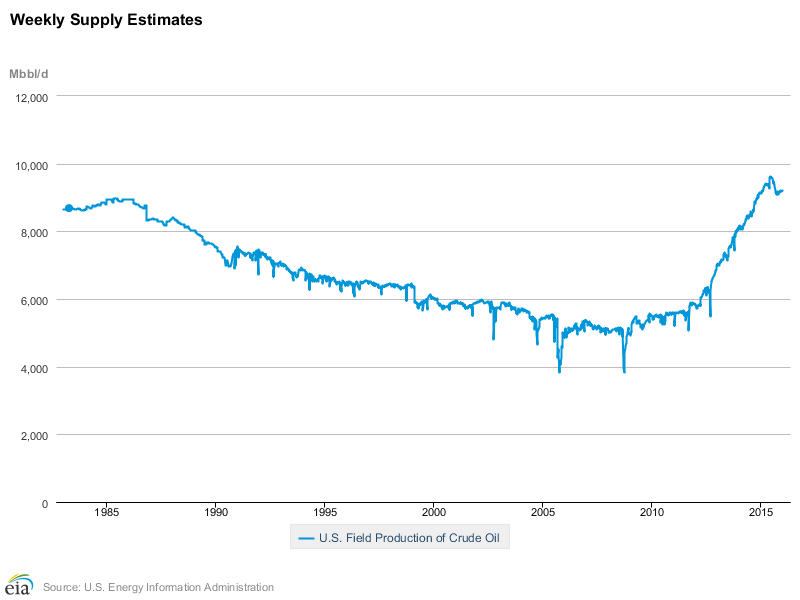

The latest EIA report shows the US Production rate steady and holding at the 9.2 million barrels per day. And although there have been some anecdotal reports out of Canada at the start of the year on this recent down leg in oil prices, that this has triggered them to shut down production, that at these prices it makes no sense to continue operations; the rest of the beleaguered producers in the oil space are continuing to operate and hold on throwing more bad money after bad money.

Was the Business Case for $40 oil?

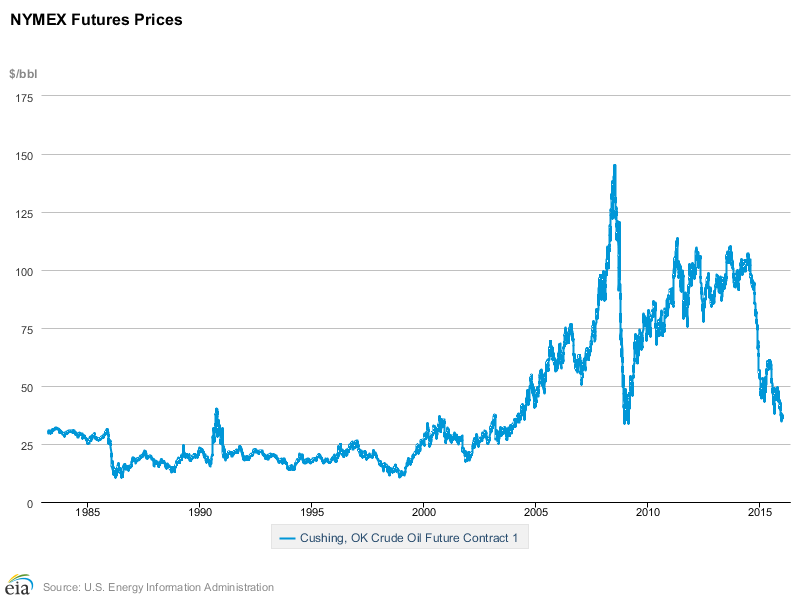

These producers aren`t getting it, these producers didn`t get into the business for $40 oil, these projects were started when the floor for WTI was $90 a barrel, with the extreme lows of a solid 5-year timeframe in the low $80s per barrel for oil. No business plan had a model with 16 months of average oil prices in the $45 barrel range. It might just take oil prices going to $25 a barrel for hands to be forced, so somebody will finally make the call, and pull the plug on some of these operations.

It seems everyone is on the hopium alternative reality trip that oil prices will recover at the back of 2016, and if they can just stay in business until then, then they can survive. But they aren`t getting it, the only way prices move higher by enough magnitude where they could actually survive, is if enough US production goes offline permanently, i.e., people go out of business – namely these same beleaguered producers who didn`t get into the business for $45 oil. Thus the Catch – 22 that none of these firms are getting is that sure prices may rise in the future, but not until you go out of business.

