Illusory Economic Recovery Supported by Hot Money

Economics / Economic Recovery Feb 05, 2016 - 06:12 PM GMTBy: Sol_Palha

Is this economic recovery real? Well if you base your observations on how far the Dow has risen since the financial crisis of 2008-2009 and on the B.S statistics the BLS puts out, the answer would be a yes. However, if you do just a little cursory digging, you will spot that this economic recovery is nothing but a grand illusion. The following factors clearly prove that this recovery is not real.

Is this economic recovery real? Well if you base your observations on how far the Dow has risen since the financial crisis of 2008-2009 and on the B.S statistics the BLS puts out, the answer would be a yes. However, if you do just a little cursory digging, you will spot that this economic recovery is nothing but a grand illusion. The following factors clearly prove that this recovery is not real.

Copper

A leading indicator is in a death spiral so all must not be well. It is trading at multi-year low. If the economic recovery were real copper would be trending upwards.

The Baltic Dry Index

Another leading indicator appears to be locked in a race to the bottom with the copper; this is another index that should be trending upwards and not at multi-year lows.

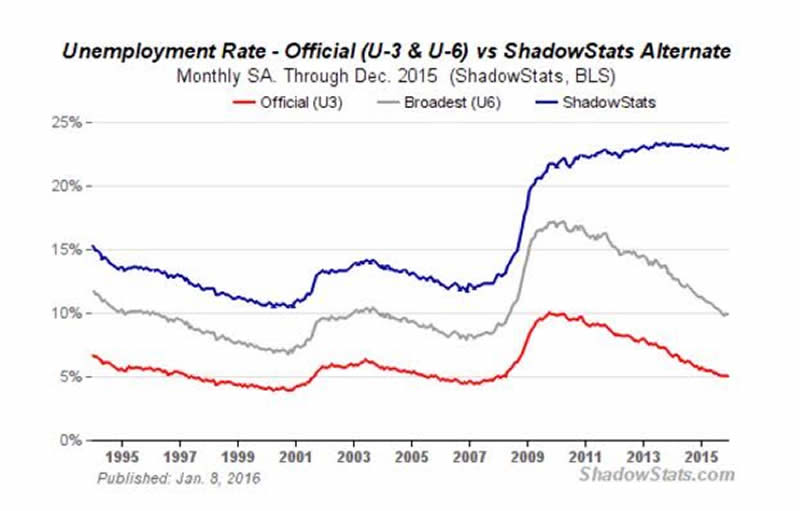

Unemployment figures

The data the BLS puts out does not give you a real picture of what is going on. According to the BLS, the unemployment rate is roughly 5%. Shadow statistics, on the other hand, states that as of Dec 2015, the unemployment rate stands at 22.9%

Wage stagnation

Real wages have been declining since 2000. In fact, $22.41 today has the same purchasing power an hourly salary of $4.03 cents hand in 1973.

Student debt

Student debt is a time bomb waiting to explode. It stands at $1.3 trillion and is growing roughly at a rate of $2,800 every second. As of June 2015, 11.5% of the debt was delinquent for at least 90 days according to Bloomberg. 40 million American now are carrying some form of student loans. 70% of college students graduate with debt, and there is no guarantee of landing a job upon graduation. The department of education has stated that the by 2025 this debt is set to surge to almost$2.5 trillion. A massive default here will make the financial crisis of 2008 appear to be a walk in the park.

We are creating new debt at a mind-boggling rate

This issue needs no explanation; our debt will soon hit the $19 trillion mark, and there appears to be no end in sight. The U.S is never going to be able to repay this debt back. And should interest rates ever move higher, it could have a hard time making payments on this huge amount of debt. Even if rates remain low, at some point debt payments are going to start to hurt. Our debt has soared from below $ 1 trillion in the 80’s to almost $19 trillion currently, it is projected to soar to $30 trillion by 2026.

Currency wars intensify as BOJ surprised markets

The BOJ (Bank of Japan) apparently understands that this economic recovery is nothing but rubbish as they lowered rates into negative territory. The currency wars are now raging, and the race to the bottom is gathering momentum; one nation after another debases its currency in the hopes of gaining a competitive edge. All this does is to buy a little extra time. The markets can continue trending higher even though economic conditions are far from optimal as the main driver is hot money. Everyone witnessed the monster rally the markets experienced after the BOJ lowered rates. While many will state the Fed has run out of bullets, it still can create money out of thin air and use that to prop the markets up. Central bankers worldwide have now embraced this strategy. The masses are nowhere near revolting so that this game could continue for a very long time. In the “devalue or die era”, most nations have no choice but to follow the leader. At some point, there will be a divergence, but on the same token, you might not be around to see that day.

The Fed is already backpedalling from the strong stance they took last year. It is hot money that saved this market by creating an illusion of stability, and it's only hot money that can maintain this illusion. The Fed is fully aware of this, they have two options, maintain an environment that propels companies to take on more debt and use this money to purchase even larger amounts of their shares; this artificially boosts the EPS and also helps drive the market as the funds corporations are allocating to share buybacks is monstrous. In fact, it is set to surge over $1 trillion in 2016; a sum that is larger than the GDP of many nations. The second option is to take an even more aggressive stance and come out with another stimulus program.

Game Plan

Despite the gloom and doom, very strong pullbacks should be viewed as buying opportunities. A host of stocks have held up very well during the current pullback, and their prices will gather even more momentum when the markets start to trend up again. Here are some examples, MCD, COST, RTN, HRL, HAS, ESLT, OA, TSN, ATVI, etc.

It appears that Gold is making a valiant attempt to put in a bottom. It will take a monthly close above $1200 to indicate that the worst is behind and that Gold is ready to trend upwards. Until then Gold is going to be tied in a trading range, with the possibility that it could still trade down to $1000. However, as we stated before, it makes sense to put some money into bullion, but we would abstain from jumping into gold stocks as the sector still has not confirmed that a bottom is in place.

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.