Stock Market S&P, NAS Best, Most Reliable Answers Come From The Market And You

Stock-Markets / Stock Markets 2016 Feb 07, 2016 - 04:01 PM GMTBy: Michael_Noonan

Almost everyone is searching for answers about what to do in the stock market. The two best sources are the market itself, and the second source will surprise many, but it is you! No one has a greater vested interest in your financial interests than you when it is your money on the line, at risk. The inherent problem with this simple solution is that few ever consider either source as the best solution.

Almost everyone is searching for answers about what to do in the stock market. The two best sources are the market itself, and the second source will surprise many, but it is you! No one has a greater vested interest in your financial interests than you when it is your money on the line, at risk. The inherent problem with this simple solution is that few ever consider either source as the best solution.

Wall Street, such a big mystery. Not really. The only mystery about Wall Street is the thieves who run it. Like the Wizard of Oz, Wall Street does not want you to look behind the curtain to discover all of the fraud, the greed, and the purely self-motivated financial interests that are opposite to yours.

The S&P used to be our staple for market commentaries. However, once the government and central banks took over the market, starting with POMO [Permanent Open Market Operations], we stopped recommending the buy side of the market to not abet the overt market manipulation to keep people trapped in stocks and simple stopped writing articles.

We did the same thing in the gold and silver markets. Once it become so apparent that the elite's central bankers were totally manipulating gold and silver to eliminate competition to their fiat Ponzi scheme, we stopped recommending any trading on the short side in PMs, again, not to abet what would otherwise be considered criminal activity.

From our point of view, markets are full of logic and reason. There are times when neither may be clear, but overall, both can be found in reading market activity. A direct result of understanding what the market is advertising is your ability to then draw a conclusion based on your own best financial interests. Is it easy? Yes and no.

It is easy if you just accept the reality of what the market is doing and compare your individual stock holdings to the market averages. The most difficult part is the realization that you have that kind of power to choose. For example, are any of your stocks under performing the market averages? If yes, accept the reality and get out. For those stocks that are outperforming the market, use a sell stop to protect your profits should the situation take a turn and start moving lower.

What follows are two market commentaries from May and August of last year. Their assessments and conclusions were dictated by the state of the market at the time, and a brief look at what was conveyed exemplifies what we are saying. After both reviews, we then return to current market conditions and give an update based on what developing market activity is saying. From our perspective, and combined with the other two articles, it ain't pretty, but you can draw your own conclusions.

In a May 4, 2015 commentary, [See Stocks - Bulls, Bears, And Pigs: Which Are You? ], we said the following: [A re-read of the entire article is a good reminder of having a market perspective, at all times.]

"Where are you as a stock investor in today's faux-Bull market? Are you a Bull, a Bear, or a Pig? If a Bear, clearly you do not understand the nature and function of one and are operating against the prevailing market strength. A mis-placed Bear in a Bull market is nothing more than an ego gone awry. Most who remain on the long side of the market more than likely considers him/herself a Bull. Unless one has been exceptionally select in being long, at this late phase of the market, those who are long and wrong are really playing the role of a Pig destined to be slaughtered.

"Share prices are in the last stages of a Bull market. It can last another week, another month, another year, maybe even longer [?], we do not know and have no clue, nor do we even need to know. What we know for certain is that the market trend still points up. Just because a trend is up, however, does not necessarily equate to all stocks rising and showing profits. It is here where you need to know if you are being a Bull or a Pig.

"During the latter phase of a Bull move, there is a lot of rotation in stock leadership. The initial leaders stop leading, and even their price may stop rising, moving more sideways, but definitely not producing the gains when the trend was in an earlier phase. These days, it is harder and harder to find quality stocks poised to undergo sustained gains. Even in a trending market, it does not always pay to be a Bull."

Last August 2015, when price had such a huge collapse, we called it a game changer, [See S&P, DAX, FTSE - When Markets Talk, Pay Attention , 4th paragraph]. It was. We also stated, just above the weekly chart:

"As an aside, the 100 point TR in the S&P, just since March, contained price swings totaling over 1,450 points. That kind of churning is a recipe for undue risk, also more of topping action than for continuation higher."

