US Housing Mortgage Market Meltdown- Say good-bye to Fannie and Freddie?

Stock-Markets / Credit Crisis 2008 Jul 12, 2008 - 10:45 AM GMT

Federal Reserve Chairman Ben Bernanke and Secretary of the Treasury Henry Paulsen told Congress Thursday that new regulatory powers are needed to insulate the national economy from damage if a big Wall Street firm collapses. Now that is an interesting proposition. We have already bailed out Bear Stearns and several other brokerage institutions in March. So is someone else in trouble already? Who could it be?

Federal Reserve Chairman Ben Bernanke and Secretary of the Treasury Henry Paulsen told Congress Thursday that new regulatory powers are needed to insulate the national economy from damage if a big Wall Street firm collapses. Now that is an interesting proposition. We have already bailed out Bear Stearns and several other brokerage institutions in March. So is someone else in trouble already? Who could it be?

Too big to fail.

Shares of Fannie Mae and Freddie Mac dropped nearly 50% Friday morning, as investors increasingly believe the mortgage giants that made the American dream of home ownership possible for millions will need to be bailed out by the U.S taxpayer. “ The government "most assuredly would back" Freddie and Fannie in light of the hand that the Federal Reserve took in engineering the acquisition of Bear Stearns Cos. by J.P. Morgan Chase & Co. earlier this year,” said David Ader, a U.S. government bond strategist at RBS Greenwich Capital, in a note to clients.

How did we guess that this would happen? You can't stop at just one bailout. There will always be someone who is bigger or more important that will need it next time. The moral hazard is growing by leaps and bounds, since we know that Fannie hasn't been able to straighten out its bookkeeping mess since 2002, even after hiring 1500 accountants in 2006 to “finalize” their balance sheets for the prior four years. The problem is, no one really understands the complexity of the transactions it has entered into with Wall Street. Fannie has become the dumping ground for a lot of toxic waste generated by the mortgage industry.

The passing of a giant in our profession.

Sir John Templeton passed away on Wednesday at the age of 95. Many of you have heard of him. He was a regular guest on Louis Rukeyser's Wall Street Week when it was being aired on PBS. I had the tremendous honor of speaking with him on several occasions. I will never forget him or his opinions, which he always submitted with humility. What follows is a comment from his last public interview made in 2005.

“ I do think it's interesting that in all my 92 years, I've never seen a time when it was so hard to find a bargain. I aided wealthy families by helping them find stocks that were selling at a small fraction of what the company was worth. But now, it's very difficult to find companies where you can buy the stock at a fraction of its value. In all my experience, I don't remember a time when you had to search so diligently to find anything that was a bargain.”

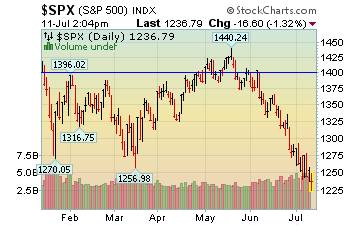

Demon Drop may be over. Next, the rally.

Previous calls for a bottom this week became muted today when Fannie Mae and Freddie Mac plummeted nearly 50% at the open this morning. Earlier this week we were seeing the media trumpeting the opportunities of buying in a bear market . Don't buy it. There has been enough technical damage done already that it will take a long time to heal.

The pain being felt as people open their quarterly statements was only the beginning. Fortunately, there should be a brief rally for investors to get out and recoup some of the losses before the next plunge.

Investors still have a taste for risk.

Bond traders still think that things are okay at Fannie Mae and Freddie Mac, despite the sell-off in their stocks. But the sell-off in stocks was accompanied by an increase in risk premium (higher yields) bringing investors out of safer treasuries and into the riskier mortgage securities.

Can gold stay up?

Gold futures rallied Friday to their highest level since mid-March, as soaring oil prices, mounting tensions between Iran and the West and a sell-off on Wall Street prompted investors to seek a safe haven in the precious metal.

Gold futures rallied Friday to their highest level since mid-March, as soaring oil prices, mounting tensions between Iran and the West and a sell-off on Wall Street prompted investors to seek a safe haven in the precious metal.

This was a fear-driven move in gold. At the end of the day, it was announced by Senator Dodd that Fannie and Freddie would have access to the discount window at the Federal Reserve. That seems to have taken some edge off the appetite for gold.

The Nikkei is beginning its next descent.

The Japanese market finished its fifth week of declines as the rising cost of fuel diminished expectations for the profitability of their auto industry. The market does not go down forever, so there should be a reprieve soon. However, the longer-term outlook is grim for the Nikkei, since the country's economy is driven in large part by exports.

The Japanese market finished its fifth week of declines as the rising cost of fuel diminished expectations for the profitability of their auto industry. The market does not go down forever, so there should be a reprieve soon. However, the longer-term outlook is grim for the Nikkei, since the country's economy is driven in large part by exports.

Rally for the Olympics.

