Gold’s Full House

Commodities / Gold and Silver 2016 Feb 25, 2016 - 08:26 PM GMTBy: Gary_Tanashian

Using the Macrocosm theme again (I can’t get enough of this gimmick) let’s update some key gold ratios in poker terms.

Using the Macrocosm theme again (I can’t get enough of this gimmick) let’s update some key gold ratios in poker terms.

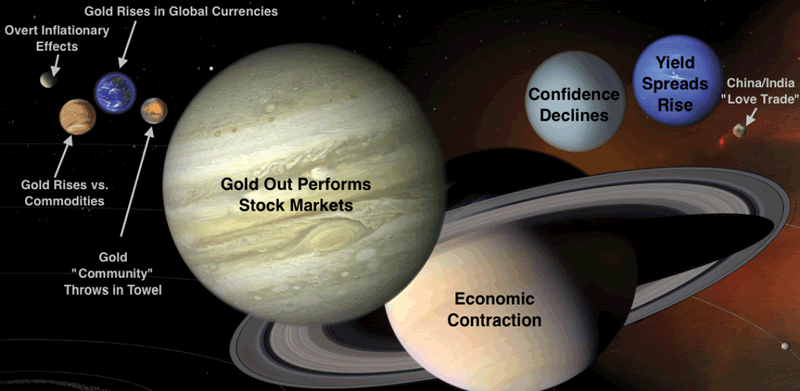

Gold is currently working on a ‘full house’, with three of a kind (gold out performs stock markets, gold rises vs. commodities and gold rises vs. global currencies). We can call the pair needed to complete the full house economic contraction (to varying degrees globally) and confidence declines.

