Gold’s Macrocosm: The Planets Align

Commodities / Gold and Silver 2016 Feb 13, 2016 - 11:03 AM GMTBy: Gary_Tanashian

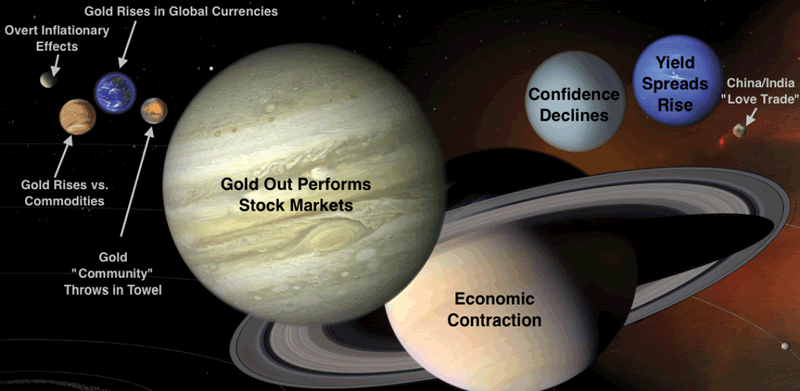

We introduced the graphical view of the preferred counter-cyclical environment for gold and especially the gold stock sector in July: Macrocosm. We have updated the view several times since at NFTRH.com, with the macro backdrop getting more and more supportive of the gold sector over the last half a year.

We introduced the graphical view of the preferred counter-cyclical environment for gold and especially the gold stock sector in July: Macrocosm. We have updated the view several times since at NFTRH.com, with the macro backdrop getting more and more supportive of the gold sector over the last half a year.

Now that the world knows gold is bullish and those pumping gold for the wrong reasons are finally right anyway, let’s take each of these macro indicators one by one. We will start with the little planets and work our way up.

- “Chindia Love Trade”: This has little to do with gold’s rise. China demand, Indian weddings and manipulative capers on the COMEX for that matter were pumped throughout the bear market, and the price kept dropping like a stone.

- Overt Inflationary Effects: This may yet come into play, but gold has not been rising on readily observable inflation or inflationary fears. Indeed, we are at peak deflation anxiety although I expect a transition out ahead. Watch silver vs. gold among other indicators.

- Gold Community Throws in the Towel: Some people are still waiting for that event, but I think this cycle is much like the 1999-2001 bottoming cycle. It was a process and gold bugs in my opinion have long since thrown in the towel when some of their most staunch members got in line behind a forecaster and his computer (which just lately seems to have altered its code, by the way). The gold “community” may have been ground to a pulp as opposed to making a final puke.

- Gold Rises vs. Commodities: This is actually an important planet and should be larger (but what are ya gonna do?). Since gold has been rising vs. commodities for years it has been an indicator of global economic contraction and deflation. It has been a ‘steady as she goes’ indicator and continues to indicate the right environment for the birth of a gold sector bull market (although when silver takes over leadership from gold later on, the dynamics are going to change as an ‘inflation trade’ whips up).

- Gold Rises vs. Currencies: This one has been in process. I have marveled at how desperately millions of market participants have clung to their confidence in monetary authorities who routinely tramp out paper and digital money units. That is now cracking and recently we have introduced a new indicator, risk ‘off’ metal (gold) vs. risk ‘off’ currency (Swiss Franc) and gold has broken out vs. Swissy, indicating a waning confidence in paper/digital money.

- Yield Spreads Rise: The 30yr-5yr yield spread has been making a very bearish signal for the US stock market. See this post: The Scariest Stock Market Chart in the World. It is potentially bottom making, but not conclusively. The 10yr-2yr is bouncing a bit but has not made any definitive signal yet. This remains a holdout fundamental to gold’s case.

- Confidence Declines: Confidence is declining the world over. See ECB jawbone QE, see market bounce and drop. Same thing with BoJ NIRP policy. This week Janet Yellen both stood firm behind the Fed’s rate hikes and openly pondered the prospects of NIRP in the US. One big chink in the formerly impenetrable armor around the Federal Reserve.

- Economic Contraction: We got on this first with the gold vs. commodities ratios’ bull market and then with palladium dumping vs. gold in June. We then added multiple posts showing machine tools decelerating (Machine Tools Fading, in July) and finally, a new downtrend in Semiconductor equipment bookings and billings. Okay, I think we can rest our case. As for declining confidence in monetary authorities, see this Biiwii post for more on Yellen, in which she finally indicates that “there’s a chance of a downturn ahead”. Unbelievable, 6 months too late for that admission, I’d say.

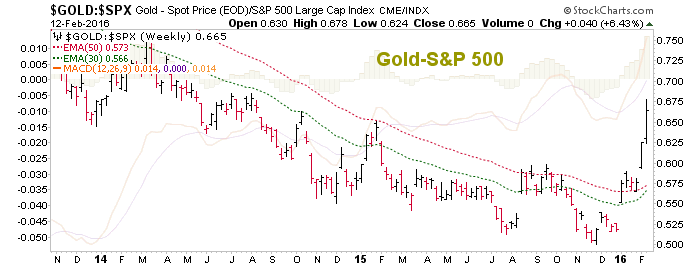

- Gold Out Performs Stock Markets: The big one, and it is the reason that our Macrocosm theme got rammed front and center over the last couple of weeks, going from the realm of the theoretical and likely to the probable and proven (to paraphrase a term from our friends, the miners :-) ). Here is gold vs. S&P 500. It is getting repelled a bit today with the stock market bounce we anticipated, but which sure tested my patience. Stocks probably need to relieve some of the short-term pressure. Sentiment had become a Tinder Box again, and the bounce was on.

That folks, is a trend being changed. The implications will be that traditional money managers (instead of just we lowly gold bugs) will be moving into the gold mining sector because their mandate is to herd into what is working.

For years now NFTRH has noted that it is the counter-cycle (h/t Bob Hoye) that is going to bring on the right environment for the gold sector, not the widespread hallucinations about inflation and Asian demand in the face of global deflation. That comes later, and it will come sooner or later as the deflation play gets… played out.

For now, gold and the miners are doing exactly what they are supposed to do at the start of a new cycle. With that knowledge in hand, I am finally able to manage the sector for subscribers not in the defensive way of the last several years, but an offensive way. The pullbacks will come and they look to be opportunities. We have our fundamentals coming into place, finally. Well Hallelujah!

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.