This week the Shanghai market had a bit of a reprieve. On Wednesday it reached 2900 again. But you can see that overhead resistance has built up there. While Hong Kong stocks gained, the Shanghai market fell.

This week the Shanghai market had a bit of a reprieve. On Wednesday it reached 2900 again. But you can see that overhead resistance has built up there. While Hong Kong stocks gained, the Shanghai market fell.

Financial stocks were hit especially hard, as were stocks in the region of the earthquake. The Chinese are doing a major job of housecleaning just in time for the Olympics.

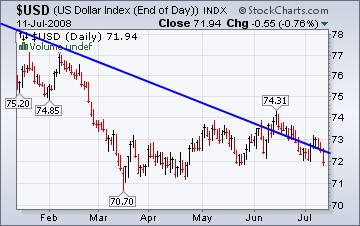

The dollar is struggling with support.

The U.S. dollar fell sharply against the e uro and the pound Friday, as fears continued that the entities that underpin the U.S. mortgage market may fail.

The U.S. dollar fell sharply against the e uro and the pound Friday, as fears continued that the entities that underpin the U.S. mortgage market may fail.

The 15-nation euro bought $1.5901 in late New York trading, above the $1.5783 it bought Thursday. The British pound climbed higher, too, buying $1.9928 compared with $1.9775.

Housing is not done plumbing its lows.

The number of homeowners stung by the rout in the U.S. housing market jumped last month as foreclosure filings grew by more than 50 percent compared with June a year ago, according to data released Thursday.

Nationwide, 252,363 homes received at least one foreclosure-related notice in June, up 53 percent from the same month last year, but down 3 percent from May, RealtyTrac Inc. said. One in every 501 U.S. households received a foreclosure filing last month.

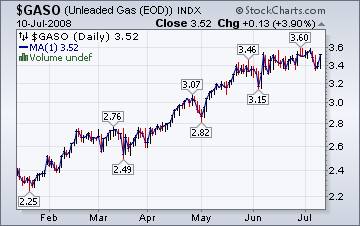

When will higher gasoline prices end?

The Energy Information Administration's This Week In Petroleum tells us that, “Once again, the U.S. average retail price for regular gasoline climbed higher into record territory, increasing 1.9 cents to 411.4 cents per gallon.”

The Energy Information Administration's This Week In Petroleum tells us that, “Once again, the U.S. average retail price for regular gasoline climbed higher into record territory, increasing 1.9 cents to 411.4 cents per gallon.”

The chart suggests there may be a crack in the uptrend. Let's see how it develops next week.

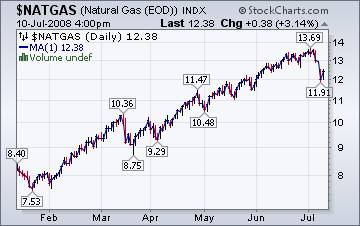

Natural gas ready to roll over?

The Energy Information Agency's Natural Gas Weekly Update states that, “During the week, concerns over the path of Hurricane Bertha lessened as the first tropical storm threat of the season turned toward the North Atlantic , likely contributing to the easing in prices. Nonetheless, much of the hurricane season lies ahead, and price volatility has become a regular feature of the natural gas market as storms form and dissipate. In addition, while temperatures during the week were moderate in key consuming regions, the peak summer demand season (from electric generators meeting air-conditioning needs) is underway, bringing increased competition for available supplies.”

The Energy Information Agency's Natural Gas Weekly Update states that, “During the week, concerns over the path of Hurricane Bertha lessened as the first tropical storm threat of the season turned toward the North Atlantic , likely contributing to the easing in prices. Nonetheless, much of the hurricane season lies ahead, and price volatility has become a regular feature of the natural gas market as storms form and dissipate. In addition, while temperatures during the week were moderate in key consuming regions, the peak summer demand season (from electric generators meeting air-conditioning needs) is underway, bringing increased competition for available supplies.”

Don't cry for Fannie and Freddie.

The B-word is being brought up when it comes to Fannie Mae and Freddie Mac. Life won't be the same without them, since Fannie Mae alone picked up $2.8 trillion of home mortgages through last year. Since the banking crisis began, Fannie and Freddie wrote the majority of home mortgages and provided the backstop to keep the real estate market from nosediving. The problem is, both institutions are even more leveraged than banks…and in serious trouble. I believe the estimated $1 trillion needed to bail them out will be (1) not enough and (2) seriously affect our country's credit rating.

“The Federal Reserve and the Treasury have taken great pains to point out that the government is not obligated to bail out either Fannie or Freddie if they face insolvency.

It's debatable where the legal obligations lie, but as a practical matter, the government can't let these institutions fail because they are being counted upon to help fix the mortgage mess. If Fannie and Freddie were unable to buy and back loans, banks would stop originating them and the pool of homebuyers would shrink, causing home prices to fall even further .”

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.