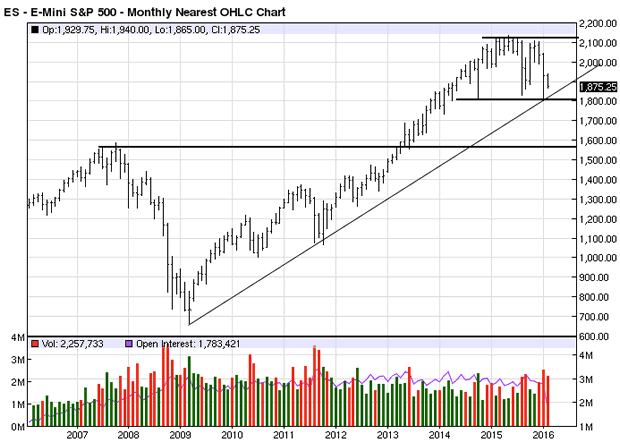

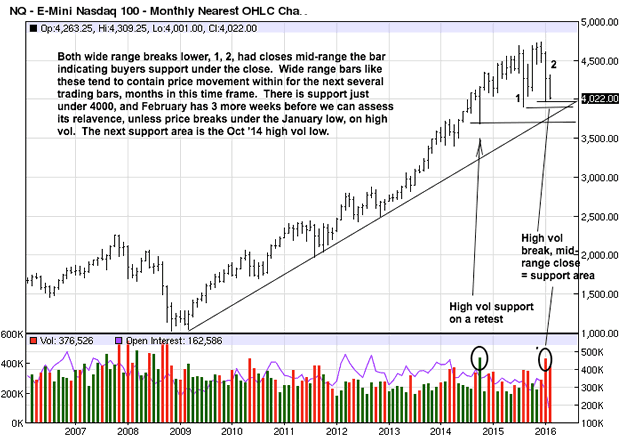

We now return to the present. A monthly chart provides an overall context, and this time frame is more controlling than the lower weekly and daily time frames. When all time frames are in sync, making market decisions is much easier.

The trend has been up since 2009. One can say the trend remains up, relative to where it has been, and we are choosing to call it sideways due to the lack of direction for the past year. Labeling the market up or sideways is less important than the context of where price is within developing market activity, and the lower time frames may clarify that point.

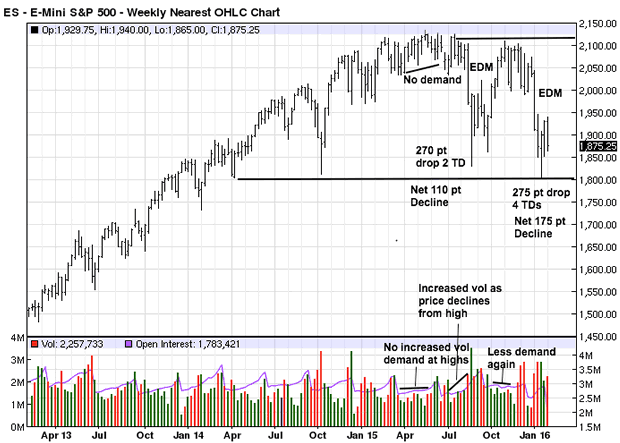

EDM = Ease of Downward Movement. It is a quick measure to determine if price has an easier time going up, [EUM, Ease of Upward Movement] or down. Clearly, the up bars are shorter and more labored when compared to the waterfall-type declines indicated on the chart.

Understand that there is no magic going on here. All we are doing is making observations about what market activity has been, the market's message to us, and then drawing a logical conclusion from the information. When the market was making its high, April and May of 2015, note how volume was relatively low. Volume is the energy force behind market activity. If volume were low, as it was, there was not as much effort coming from buyers to move the market higher, or a lack of demand. Sellers see this, and it opens the door for them so see if they can take over control.

You can now better see how the May '15 article puts market-making decisions into a context, at the time, when although price was at the highs, there were warning signs to assess your take on how you should be positioning yourself in light of what the market was saying to everyone. Well, the information is/was available to everyone, at the time, but if one were not paying attention, whose fault is it?

The first EDM on the chart was when we wrote the August '15 article calling it a game changer. There was a 270 drop in two TDs, [Trading Days], but on the second day, the market closed near the high of the day for only a net decline of 110 points. While the two-day decline was a huge red flag alert, the recovery close told us buyers [manipulating central banks] were still present. That effort led to another attempt at new highs just before another EDM occurred in January of this year.

If one had not already done so, it was after the August 2015 alert that one should have made another assessment of one's stock holdings to determine what to sell or hold, or simple sell. One does not have to be an expert or rely on experts to make these kinds of determinations to protect one's capital.