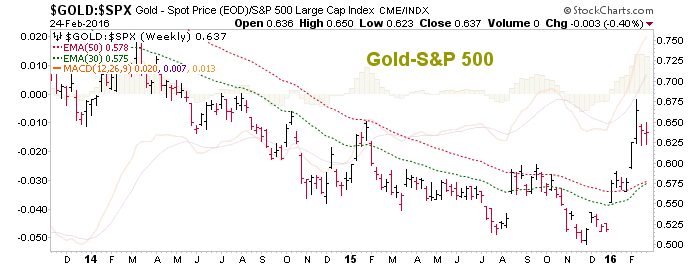

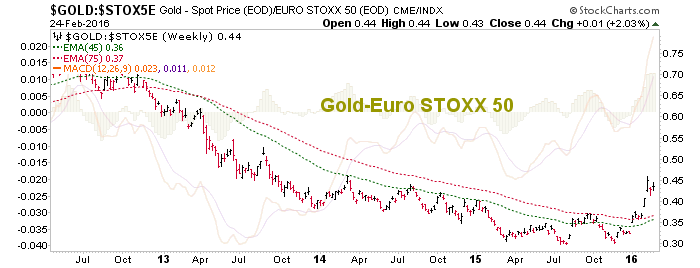

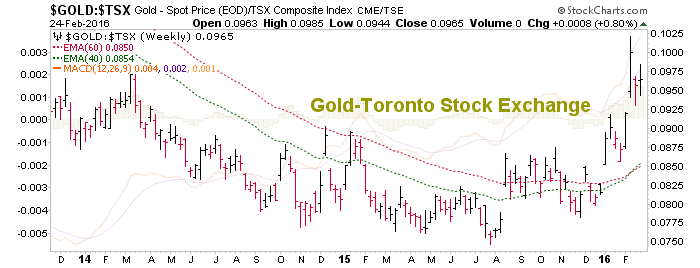

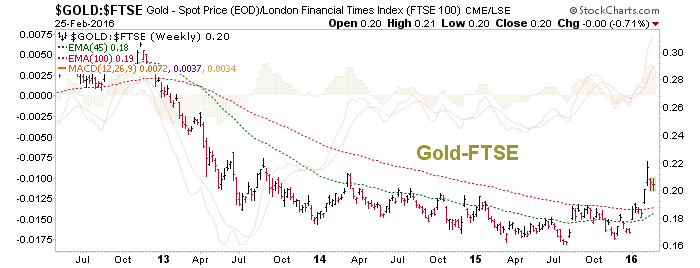

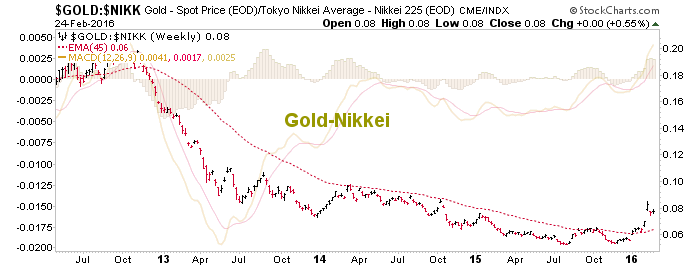

Gold vs. Stock Markets

Gold vs. developed world stock markets is bullish and consolidating. This is a critical macro consideration to the gold sector investment case and these weekly charts show trends changing vs. all world stock markets. The ratios are in consolidation as gold itself consolidates and markets bounce.

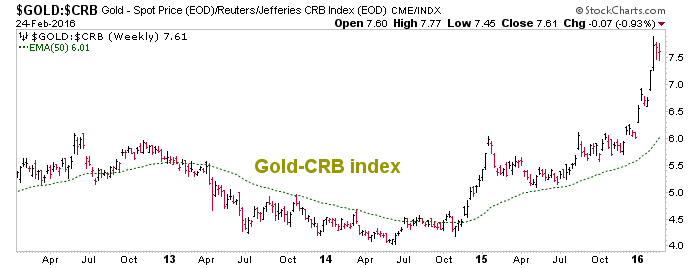

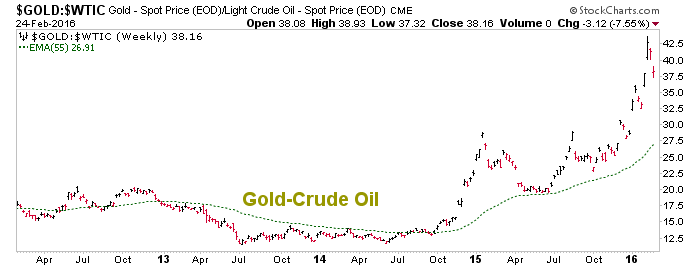

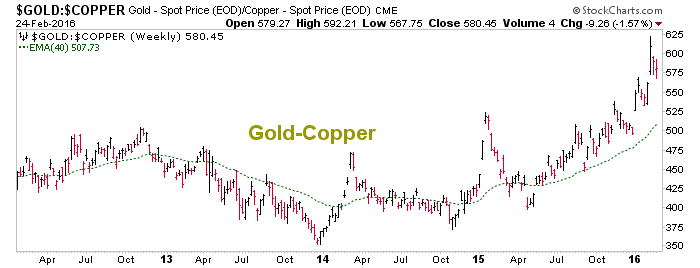

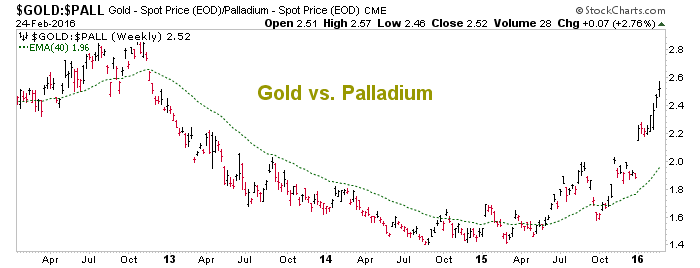

Gold vs. Commodities is wildly bullish and consolidating a bit.

