Is the Gold Price Manipulated? Part IV

Commodities / Gold and Silver 2016 Mar 01, 2016 - 04:46 PM GMTBy: Arkadiusz_Sieron

We have examined the major theories of manipulation in the gold market, so let’s deal with other interesting problems: high-frequency trading, declining inventories in Comex, London bias and gold leasing.

We have examined the major theories of manipulation in the gold market, so let’s deal with other interesting problems: high-frequency trading, declining inventories in Comex, London bias and gold leasing.

First, some people accuse big banks of suppressing gold prices by not only using ‘naked’ shorts, but also engaging in high-frequency trading (HFT). The HTF is a type of algorithmic trading characterized by the large number of orders at very fast speed (they operate in milli – or microseconds). Many investors believe that bankers using HFT create massive volumes of artificial traffic, or place and quickly cancel orders in order to create waterfall declines in the price of gold.

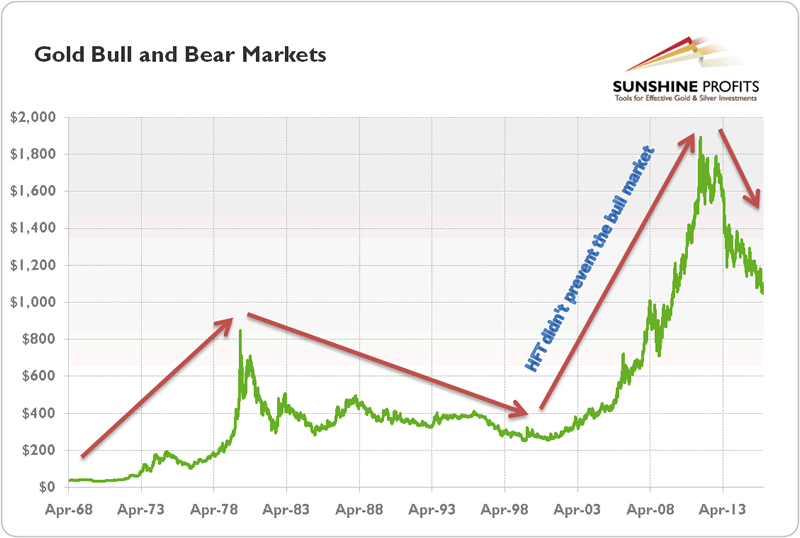

However, most HFT firms trade only intra-day, so their impact on the gold market should be short-lived by definition. Moreover, the HFT may be actually helpful for markets, since it improves efficiency by discounting new information and driving the market into equilibrium much quicker. Additionally, since HFT companies execute thousands of orders an hour, they add liquidity to the market. Undoubtedly, some companies abuse this technology, but the fraudsters have always existed. HFT may be considered as a next step to accelerate trades, as computers or financial press before. It may be used as a tool for manipulation, but not in a different way than computers before. As a reminder, financial institutions adopted extensive computer networks in the 1970s, when gold was in the bull phase. Similarly, HFT has taken place at least since 1999, but it did not prevent the bull market in gold (see the chart below).

Chart 1: The HFT did not prevent the bull market in gold in the 2000s.

Second, other investors point out that decreasing gold inventories in the Comex gives evidence of manipulation in the gold market. The decline in Comex gold inventories is seen as a sign of shortage of physical gold relative to the massive creation of paper gold. However, the amount of ‘registered’ gold is not the only amount of gold available for delivery, since eligible gold can be quickly converted to registered. Moreover, the changes in Comex gold inventories do not drive the price of gold, but result from gold price fluctuations. When the gold prices rise, more people want to own it, and vice versa. Thus, the declining Comex inventories are not the proof of manipulation, but simply reflect the bear market in gold and negative sentiment among some owners, who withdraw metal from that exchange to sell it in other markets.

Third, another type of alleged evidence against bullion banks manipulating the gold market is the so-called ‘London bias’, i.e. the statistical regularity showing that gold prices usually decline during London trading hours, especially around the PM Fix, whilst they rise during Asian trading hours. We do not deny that such behavior exists, but investors should be aware that certain price patterns do not as such constitute evidence of manipulation. There are many anomalies in the financial markets (like the January effect), which are not necessarily caused by manipulation. Moreover, during London trading hours, the New York markets open and some of the most important U.S. economic data is released at this time, which may cause strong reaction in the markets.

The last argument refers to the leasing of gold by central banks in order to suppress its price. Again, although central banks certainly lease their gold, managing currency reserves is precisely within their mandate and does not prove manipulation. Moreover, the central bankers may simply try to generate a return on their assets by leasing gold, which would otherwise be sitting in a vault earning no income. If there was any manipulation, it would be ineffective, given the bull market in the 2000s. Perhaps, the price of gold affects the scale of gold leasing, not vice versa. The borrowing demand will only remain strong as long as gold is perceived to be in a bear market, because borrowers could only then repay the loan with gold that had dropped in price.

The bottom line is that despite many variations of theory of manipulation in the gold market, their supporters hardly offer any proofs. The gold market is complex enough when considering only true fundamentals, so there is no need to follow unproven suppositions. They are dangerous for investors, since they can expose them to losses. The manipulation theories create elevated expectations that one day the manipulation will end and the price of gold will reach its ‘true value’ over many tens of thousands of dollars per ounce, which may lead to unnecessarily long holding periods and sub-optimal investment decisions (and not exiting the market at all during bear markets). For instance, the above approach could lead to losses even if gold moves substantially higher but not as high as one expects – it’s important to stay open to new information and react to it when it becomes available – staying in any market (even as promising a market as precious metals) without paying attention to its dynamics can be costly.

Thank you for reading the above free issue of the Gold News Monitor. If you'd like to receive these issues on a daily basis, please subscribe. In addition to these short daily fundamental reports, we focus on the global economy and the fundamental side of the gold market in our monthly gold Market Overview reports. We also provide Gold & Silver Trading Alerts for traders interested more in the short-term prospects. If you're not ready to subscribe yet, or are unsure which product suits you, we encourage you to sign up for our mailing list and receive other free alerts from us. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.