The Hopium Trade

You are the problem, taking US Production from 5 million barrels per day to 9.5 million is what is currently unsupportable in the market. The market will not clear and rationalize until you get out of the business for good. Therefore, the hopium trade is all built on a false premise, yeah if prices rise the second half of the year maybe you can last a little longer. But you’re missing the point, the oil market which supported $95 a barrel prices, the reason you got into the business in the first place, was built upon a 5 or 6 million barrel per day US Production number, and not 9.5 million barrels per day.

Therefore, these beleaguered producers who are trying to just hang in there hoping their competition goes by the wayside, don`t realize that everybody is going by the wayside over the 6 million barrels per day threshold for US Production. At least until global demand pics up considerably with a much stronger industrial growth phase with maybe some future CAP EX Development in underperforming regions like India, Africa, Latin America and China.

OPEC Production Stability

In concert with OPEC at least stabilizing production at 32 million barrels per day going forward for the next 5 years, and not trying to gain market share by increasing production at the current rate of the last two years in this current price war for market share. But OPEC has moved from 30 million to 32 million barrels per day during this price collapse in oil prices, and given the downturn in China`s rebalancing campaign, there is no doubt that US Domestic production needs to go out of business for the foreseeable future. In short, for oil prices to recover, US Production needs to drop to at the very least 6 million barrels per day for the market to rationalize in price.

Bank Regulators

This isn`t rocket science, anybody that recently got into the business taking US Domestic production from 6 million barrels per day to over 9 million barrels per day needs to cease operations for good. This isn`t a have your cake and eat it too moment. Oil prices don`t recover until you go out of business, so you are just delaying the inevitable. I cannot believe how stupid people are in the oil industry, 9.2 million barrels per day of US Production is just too much given the last 16 month`s pricing environment in oil markets. US Production needs to drop fast, stop looking around at your neighbor to stop producing, if you got into the business the last 5 years, prices are not recovering until you leave for good.

Economics Lesson

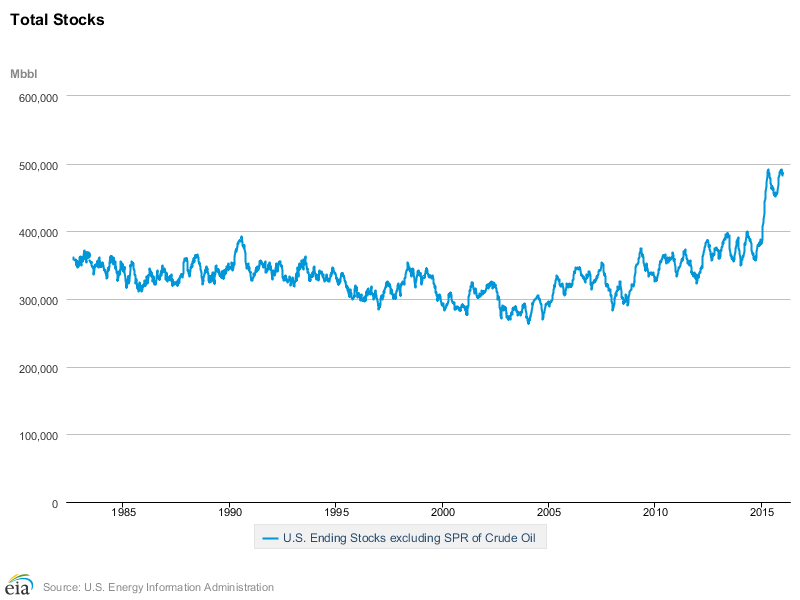

This is economics 101. Any first year economics student could pull the cord on projects that are unprofitable. Obviously these projects weren`t started with $45 oil in the model, so why are they continuing to operate when a banker, regulator, or business manager can look at the charts above, see the economic correlations between the three charts, and realize what needs to happen to rationalize the model back to the oil market being a balanced market. If you believe in the hang in there just a little longer notion, you are in dire need of an economics intervention. This is what the market will do it will give these producers an economics intervention, and send prices down to $25 a barrel, and speed up the decision making process. In essence, make the decision for you Oil Producers!

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2016 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.