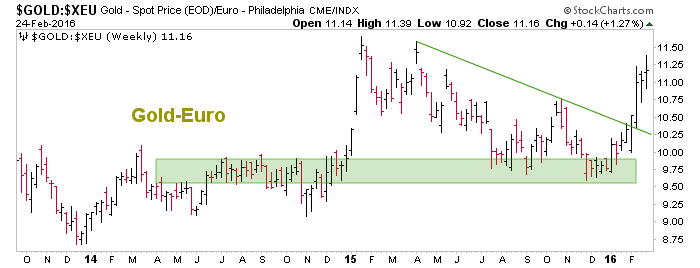

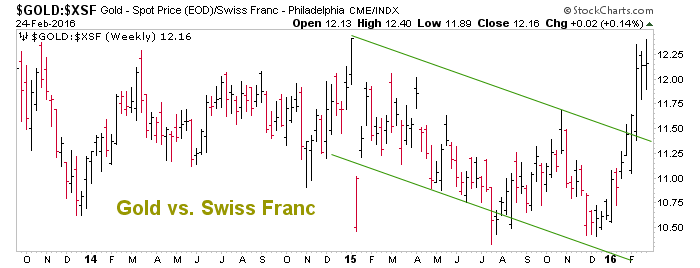

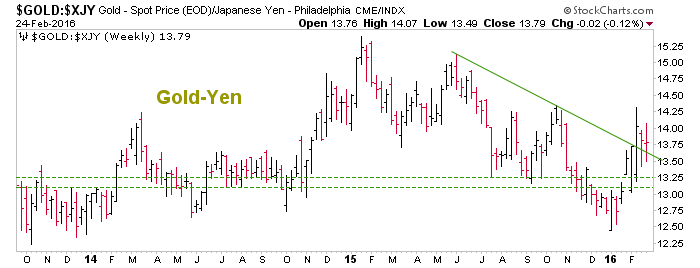

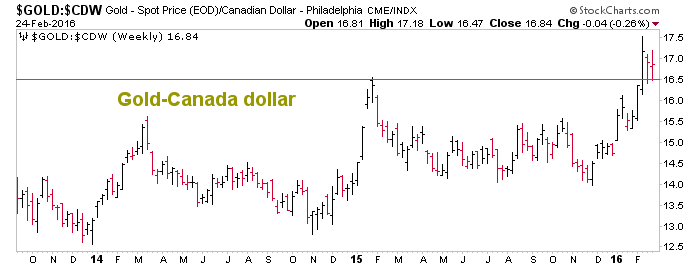

Gold vs. Currencies shows a breakout from a downtrend in Euros, consolidation above support in ‘commodity currencies’ of Canada and Australia, a breakout attempt in Yen and a clear vote of confidence in the risk ‘off’ metallic monetary asset vs. a paper risk ‘off’ note (Swissy).

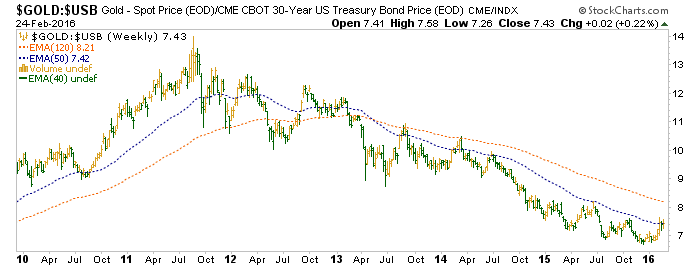

Finally, in keeping with the poker theme, what beats a full house? ‘Four of a kind’. Gold vs. the all-important US Treasury bond market is working on its 3rd week in trying to deal with the first restraining moving average. The pictures above show waning confidence and if this one (indicating confidence in a conventional risk ‘off’ repository vs. gold) joins them we will have four of a kind in gold’s favor.

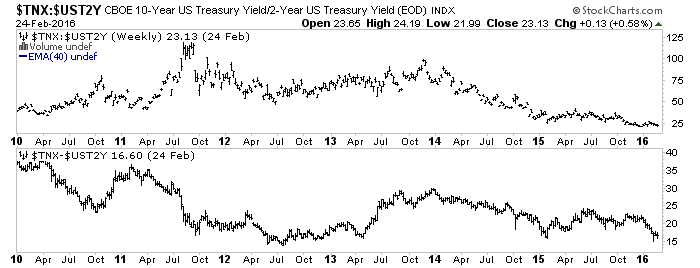

Obviously, ‘five of a kind’ would be ideal. While the 4th card above looks to be in process, the 5th is not. That’s the ‘yield curves rise’ planet in the macrocosm. Whether calculated by dividing the 10 by the 2 or subtracting it, this curve is not yet rising. The implication is that the game has not completely turned the table on the Federal Reserve with respect to the market’s confidence.

Bottom Line

Through all the years of gold bugs clicking the heels of their ruby slippers, demanding that inflation would drive gold higher any day now, it was the macro indicators that would tell the story. As we entered 2016 they began telling a story of a counter-cyclical environment that would be necessary to launch the gold sector. The story, or game, is not yet over but the odds are now in gold’s favor. Prepare for volatility and opportunity as the process continues.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.