Donald Trump – Bad For US Dollar, Good For Gold?

Commodities / Gold and Silver 2016 Mar 03, 2016 - 12:40 PM GMTBy: GoldCore

Donald Trump’s emergence as the Republican frontrunner and possible future U.S. President is causing some gold and investment analysts to suggest diversifying into gold according to the Wall Street Journal.

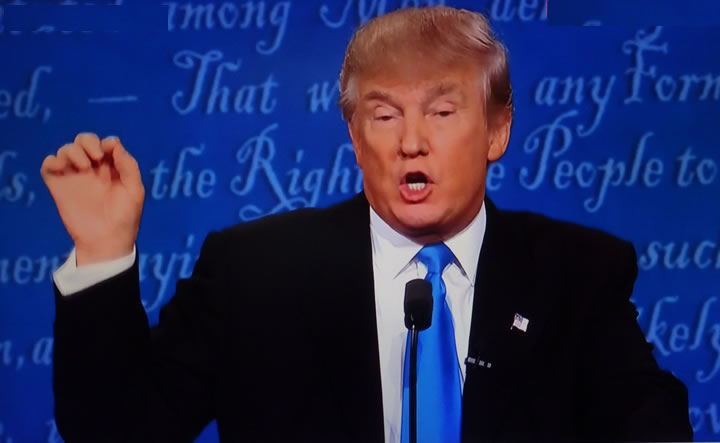

Donald Trump – Gage Skidmore via Commons.wikimedia.org

From the WSJ:

The other winner from Super Tuesday could be gold.

With Donald Trump solidifying his status as the front runner in the Republican field, some investors and analysts watching from overseas say that the ascendancy of the brash New York businessman could rattle global markets as the November presidential election inches closer. Nervous investors, they say, could pile in to gold and other safe-haven assets as an insurance policy.

The journal quotes David Govett of London-based commodities broker Marex Spectron:

“The mere thought would suggest a good opportunity to buy gold,” said Mr. Govett, who heads the firm’s precious-metals trading desk.

“Who knows what could happen should he be handed the keys to the White House,” said Mr. Govett.”

James Sutton, a London-based portfolio manager on the global natural resources equities team at J.P. Morgan Asset Management concurs:

“If there’s any uncertainty regarding the U.S. election and the potential for a slightly off-center candidate, whether that be Sanders or Trump winning the election, then I can see a scenario where that’s bad for the dollar.”

It is important to note that gold’s fundamentals are very sound and the possible “Trump gold factor,” if there is one, is only one of a myriad of fundamentals that are driving the gold market.

As Mining.com comprehensively notes

Following three down years, many factors have been driving gold’s resurgence in 2016:

- Geopolitical turmoil – spreading from the Middle-East into Europe and beyond – burnishing gold’s safe haven status

- Doubts about the health of the global economy and financial system and the longer-term impact of the slump in oil prices forcing investors to look for insurance policies

- Uncertainty surrounding the future of the European Union and the possible fallout from a Brexit

- Slumping stock markets around the world pushing investors into alternative assets particularly gold

- Physical gold investors jumping back into ETFs – more than wiping out all of last year’s outflows less than two months into the new year

- Skepticism about further rate hikes in the US and negative interest rate policies in a growing number of developed economies around the world lowering the opportunity costs of holding gold

- Continued central bank buying and a belief that the strengthening trend in the US dollar is over for now

- First indications that inflation may be creeping back into the financial system making gold attractive as a hedge

- A realization that gold around $1,000 an ounce represents an historical bargain buying opportunity

Uncertainty regarding the U.S. presidential election will likely aid gold. But gold’s outlook is bright whether Donald Trump, Hillary Clinton or the Messiah himself or herself becomes President.

Gold’s fundamentals are positive given the very high degree of macroeconomic, monetary, geopolitical and systemic risk in the U.S. and indeed the world today.

LBMA Gold Prices

03 Mar: USD 1,241.95, EUR 1,141.48 and GBP 882.24 per ounce

02 Mar: USD 1,229.35, EUR 1,131.53 and GBP 881.54 per ounce

01 Mar: USD 1,240.00, EUR 1,141.70 and GBP 886.09 per ounce

29 Feb: USD 1,234.15, EUR 1,131.46 and GBP 890.95 per ounce

26 Feb: USD 1,231.00, EUR 1117.58 and GBP 878.87 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.