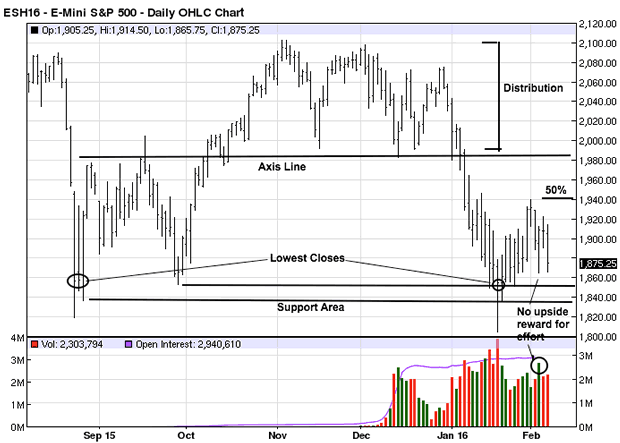

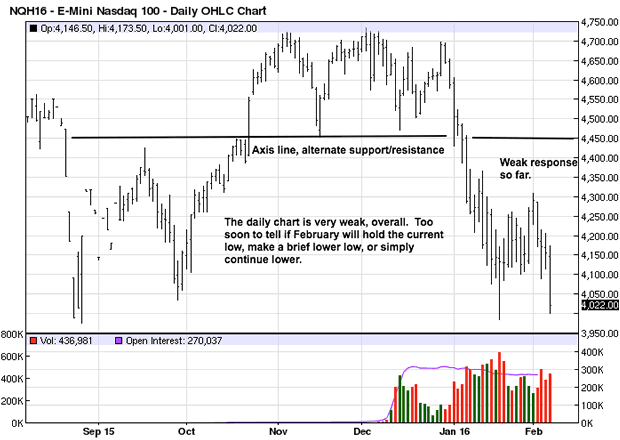

We marked the recent topping action as distribution, [professionals selling to weak- handed buyers], but if you go back to the weekly chart above, you can see distribution really began throughout much of 2015. While the daily chart could be viewed as broad distribution and a sideways move, the price moves from low to high to low can greatly impact overall performance. This kind of activity is not conducive to smart investing.

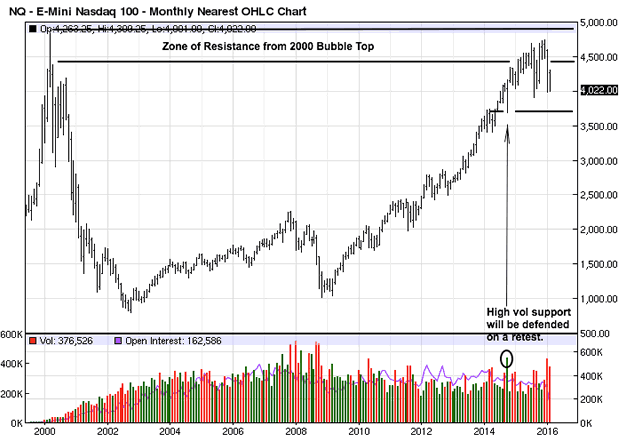

We include a longer term monthly time frame to show what can be considered as a double top from when prices first collapsed during the Dot.com Bubble. Here we are again. People tend not to learn from history, but individuals do.

This monthly chart does not go back as far so we can see the current activity more clearly. Where the S&P topped in mid-2015, the Nas topped later in the year. This chart could be considered in an up trend, and not sideways, but the warning signs are still present. There is support near the current close, but February still has three more weeks before we can better assess its development. Chart comments apply.

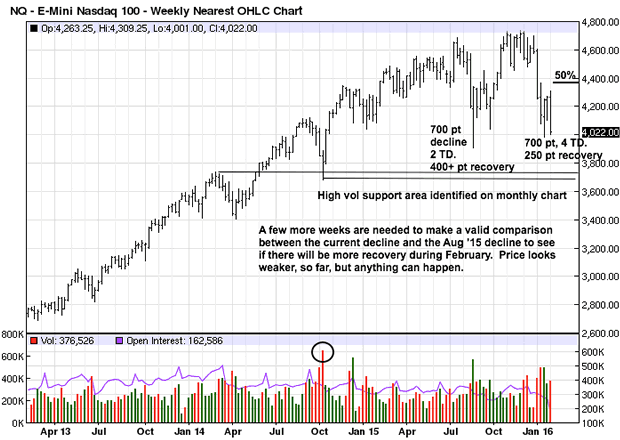

The weekly chart takes on a more troubling potential topping appearance as we see more detail. So far, February looks very weak. When stocks close lower in January, February is often a lower month, as well, historically speaking. Price is well under a 50% retracement, indicated on the chart, so one should be aggressively defensive, if still long the market.

By now, it should be evident that one need not be a so-called Wall Street expert to make a self-determination about what to do in the markets and when. The information is always available in real-time, and in our mind, the logic is inescapable when one begins to apply a little, or a lot of common sense to what the market is revealing.

You will not get this kind of information or answers from overpaid talking heads on televised financial networks, nor from print media. Neither have your specific interests in mind, even though they say otherwise.

From Star Wars, "Trust in the Force," is another way of saying to trust in yourself.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.