Stock Market Myths, and What’s Wrong with the Economy

Stock-Markets / Stock Markets 2016 Mar 08, 2016 - 03:10 PM GMTBy: Tony_Caldaro

Stock market myths

Stock market myths

Over the decades we have all learned to accept that earnings drive stock prices. Rising earnings – rising stock markets and stocks. Falling earnings – falling stock markets and stocks. In fact, there have been numerous studies, using current, future and lagging earnings, to determine an appropriate market price earnings multiple. Then standard deviations from that multiple are used to suggest a risk-on or risk-off investment climate.

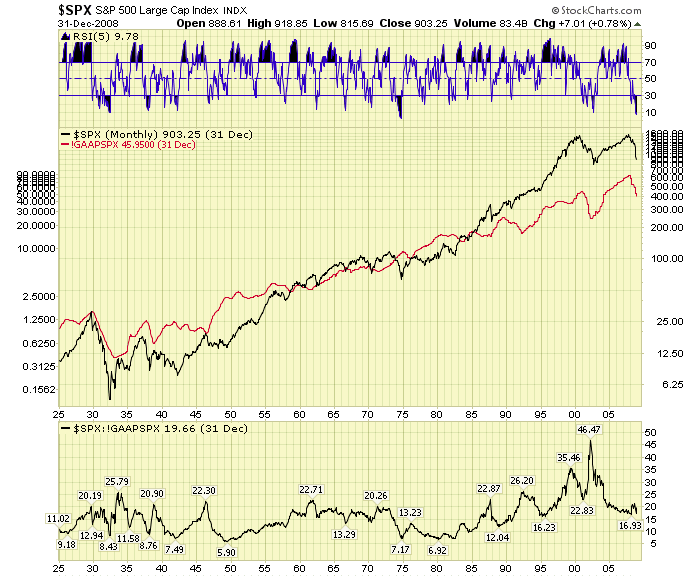

With SPX GAAP earnings on the decline from $106 to $91 over the past year. We took a look at the history of stock market activity verses GAAP earnings since the 1920’s. Nearly 100 years. We found something completely different than what we had expected. As you can easily observe from the chart below the noted generalization, rising/declining markets during rising/declining earnings, does not hold up very well over time. This observation might help to explain the oddity: why growth companies, with hardly any earnings, can sell at PE multiples in the 100’s. While cyclical companies, during the same period, with the same revenues, can sell at PE multiples in the single digits.

After analyzing the chart data in detail, and using OEW analysis from the years 1921 to 2015, we determined there have been 33 bull/bear markets. Seventeen bull markets and sixteen bear markets. Then after analyzing each of the bull/bear markets individually, plus allowing for earnings to top/bottom within one year of a stock market top/bottom, we found that earnings are correlated with the stock market slightly less than 58% of the time, i.e. 19 of the 33 times.

In fact, we found nine instances when the stock market and earnings moved in completely opposite directions. Seven times earnings rose throughout an entire bear market, and twice earnings declined throughout an entire bull market. Simply put, 27% of the time earnings and stock market prices move in completely opposite directions. During the remaining five periods, earnings trended up/down within the five bull/bear markets.

While reviewing all these bull/bear markets we made note of their PE multiple peaks and lows. Bull market multiples have peaked at as low as 9 in 1980, and as high as 35 in 2000, with the mean PE at 19 in 2007. Bear market multiples have bottomed as low as 6 in 1949, and as high as 23 in 2002, with the mean PE at 11 in 1957 and 1984. What was also surprising was the PE multiple at the highly acclaimed “wildly speculative” 1929 peak was an historically normal bull market PE of 20.

Another common belief is that interest rates have an effect on market price earnings ratios. So we took a look at that relationship also. We were able to start this analysis during the 1932-1937 bull market, dropping the total bull/bear markets covered to 31. What we found is that normal short term rates of 6% or less have little impact, if any, on market multiples. The only times we noticed a definite impact was during the 1978-1980 advance and the 1982-1983 advance. Rates peaked at 15.0% during 1978-1980, and that advance ended with a PE of 9. Rates peaked at 9.0% during the 1982-1983 advance, and that one ended with a PE of 13. These two advances were the only times short term rates hit over 7% during a bull market in the entire study. Normal short term rates, under 7%, have little to no impact.

Conclusions and further observations

Since corporate earnings are rising with the stock market only 50% of the time, they are not the determining factor to create and/or sustain bull markets. Investor confidence in the economy, or an individual company, along with future expectations drive bull markets. Investor sentiment is the driving force. Individual stocks can sell at multiples in the 100’s, if confidence in future growth is strong. While stocks can sell at multiples in the single digits, if confidence in future growth is lacking.

While mergers and acquisitions can make companies bigger and more cost effective. This does not directly translate into higher investor confidence. It just creates a larger company. A strong management team and consistent results are more important.

Stock buybacks, aimed at decreasing the amount of shares outstanding, which should translate into lower PE multiples and higher stock prices. Does not directly increase investor confidence either. Especially when debt is used to buy back the shares. It just creates more debt.

Laying off employees during an economic downturn, and/or a decline in revenue or gross margins, does not directly increase investor confidence. It only makes a company look cyclical. Which as noted earlier generally goes hand in hand with lower PE multiples, and a lower stock price.

In summary, M & A, stock buybacks and laying off employees, all of which are quite popular activities in recent decades, do not automatically translate into higher stock prices. They simply represent an active management team that is short term oriented. What drives up stock prices is long term planning, and consistency in meeting long term goals. This increases investor confidence, and it alone drives up stock prices. When investor confidence is high bull markets unfold, whether or not, earnings are rising or not. The same thing could apply to individual stocks, and it does at times.

The Economy

While continuing the GAAP earnings analysis we took a look at Real GDP growth during all the bull/bear market periods from the 1930’s. Overall we did not observe any direct correlation between GDP peaks and Bull market peaks. However, we did observe something interesting which confirmed our suspicions.

When we throw out the volatile 1930’s and 1940’s, created by depression rebounds and war demands, we find that Real GDP growth moved above 5% during economic expansions, and below 0% during contractions. This continued from the 1950’s until it stopped in the mid-1980’s. Since the mid-1980’s peak growth has been under 5% and getting less and less.

Data: 1984-1987 +4.2%, 1987-2000 +4.9%, 2002-2007 +3.8%, and 2009-2015 +2.5%.

The cause, and problem, is easily observed in the Federal Debt as a percentage of GDP link. In the mid-1980’s this ratio first approached, and exceeded, the 50% threshold. Since then it has continued to rise, and even the decline in 2000 held above 50%. Until the government gets debt back under control, GDP growth will continue to be weaker than it should be for a country as innovative and productive as the USA.

https://research.stlouisfed.org/fred2/series/A191RL1A225NBEA

https://research.stlouisfed.org/fred2/series/GFDEGDQ188S

CHARTS: http://stockcharts.com/public/1269446/tenpp

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2016 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.